The resonance of summer warnings that the US economy is on the precipice of recession continue to fade from the perspective of the upcoming third-quarter GDP report. The latest run of numbers continues to highlight encouraging nowcasts for the government’s initial Q3 report, scheduled for release on Oct. 30.

Monthly Archives: September 2024

Macro Briefing: 30 September 2024

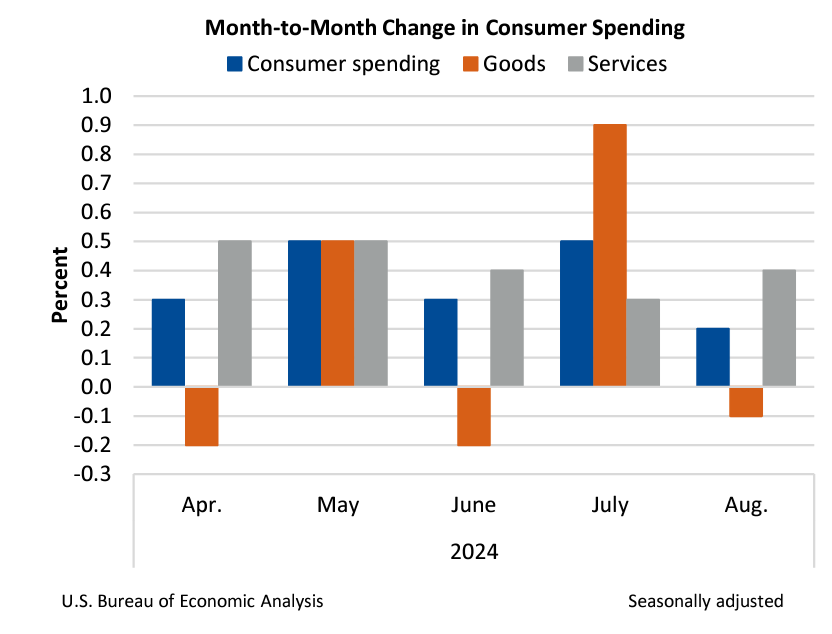

US consumer spending continued to rise in August, driven by services spending. “The resilience of consumer spending and the stronger foundations strengthen our conviction that the near-term outlook for the economy remains bright,” says Michael Pearce, deputy chief US economist at Oxford Economics.

Book Bits: 28 September 2024

● All the Presidents’ Money: How the Men Who Governed America Governed Their Money

● All the Presidents’ Money: How the Men Who Governed America Governed Their Money

Megan Gorman

Interview with author via The Stacking Benjamins Show

Wealth historian Megan Gorman stops by the basement and drops intriguing nuggets on how U.S. presidents like FDR and Ulysses S. Grant navigated their finances. There are many lessons you can learn from these iconic figures. Later, our headline conversation meanders through ERISA’s 50-year legacy and political party impacts on investments, as preparations unfold for an RV trip to Oregon. The adventure continues with exotic travel stories, packing tips, and reflections on Dave Barry’s life lessons. Listener engagement and very-important debates, including daylight savings time, ensure there’s never a dull moment! Join the lively trio of Joe, OG, and Doug as they blend retirement strategies with a dash of humor, exploring everything from coffee mugs to memes.

Slide In Energy Contrasts With Rallies Elsewhere In Commodities

The case for categorizing commodities as one asset class has always been a shaky affair based on convenience rather than logic. The economic factors driving prices of specific types of raw materials varies widely and so a more nuanced view from an asset allocation perspective is compelling. Recent market trends tell the story.

Macro Briefing: 27 September 2024

US initial jobless claims fell again last week, dropping to the lowest level since mid-May. The current level of new filings for unemployment benefits remains near a multi-decade low and suggests that the labor market’s outlook remains healthy for the near term.

Markets Lean Into Another ½-Point Rate Cut By The Fed

Markets are highly confident that the Federal Reserve will announce another cut in interest rates at the next policy meeting on Nov. 7, two days after the election. The uncertainty is whether the cut will be 25 or 50 basis points.

Macro Briefing: 26 September 2024

Congress passed a funding bill Wednesday to avert a government shutdown next week. If signed by President Biden, which is expected, the bill will fund the government through Dec. 20, setting up another spending fight just before the holidays.

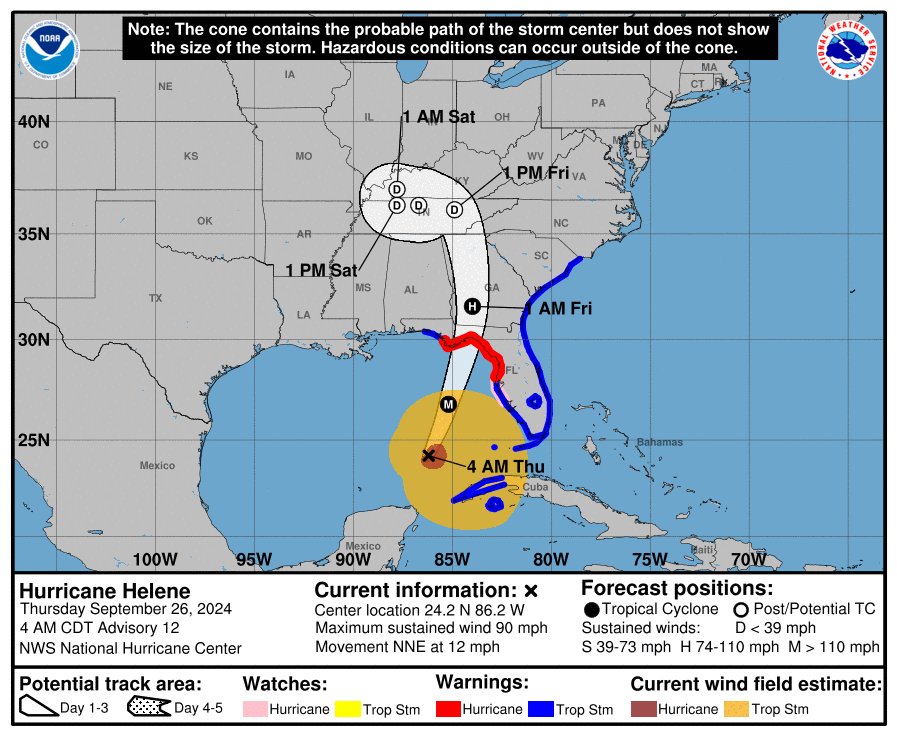

Florida’s upper west coast braces for Hurricane Helene for a Thursday evening or early Friday morning landfall. The National Weather Service warns: “A catastrophic and deadly storm surge is likely along portions of the Florida Big Bend coast, where inundation could reach as high as 20 feet above ground level, along with destructive waves.

Continue reading

US Still On Track To Avoid Recession In Q3

The odds continue to look favorable that the US will dodge an NBER-defined recession through the end of the third quarter. Q4 still looks more challenging, but that’s guesswork at this point. By contrast, the case for expecting an positive trend to endure in Q3 reflects a rising set of published economic data to date.

Macro Briefing: 25 September 2024

US housing prices rose to another all-time high in July, based on the S&P CoreLogic Case-Shiller Index, which rose 5% year over year. The July increase marks the 14th consecutive month of a record high for the National Index component. “Overall, the indices continue to grow at a rate that exceeds long-run averages after accounting for inflation,” says Brian Luke, an analyst at S&P Dow Jones Indices.

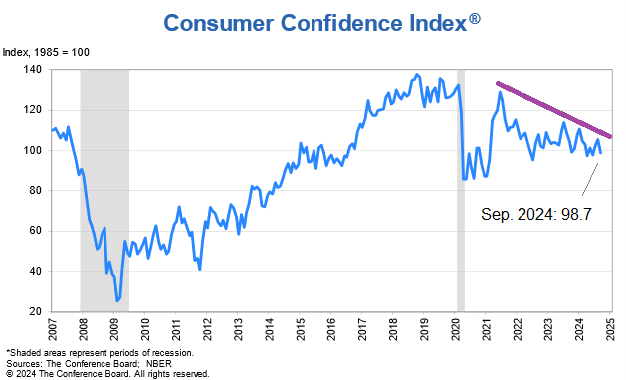

US Consumer Confidence Index fell to a 3-month low in September. The decline highlights an ongoing slide in the index over the past two years. “September’s decline was the largest since August 2021 and all five components of the Index deteriorated,” notes Dana Peterson, chief economist at The Conference Board. “Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further.”

Broad-Based Gains For Global Equities Persist In 2024

You might think that war in the Middle East, heightened geopolitical risk elsewhere, and the potential for turmoil in the upcoming US election would spell trouble for world stock markets. But a review of year-to-date results through Monday’s close (Sep. 23), based on a set of ETFs, suggests otherwise.