The CNN Fear and Greed Index as a Predictor of Us Equity Index Returns

Hugh Farrell and Fergal A. O’Connor (University College Cork)

July 2024

We assess whether the CNN “Fear and Greed” Index can be used to predict returns on equity indices and gold using hand-collected data. We find that the Fear and Greed Index Granger causes returns on the S&P 500, Nasdaq Composite and Russell 3000 in the first sample period (2011-2020), but not gold returns. Analysis from 2021–2024 indicates the Fear and Greed index Granger causes S&P 500 and Russell 3000 returns, but the relationship is weaker. No significant relationship is found between the VIX and stock indices, indicating that the Fear and Greed Index is a better predictor of equity returns.

Monthly Archives: August 2024

Macro Briefing: 9 August 2024

* JP Morgan lifts US recession odds to moderate 35% for this year

* US mortgage rates fall to lowest level in over a year

* US government will offer loan to S. Korean firm build solar plant in Georgia

* China inflation picks up, but remains low–just 0.5% vs. year-ago level

* US jobless claims fall more than expected, offering upbeat labor market news:

Markets Take A Hit, But A Clear Risk-Off Signal Is Still In Dispute

From the vantage of the past week of trading the case looks clear for calling recent market volatility a sign of a risk-off pivot. But if your time horizon is longer, there’s still room for debate, based on a set of ETF pairs for gauging the broad trend via prices through Aug. 7.

Macro Briefing: 8 August 2024

* Consumers trimmed their borrowing in June, according to Fed data

* Post-pandemic surge in travel appears to be ending

* US not currently in recession, says JPMorgan Chase CEO Jamie Dimon

* ‘Covered call’ ETFs fail to deliver protection from volatility in sell-off

* US 10yr-2yr Treasury yield curve is flat for first time in two years:

Utilities Lead US Equity Sectors This Year After Market Turmoil

Utility stocks have taken the lead in 2024 among US equity sectors following the market sell-off in recent days, based on a set of ETFs through Tuesday’s close (Aug. 6).

Macro Briefing: 7 August 2024

* Consumer spending will be a key factor for gauging US recession risk

* Markets expect Fed to head off a recession with rate cuts

* US trade deficit narrowed in June as exports outpace imports

* Americans continue to rack up credit card debt, which rose to a new high in Q2

* Sahm Rule-creator doesn’t recommend emergency Fed rate cut

* US stock market (S&P 500) claws back some of the loss after 3-day sell-off:

US Isn’t In Recession Now, But Downturn Risk May Be Rising

Judging by the current numbers, the US expansion almost certainly endures. There are well-founded concerns that the tide may be turning, but that’s still a speculative call. By comparison, published numbers to date, overall, speak clearly: growth still has the upper hand. That’s not written in stone, of course, but for this specific point in time it’s the odds-on favorite for describing current conditions.

Macro Briefing: 6 August 2024

* Biden convenes national security team amid fears of Iran attack on Israel

* US economy is starting to look “pre-recessionary”: Krugman

* Will the Fed announce an emergency rate cut? Unlikely, predict analysts, history

* ISM Services Index rebounds in July, showing key US sector strengthening

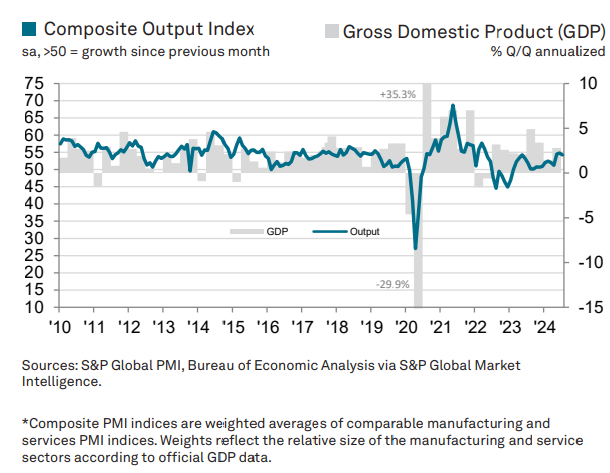

* Global economic growth eases for second month in July via PMI survey data

* US output expands “solidly” in July via Composite PMI Index, a GDP proxy:

Will Global Market Sell-Off Dethrone US Stocks’ 2024 Leadership?

The selling that roiled global markets late last week looks set to continue on Monday. Triggered by weaker-than-expected news for the US labor market, the surge in risk-off sentiment took a bite out of the high-flying market for American shares. But even after last week’s hit, US equities are still leading the major asset classes by a wide margin. In the current climate, however, that premium suggests US shares are still vulnerable to a period of “normalizing” performance comparisons.

Macro Briefing: 5 August 2024

* Does a surprising rise in unemployment signal a recession?

* Economist says Fed waited too long to cut interest rates

* Growth in China’s services activity strengthened in July

* Eurozone economy “stalls” in July via PMI survey data

* US 10-year yield fell sharply last week, settling at 3.79%–lowest since December: