* Is the potential unwinding of Biden’s economic policies an investment risk?

* China cuts interest rates for a second time this week

* John Deere says it’s laying off workers due to agriculture downturn

* New US home sales fell to 7-month low in June

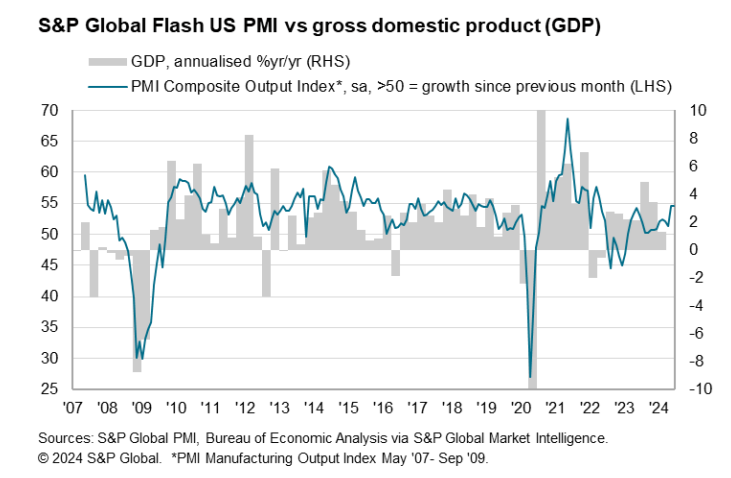

* US business activity growth accelerates in July, driven by services:

Monthly Archives: July 2024

The Case Against Lone Recession Indicators Is Stronger Than Ever

It’s a human shortcoming to favor simple explanations for the business cycle. The notion that reliability and timeliness can be forged in one indicator endures, but recent history has hammered this approach, reminds a new commentary from Axios.

Macro Briefing: 24 July 2024

* Several widely-monitored recession indicators “don’t work like they used to”

* Trading volume tops $1 billion for debut of ether ETFs

* FTC launches probe into ‘surveillance pricing’ that rapidly changes prices

* Eurozone business activity is nearly at standstill in July: PMI survey

* US existing home sales fell for fourth month in June:

US Q2 GDP Growth Set For Modest Pickup In Thursday’s Report

US economic activity is on track to post a modestly firmer growth rate for the second quarter GDP report scheduled for release on Thursday, July 25. The estimate is based on the median estimate for a set of projections compiled by CapitalSpectator.com.

Macro Briefing: 23 July 2024

* Harris secures enough delegates to become Democratic party’s nominee

* US regulator finds weak risk management at over half of major banks

* Cyber-security startup Wiz rejects Google’s $23 billion acquisition offer

* Ethereum ETFs approved by SEC set to start trading

* US economic growth shows signs of stabilizing in June:

Large-Cap Growth Is Still Leading The Market. Will It Last?

Reviewing the major US equity factors on a year-to-date basis continues to show large-cap growth leading the horse race, based on a set of ETF prices through Friday, July 19. But last week may have been a turning point for the factor laggards, say analysts.

Macro Briefing: 22 July 2024

* US presidential race set to tighten with VP Harris on track to replace Biden

* Stock market’s laggards have sprung to life in recent days as tech stumbles

* People’s Bank of China unexpectedly cuts short-term policy rate

* Tight oil market is set to fade in 2025, predicts Morgan Stanley

* Sovereign wealth funds turning bullish on emerging markets, survey shows:

Book Bits: 20 July 2024

● Tax Alpha Solutions: Effective Tax Management Strategies for High-Net-Worth Investors

● Tax Alpha Solutions: Effective Tax Management Strategies for High-Net-Worth Investors

Matthew Chancey

Essay by author via WealthManagement.com

The Internal Revenue Service recently announced its plans to significantly increase audits on the wealthiest taxpayers, large corporations and large, complex partnerships for tax year 2026.

Audit rates will rise by more than 50% for those with total positive income over $10 million (up from an 11% coverage rate in 2019 to 16.5% in tax year 2026). That news is sure to trigger anxiety in some high-net-worth earners.

But an IRS audit is more of an exercise that seeks documentation; it’s not necessarily an accusatory event. They just want to see your clients’ homework to show how they got their answers.

Has The Neutral Rate Of Interest Increased?

The Federal Reserve is widely expected to start cutting interest rates at the Sep. 18 FOMC meeting, but the debate is turning to how far the central bank will trim its policy rate once the easing begins? A key part of the answer will be determined by how much the neutral rate has increased, if at all, in recent years.

Macro Briefing: 19 July 2024

* Mass IT outage has causes chaos for businesses around the world

* Key U.S. mortgage rate drops to lowest since March: Freddie Mac

* US leading economic index fell slightly in June

* Manufacturing activity expands in July for Philadelphia Fed region

* US jobless claims rose last week, matching highest level so far in 2024: