Year-to-date returns for US fixed income are skewing positive this year ahead of the Federal Reserve policy announcement this afternoon. Although the central bank is expected to leave rates unchanged today, markets are pricing in a September cut and much the US fixed-income market is all-in on anticipating that outcome.

Monthly Archives: July 2024

Macro Briefing: 31 July 2024

* Hamas leader killed in Iran in alleged Israeli strike, threatening escalation

* Japan raises interest rates as it unwinds long-running easy policy

* Fed expected to leave rates unchanged today

* US consumer confidence remains middling in July vs. recent history

* US home prices reach a new record high: Case-Shiller Home Price Index

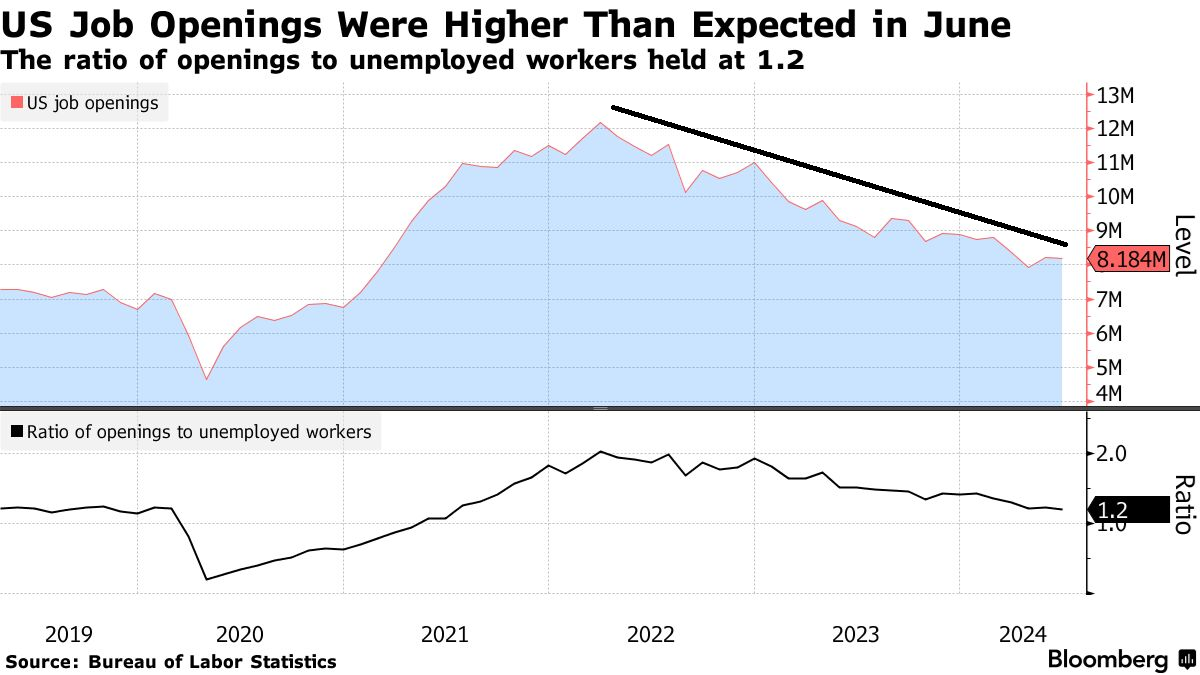

* US job openings edge down in June, reaffirming ongoing downtrend:

Will The Fed Meeting Support A September Rate Cut Forecast?

The market’s convinced that the Federal Reserve will start cutting interest rates at the Sep. 18 policy meeting. Tomorrow’s central bank announcement and press conference is still a wild card, but only by the smallest of margins, according to market sentiment. Indeed, it’s fair to say that the crowd’s super confident that the future is clear.

Macro Briefing: 30 July 2024

* Longest, deepest US Treasury yield curve inversion may be close to ending

* Eurozone maintains sluggish growth in second quarter

* Sen. Lummis announces bill for US Treasury to establish bitcoin reserve

* AI is improving the accuracy and timeliness of weather forecasting

* Texas manufacturing activity stays flat in July as demand weakens

* Despite expectations of rate cuts, long-term bonds still look risky:

Despite The Latest Correction, US Stocks Still Lead Global Markets

US equities fell for a second week in trading through Friday, July 26, based on the S&P 500 Index. The slide marks the first back-to-back weekly decline since April. No one knows at this point whether this is noise or the start of an extended downturn. But one thing is clear: US stocks continue to lead markets this year by a wide margin, based on a set of ETFs representing the major asset classes.

Macro Briefing: 29 July 2024

* Reviewing the case that the Fed has waited too long to cut rates

* US manufacturers are rethinking hiring plans

* Foreclosures of distressed commercial properties surge

* A review of threats to the boom in artificial intelligence

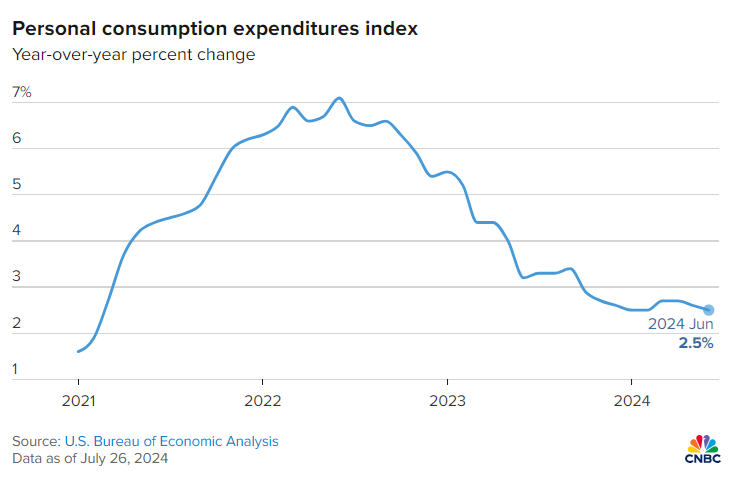

* PCE inflation ticks down to 2.5% in June vs. year-ago level:

Book Bits: 27 July 2024

● The Fragility of China: Breaking Points of an Invincible Regime

● The Fragility of China: Breaking Points of an Invincible Regime

Dennis Unkovic

Summary via publisher (Encounter Books)

Chinese President Xi Jinping believes his country is destined to displace the United States as the world’s top military and economic power. Every policy that Xi has put forth since assuming power in 2013 has been carefully crafted with this end goal in mind. Nearly four decades of meteoric economic growth have convinced many in the West that modern China is indeed an invincible regime and Xi’s grand plan will come to fruition. Closer examination reveals that China is not invulnerable, but in fact is far more fragile than it outwardly appears. In this book, Dennis Unkovic coins the term MaxTrends® to identify critical factors and developments that have the potential to derail Xi’s aggressive ambitions for China. These MaxTrends® include alarming demographic shifts, cracks in the global supply chain, an accelerating global arms race, and the Taiwan conundrum, all of which indicate that China’s strength may be more illusion than reality.

Strong US GDP Rise For Q2 Derails Recession Forecasts… Again

The recessionistas are now forced to look to the third quarter as the earliest start date for an economic downturn in the US. The odds have been low recently that Q2 would mark the beginning of an NBER-defined contraction and yesterday’s stronger-than-expected rise in output for the April-through-June period seals the deal.

Macro Briefing: 26 July 2024

* Big-tech rally at risk if US economy cools, predicts Bank of America analyst

* US credit card delinquency rates rise to 12-year high

* Durable goods orders for US post surprisingly large decline in June

* Apple falls out of top-5 smartphone vendors in China

* US jobless claims fell last week, holding in relatively low range

* US economic growth rises more than expected in Q2:

Is The Latest Surge In Stock Market Volatility Noise Or Signal?

Two weeks ago I wrote: “US stocks look overbought,” based on a variety of metrics. Fast forward to yesterday’s close for the S&P 500 Index and equities are well below their recent peak. Dumb luck? Maybe, but the better question is whether the latest decline is the start of an extended slide or just a garden variety correction? Alas, no one knows the answer. Indeed, no one ever does. But we can review the basics for developing calculated-risk estimates.