* The number of zombie companies (debt-laden firms) in the world has surged

* The US debt problem may be less threatening than it appears

* China exports rise sharply in May amid increasing trade tensions

* ECB cuts interest rates for first time since 2019

* US jobless claims edged higher last week but remain low

* US trade deficit widened in April

* US 10-year Treasury yield stabilizes after 5 days of sharp declines:

Monthly Archives: June 2024

Is The US Bond Market Poised For Recovery?

The sharp drop in Treasury yields in recent days has revived chatter that the worst for the bond market may be over. It’s still early to confidently forecast that scenario, but the odds for recovery are looking better these days after a two-year bear market for much of the asset class following the start of Federal Reserve rate hikes in early 2022.

Macro Briefing: 6 June 2024

* Financial distress in commercial real estate continues to rise

* New solar generation capacity installations in US rose to record high in Q1

* Nvidia overtakes Apple to become 2nd largest public firm in US

* US firms trim hiring in May to slowest rise since January, ADP reports

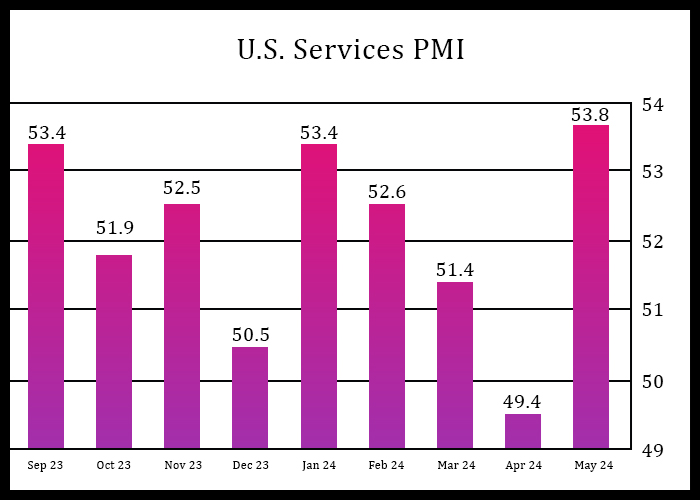

* US ISM Services Index rebounds sharply in May to 9-month high:

Is The Bond Market Rethinking The Outlook For Rate Cuts?

Here we go again. After yesterday’s news that US job openings fell to a three-year low in April, the data fueled the incentive for the bond market to reassess the view that the Federal Reserve will keep interest rates higher for longer.

Macro Briefing: 5 June 2024

* US 10-year Treasury yield drops sharply for fourth straight day

* Eurozone economy grows at fastest rate in a year: PMI survey data

* China services sector grows at fastest pace in 10 months

* US factory orders rose for a third straight month in April

* US job openings fell in April to lowest level in over 3 years:

Total Return Forecasts: Major Asset Classes | 4 June 2024

The performance outlook for the Global Market Index (GMI) ticked higher again in May. For the fourth straight month, GMI’s long-term forecast edged up, rising to an annualized 7.1% pace, which is fractionally above the estimate in the previous month, based on the average of three models (defined below). GMI is an unmanaged benchmark that holds all the major asset classes (except cash), according to market weights via a set of ETF proxies.

Macro Briefing: 4 June 2024

* US Q2 GDP nowcast revised down, again, to +1.8% via Altanta Fed’s model

* Global manufacturing activity improves in May, rising to 22-month high

* Weak US construction spending trend continues in April

* Warren Buffett’s Berkshire Hathaway owns 3% of the US Treasury bill market

* US manufacturing activity contracts for second month in May:

Major Asset Classes | May 2024 | Performance Review

Global markets rebounded sharply in May, with the exception of commodities, based on a set of ETF proxies. Otherwise, gains dominated the major asset classes after April’s widespread pummeling.

Macro Briefing: 3 June 2024

* European Central Bank expected to announce rate cut this week

* Opec announces extension of oil-production cuts into next year

* Eurozone factory output close to stabilizing in May via PMI survey data

* China manufacturing activity surges in May, survey data show

* Chicago PMI plunges to 4-year low in May

* US PCE inflation held steady at 2.7% year-over-year pace in April

* US consumer spending and income growth slow in April:

Book Bits: 1 June 2024

● The Hamilton Scheme: An Epic Tale of Money and Power in the American Founding

● The Hamilton Scheme: An Epic Tale of Money and Power in the American Founding

William Hogeland

Summary via publisher (Macmillan)

Forgotten founder” no more, Alexander Hamilton has become a global celebrity. Millions know his name. Millions imagine knowing the man. But what did he really want for the country? What risks did he run in pursuing those vaulting ambitions? Who tried to stop him? How did they fight? It’s ironic that the Hamilton revival has obscured the man’s most dramatic battles and hardest-won achievements—as well as downplaying unsettling aspects of his legacy. Thrilling to the romance of becoming the one-man inventor of a modern nation, our first Treasury secretary fostered growth by engineering an ingenious dynamo—banking, public debt, manufacturing—for concentrating national wealth in the hands of a government-connected elite. Seeking American prosperity, he built American oligarchy. Hence his animus and mutual sense of betrayal with Jefferson and Madison—and his career-long fight to suppress a rowdy egalitarian movement little remembered today: the eighteenth-century white working class.