* Biden expected to announce new tariffs on some Chinese goods

* Falling birthrates around the world is raising alarms

* Analysts forecast upbeat Q1 earnings results will continue in Q2

* China’s seizure of Taiwan’s TSMC would be ‘devastating’ for US, says official

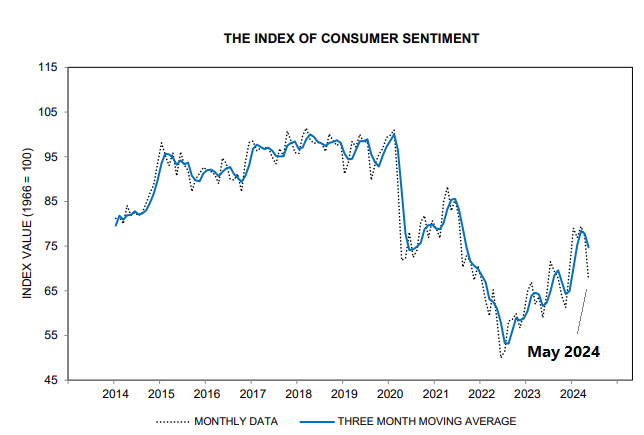

* US Consumer Sentiment Index falls to 6-month low in May:

Monthly Archives: May 2024

Book Bits: 11 May 2024

● The Quiet Coup: Neoliberalism and the Looting of America

● The Quiet Coup: Neoliberalism and the Looting of America

Mehrsa Baradaran

Summary via publisher (W.W. Norton)

With the nation lurching from one crisis to the next, many Americans believe that something fundamental has gone wrong. Why aren’t college graduates able to achieve financial security? Why is government completely inept in the face of natural disasters? And why do pundits tell us that the economy is strong even though the majority of Americans can barely make ends meet? In The Quiet Coup, Mehrsa Baradaran, one of our leading public intellectuals, argues that the system is in fact rigged toward the powerful, though it wasn’t the work of evil puppet masters behind the curtain. Rather, the rigging was carried out by hundreds of (mostly) law-abiding lawyers, judges, regulators, policy makers, and lobbyists. Adherents of a market-centered doctrine called neoliberalism, these individuals, over the course of decades, worked to transform the nation—and succeeded.

Emerging Markets Corporates Are Upside Outlier For Global Bonds

Foreign fixed-income markets from a US investor perspective have been an unappealing asset class lately – with a glaring exception: corporate bonds in emerging markets. Year to date, this slice of global fixed-income securities is hot, based on a set of ETFs through Thursday’s close (May 9). The rest of the field is struggling.

Macro Briefing: 10 May 2024

* Defensive stocks are driving the current market rally

* 30-year mortgage rate drops for the first time in four weeks

* Long delays between Fed actions tend to be good for stocks

* UK economic activity rebounds as country exits recession

* US jobless claims rise to highest level since August:

US Labor Market Cycle Has Peaked. Will Recession Soon Follow?

There are many ways to monitor recession risk, but any one indicator in isolation is flawed. Context in the form of reviewing a wide variety of metrics is essential for minimizing noise. But in the search of early warning signs of trouble it’s useful to focus on the labor market, which is arguably the key driver of economic strength and weakness. Caution is still required, but a particular measure of the ebb and flow of payrolls is signaling a warning and so it’s worthwhile to take a closer look.

Macro Briefing: 9 May 2024

* Boston Fed president joins the view that rates will stay higher for longer

* China’s factory glut alarms the world, but easy fixes are nowhere on the horizon

* China’s imports surge in April, beating expectations by wide margin

* Americans reduced credit card debt sharply in March

* US stocks (S&P 500) pull back, still trading below record high set in March:

Will Housing Inflation Keep Interest Rates Higher For Longer?

Housing is among the most interest-rate sensitive sectors of the economy. It’s also one of the most cyclical and crucial inputs for the business cycle. On that basis, one could reasonably expect that the sharp runup in interest rates over the past two years would have crushed the trend in housing prices. For a while that was the effect, but the dramatic slide in the year-over-year change in US house prices is accelerating again. The reflation is moderate so far, at least compared with 2021-2022. But it’s notable that housing prices are once more looking resilient after the Federal Reserve’s most aggressive tightening policy in decades and before rate cuts have arrived.

Macro Briefing: 8 May 2024

* US economic growth will continue to weaken until Fed cuts rates: Morningstar

* Rents expected to be last hurdle in taming global inflation

* Fed may need to hold rates steady in 2024, says Minneapolis Fed President

* US consumer credit growth slowed in March

* Federal subsidies for semi firms to fuel industry growth, report projects…

* Semiconductor ETF (SMH) trades near record high:

Communications, Energy Are 2024’s Sector Leaders For US Stocks

The upside momentum in the US stock market so far this year continues to be led by rallies in communications services and energy shares, based on a set of ETFs through Monday’s close (May 6). Both sectors are outperforming the broad market and their counterparts.

Macro Briefing: 7 May 2024

* Global economic growth at 10-month high in April: PMI survey

* America’s fiscal outlook is troubling, but largely ignored on campaign trail

* Sahm Indicator rises for 3rd month in April, closer to recession tipping point

* Renters’ expectations of owning home fall to record low: NY Fed survey

* US 10yr Treasury yield falls for 5th straight dat to lowest level since Dec: