● A Map of the New Normal: How Inflation, War, and Sanctions Will Change Your World Forever

● A Map of the New Normal: How Inflation, War, and Sanctions Will Change Your World Forever

Jeff Rubin

Adapted essay from book via The Globe and Mail

The world is engulfed in an ever-escalating global trade war. Virtually every day, new sanctions are being imposed, triggering reciprocal actions against Western goods.

Where will this lead? Can the West still win such wars, as it has done before? If not, what are the consequences of losing?

Along with sanctions has risen a new world order in which the United States and its NATO allies can no longer use their economic and military power to unilaterally dictate terms to the rest of the world.

Monthly Archives: May 2024

Research Review | 17 May 2024 | Market Analytics

Regime-Based Strategic Asset Allocation

Eric Bouyé and Jerome Teiletche (World Bank)

April 2024

What should investors do in the presence of economic regimes? Researchers and practitioners usually address this topic from a tactical asset allocation point of view. In this article, we depart from the literature by tackling the issue strategically and analytically. Modeling economic regimes as a mixture of distributions, we first investigate what happens to moments of the distribution of returns. We next deduct the implications for portfolios built under popular asset allocation methodologies (mean-variance-optimization, risk budgeting). Using these analytical results, we define new portfolio construction methodologies seeking to exploit the information in macroeconomic (macro) regimes through the composition of optimal portfolios for each regime, the risk structure of these portfolios, and the long-term probability of the regimes. We empirically show that macro regime-based portfolios can outperform traditional asset-based portfolios, for both multi-asset and equity factor universes, over a sample of more than fifty years.

Macro Briefing: 17 May 2024

10-Year US Treasury Yield ‘Fair Value’ Estimate: 16 May 2024

A ‘fair-value’ estimate of the US 10-year Treasury yield was steady in April while the market level for the benchmark rate continued to rise well above the theoretical level. But trading activity this month suggests the trend may be shifting. Yesterday’s sharp fall in the 10-year yield (May 15) substantially narrowed the spread, which implies that the market’s premium over fair value had become extreme.

Macro Briefing: 16 May 2024

* US stocks rally to record high after encouraging inflation data

* Americans unexpectedly paused spending in April vs. March

* US homebuilder sentiment in May weakens for first time in six months

* NY Manufacturing Index indicates slightly faster contraction in May

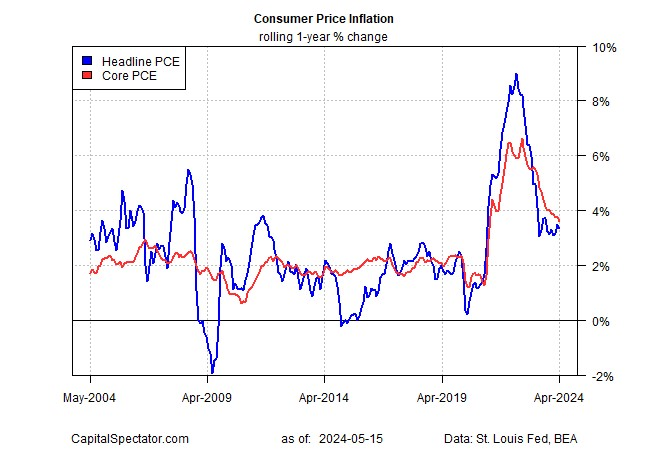

* US Core Consumer Inflation falls to 3-year low in April:

Guesstimating The Level Of Froth In US Stocks

Calling tops and bottoms in the stock market is the Holy Grail for investing analytics. Alas, success on this front is nearly impossible, at least in terms of timely precision. Yet some of us still venture down this path. Why? Developing perspective helps, even if it’s less than perfect perspective and it’s used judiciously and the caveats are recognized.

Macro Briefing: 15 May 2024

* Fed Chairman Powell says inflation has been higher he expected

* Is the Fed courting higher-inflation risk again? Yes, says economist

* US household debt rises to record, highlighting financial pressure on families

* Copper rises to record high

* BlackRock on track to run world’s largest bitcoin fund

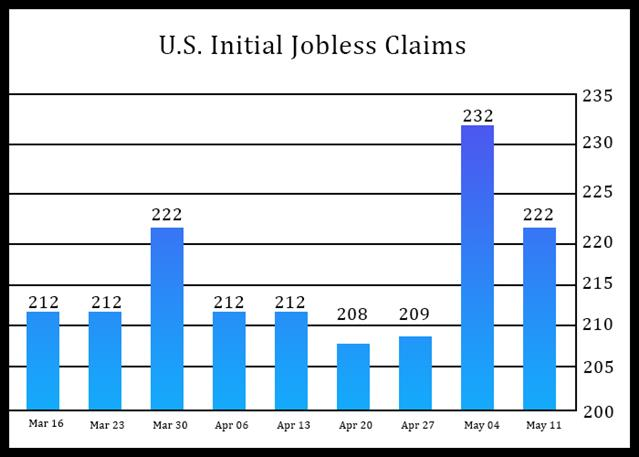

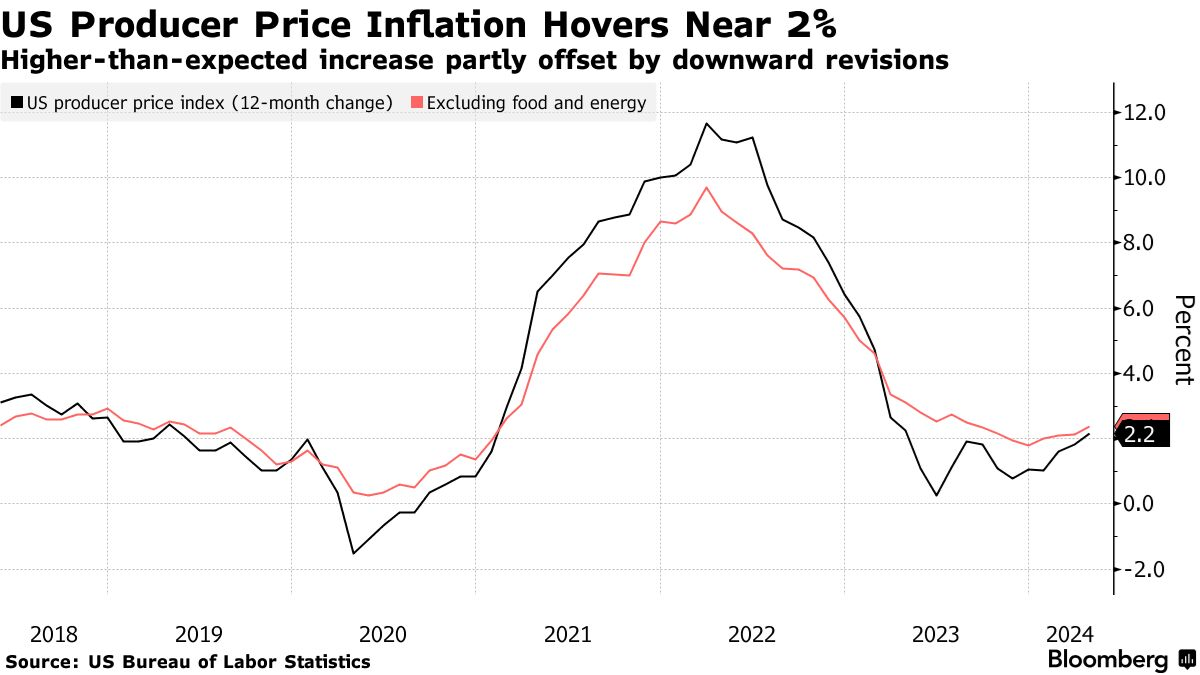

* US wholesale inflation rises more than forecast in April:

Disinflation Expected To Resume In April CPI Report

US consumer inflation data was surprisingly firm in March, raising the stakes for tomorrow’s April report (Wed., May 15). Another round of disappointing numbers would arguably confirm that the recent disinflation trend is in serious trouble. No one can rule out that possibility, but I’m expecting we’ll see disinflation will return in some degree.

Macro Briefing: 14 May 2024

* 1-year-ahead consumer inflation expectations increase to 3.3%: NY Fed survey

* New US tariffs on China raise tensions with Beijing

* US regulators OK changes to ease transmission of renewable energy

* Home Depot’s Q1 revenue below expectations but earnings outperform

* US small business sentiment ticks up in April but remains below average:

Commodities And Stocks Are Driving Investment Returns In 2024

April was a rough month for global markets, but commodities and stocks are still the performance leaders for the major asset classes this year, based on a set of ETFs through Friday’s close (May 10).