The monetary policy outlook has been uncertain, but primarily in terms of the timing of the first rate cut. But that’s starting to change as Fed funds futures price in the possibility of a rate hike. To be clear, the implied probability for a hike is extremely low: no more than 1%. But the fact that market sentiment is pricing in any chance of a hike marks a shift.

Monthly Archives: May 2024

Macro Briefing: 24 May 2024

* Crude oil drops to lowest price in over 3 months

* China has a bold plan for its housing crisis, but it’s still not enough

* Sales of new US single-family homes fell more than expected in April

* US jobless claims fell again last week, reaffirming low level of layoffs

* Chicago Fed Nat’l Activity Index weakened in April, but…

* US business activity accelerates in May via PMI survey data:

Market Trends Continue To Lean Into A Bullish Signal

The old saw that markets climb a wall of worry is alive and kicking. Although there are plenty of warnings from analysts who see trouble ahead, trend profiles show no fear, via several pairs of ETF proxies for profiling the appetite for risk, based on prices through yesterday’s close (May 22).

Macro Briefing: 23 May 2024

* China launches military drills around Taiwan after inauguration of new president

* Fed minutes show concern over lack of progress on inflation

* Eurozone economic recovery strengthens for third straight month in May

* China may raise tariffs on vehicle imports up to 25%

* Business inflation expectations unchanged at 2.4% in May: Atlanta Fed

* US existing home sales fall for second month in April:

US Economy Still On Track For Modest Pickup In Growth For Q2

US economic activity is expected to post a modestly firmer increase in the second-quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. More than half of the quarter’s data sets have yet to be published, but the early clues continue to skew positive.

Macro Briefing: 22 May 2024

* Fed’s Waller wants ‘several months’ of good inflation data before rate cuts

* Biden to release 1 million barrels of gasoline from reserves to reduce prices

* US single-family rent overall edged up again in March vs. year-ago level

* AI will be a bullish factor for stocks for the next decade: former Cisco CEO

* Rally in junk bonds reflects bets for soft US economic landing:

Is The Yield Curve Still Relevant? An Economist Clarifies

When the US Treasury yield curve inverts (short rates rise above long rates) the shift is widely viewed as a reliable forecast that a recession is near. But this time has been different, or so it seems. The curve has been inverted since July 2022, the longest inversion on record, but a recession has yet to arrive.

Macro Briefing: 21 May 2024

* US should join with Europe to combat cheap Chinese exports: Yellen

* Target announces price cuts on 5,000 items

* Electricity grid under strain from growing use of AI

* There’s no “urgency” to adjust interest rates, says SF Fed president

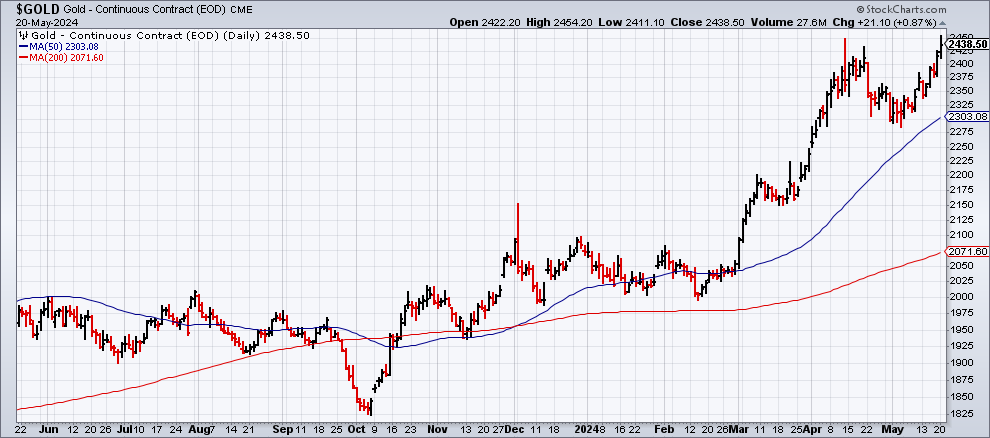

* China is a key factor driving the rally in gold:

Commodities’ Performance Lead Widens Over Markets In 2024

Last week’s strong rally in commodities expanded the performance lead for the asset class over the rest of global markets, based on a set of ETFs through Friday’s close (May 17).

Macro Briefing: 20 May 2024

* Iran’s president dies in helicopter crash

* Gold rises to record high in early Monday trading

* Copper hits record high in anticipation of deepening supply shortages

* Do the new Biden tariffs mark the end of cheap Chinese goods for US?

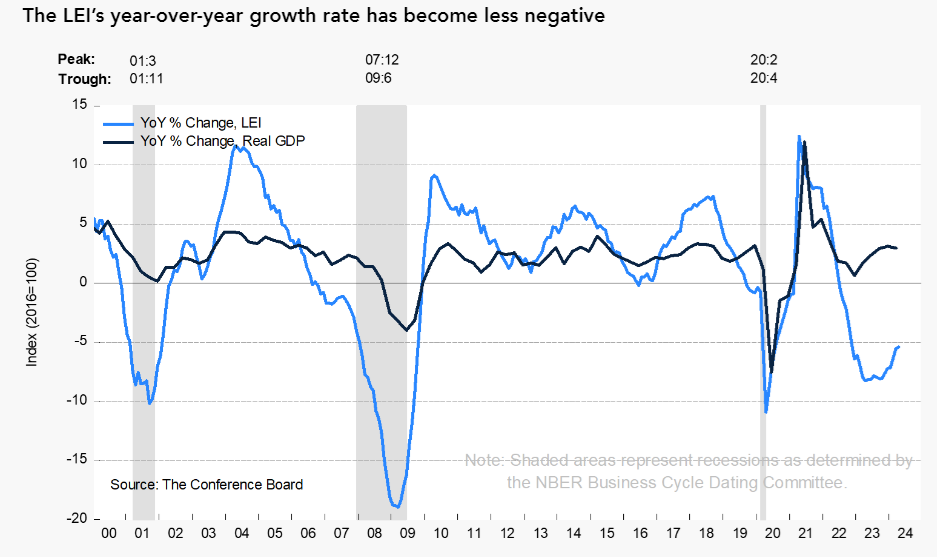

* US Leading Economic stays negative in April as growth persists: