Market Risk Premium Expectation: Combining Option Theory with Traditional Predictors

Hong Liu (Washington University in St. Louis), et al.

December 2022

In general, the slackness between the Martin lower bound (solely based on option prices) and the market risk premium depends on economic state variables. Empirically, we find that combining information from option prices and economic state variables yields forecasts of the market risk premium with greater out-of-sample performance compared to forecasts using option prices alone or economic state variables alone. Additionally, these combination-based forecasts can significantly increase investors’ utility by improving their portfolios’ Sharpe ratios. Our findings suggest the importance of combining information from option prices and economic state variables.

Daily Archives: March 8, 2024

Macro Briefing: 8 March 2024

* Fed’s Powell says central bank “not far” from cutting rates, but…

* Powell also says “there will be bank failures” due to commercial property losses

* US consumer borrowing rose more than expected in January

* US trade deficit widens in January to largest gap in nine months

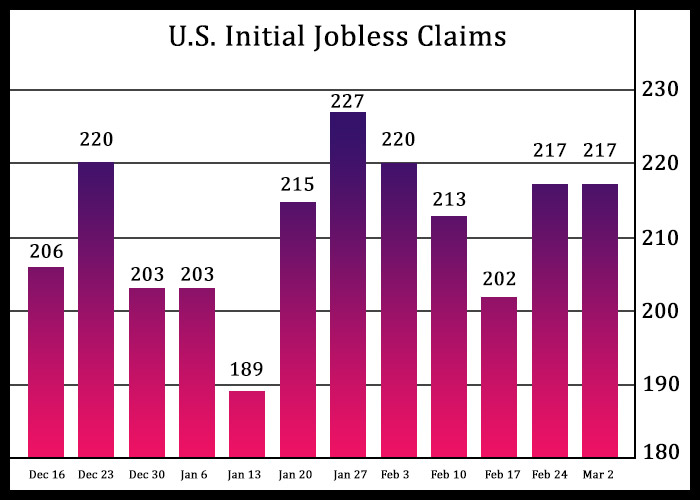

* US jobless claims were unchanged last week, holding at a low level: