Just when you thought it was safe to assume that the soft-landing fix was in, the bond market has thrown a wrench into the machine. So it goes with the constantly shape-shifting risk profile for the US business cycle. Most of the time the changes are relatively trivial. Is this time different?

Monthly Archives: October 2023

Macro Briefing: 5 October 2023

* Hard landing risk for US economy rising as Treasury yields increase

* Rise in interest rates creates bigger challenge for managing deficits

* A stock market crash may be the only savior for a falling bond market: Barclays

* Earth on track for hottest year on record, predicts European climate agency

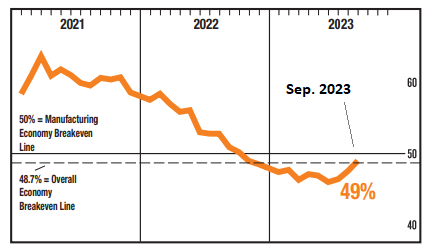

* ISM Mfg Index edged lower in September but still reflects moderate growth

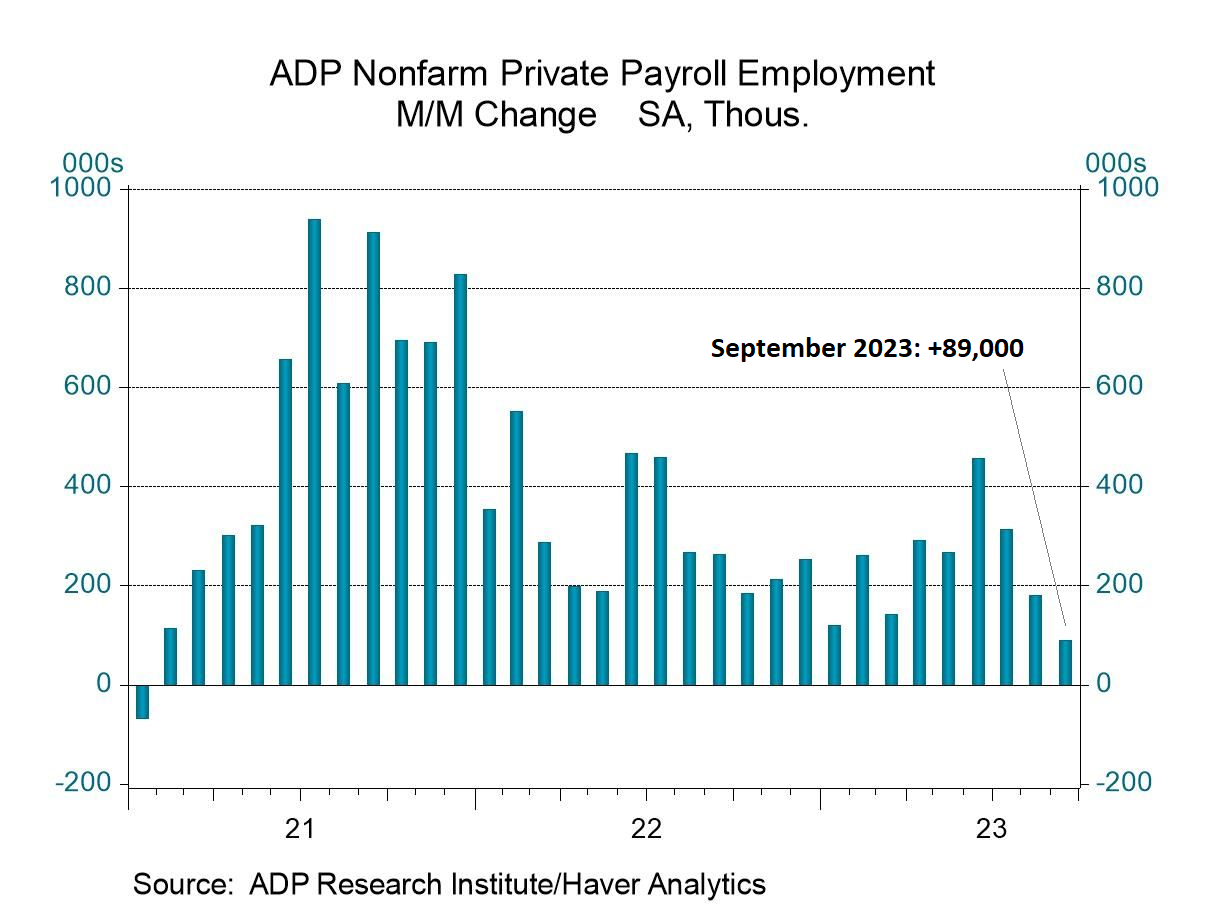

* US private employment growth slowed sharply in September via ADP data:

US Median Q3 GDP Nowcast Holds Above 3%

Rising interest rates may threaten the “soft landing” outlook for the US economy, but the upcoming preliminary estimate of third-quarter GDP from the government still looks set to report that output picked up from Q2.

Macro Briefing: 4 October 2023

* Republicans remove House speaker, leaving chamber in chaos

* Rising Treasury yields threaten ‘soft landing’ scenario for US economy

* Two Fed officials say interest rates will likely stay high

* US auto sales rose in Q3 despite strikes and higher interest rates

* ‘Stalling and divergent’ global economy expected, UN trade division predicts

* Saudi Arabia says its oil production cuts will last through end of year

* US job openings post unexpected gain in August:

Total Return Forecasts: Major Asset Classes | 3 October 2023

The expected return for the Global Market Index (GMI) continued to edge higher in September from the previous month. Today’s revised long-run forecast for this benchmark — a market-value-weighted portfolio that holds all the major asset classes (except cash) via a set of ETF proxies — inched up to an annualized 6.7% return, the highest so far this year.

Macro Briefing: 3 October 2023

* OPEC leader: “resilient” demand and low investment could keep oil prices high

* United Auto Workers union reaches tentative deal on contract with Mack Trucks

* Office market headed for crash in US, investor survey says

* Office attendance in big cities still half of pre-pandemic level

* Construction spending in US increased for eighth straight month in August

* US ISM Manufacturing Index edges higher again in September, close to neutral:

Major Asset Classes | September 2023 | Performance Review

Commodities and cash continued to top the monthly performance tables in September for the major asset classes. Also on display for a second straight month: widespread losses elsewhere for global markets, based on a set of ETF proxies.

Macro Briefing: 2 October 2023

* AI boom expected to “dramatically increase” energy consumption

* Sluggish China and global demand cuts Asia growth outlook: World Bank

* China’s demand for commodities growing at “robust rates”: Goldman Sachs

* US 10-year Treasury yield starts week near 15-year high

* China’s factory recover slows in September

* Automakers’ strike expands to 17% of UAW members at Big Three firms

* Fed’s favorite inflation gauge rose less than expected in August

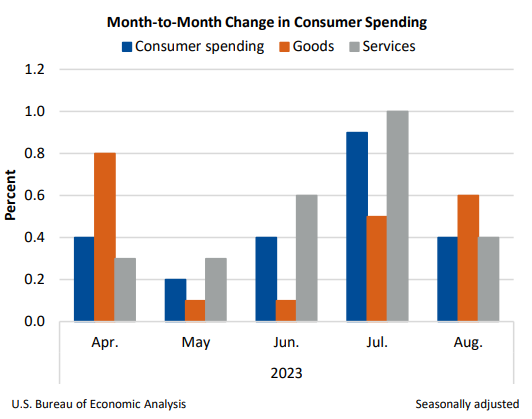

* US consumer spending increased for fifth straight month in August: