* Israel-Hamas war may disrupt gas output and major shipping chokepoints

* Israel-Hamas conflict expected to have limited impact on global economy: Yellen

* Speaker-designate Scalise struggling to win votes for House speakership

* UAW strike expands at Ford plant at Kentucky

* Fed minutes: officials see ‘restrictive’ policy in place until inflation eases

* Business inflation outlook relatively unchanged at 2.4% in October

* US wholesale inflation rose more than expected in September:

Monthly Archives: October 2023

US Stock Market Flirting With Strong 2023 Gain… If It Holds

The spring/summer rally for the S&P 500 Index has faded, but the pullback still leaves the market positioned to post one of its stronger calendar-year gains in decades. The obvious caveat: a lot can happen between now and Dec. 31. But for the moment, American shares reflect a robust bull run for the year to date.

Macro Briefing: 11 October 2023

* Republicans remain divided over choice for House Speaker

* Rising bond yields expected to support pause in Fed rate hikes

* Housing industry urges Fed to halt rate hikes to avoid hard economic landing

* Economist Paul Krugman reverses view and says US budget deficit is too high

* Exxon agrees to acquire shale oil firm Pioneer

* Small business optimism dips in September— inflation is still “top problem”

* Oil market downplays Israel-Gaza conflict… so far

Large-Cap Stocks Still Lead US Equity Factors In 2023

It wasn’t that long ago that several brave forecasters were advising that 2023 would be the year that value stocks regained their leadership credentials that the historical record suggests is the prevailing trend. Measured in relative terms for 2023, however, growth shares continue to dominate the performance race, based on a set of factor ETFs through Oct. 9.

Macro Briefing: 10 October 2023

* IMF: world economy has lost momentum due to higher interest rates, but…

* IMF raises US growth forecast for 2023

* Israel shuts down Tamar offshore natural gas field after Hamas attack

* China reportedly considering new stimulus to boost slowing economy

* China’s Country Garden property developer says it may not repay debts

* Fed officials say rise in bond yields may allow Fed to forego more rate hikes:

Will US Stock Market’s Outsized Leadership Persist In Q4?

American shares have been the upside outlier for performance leadership for much of the year for the major asset classes, based on set of proxy ETFs through Friday’s close (Oct. 6). But applying a hefty dose of optimism to US equities may become increasingly challenged as various risk factors resonate in the fourth quarter.

Macro Briefing: 9 October 2023

* US sends aircraft carrier group to eastern Mediterranean after attack on Israel

* Oil prices rise after Hamas attack on Israel

* OPEC raises long-term oil demand outlook

* Weighing the odds that Treasury yields will keep rising

* Private-credit firms are rapidly rising source of lending for corporate America

* Bank stocks under pressure from rising rates

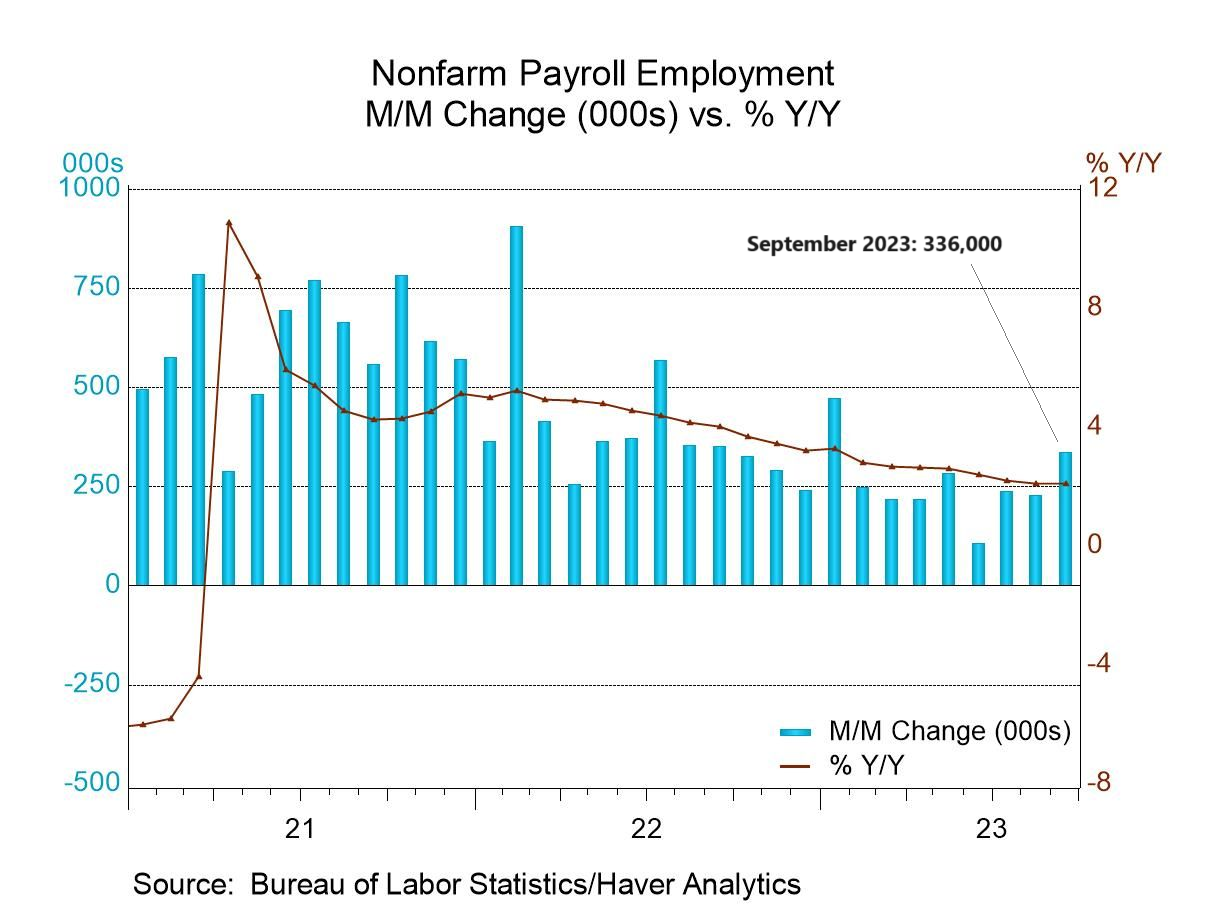

* Strong rise in September US payrolls will nudge Fed toward another rate hike:

Book Bits: 7 October 2023

● Economics in America: An Immigrant Economist Explores the Land of Inequality

Angus Deaton

Review via NPR

Deaton (and Case) argue that the alarming rise in deaths of despair amongst non-college-educated Americans — which accounts for almost two-thirds of the adult population — is intimately related to their fading economic prospects. Deaton writes that “the decline of good jobs” is a crucial driver of despair. “This decline, in response to globalization and, more importantly, technical change (robots), is made much worse in the United States than elsewhere by the grotesquely exorbitant cost of healthcare,” Deaton writes. “Beyond that, when bad things happen and people need help, the safety net in the United States is fragmentary compared with those in other rich countries.”

Several Corners Of Bond Market Manage To Shine This Year

The ongoing bear market in Treasury bonds is among the worst on record, but several sectors of the fixed-income market remain ports in a storm, based on year-to-date results through Thursday (Oct. 5) for a set of fixed-income ETFs.

Macro Briefing: 6 October 2023

* The slide in Treasury bond prices since 2020 is among the worst on record

* China’s economy faces years of headwinds due to real estate crisis

* More than 40% of small firms report difficulty in finding workers

* Oil prices set for biggest weekly decline in 6 months

* Average US mortgage rate rises to 23-year high: 7.49%

* Exxon Mobil near deal in acquiring shale driller Pioneer

* Narrowing US trade gap in August expected to support Q3 GDP growth

* US jobless claims remain low, suggesting labor market strength in near term: