The US recession forecasts persist for some analysts, but the start date keeps moving forward as incoming economic data continues to reflect strength. The trend is reflected in today’s upwardly revised nowcast for the upcoming third-quarter GDP report.

Monthly Archives: October 2023

Macro Briefing: 18 October 2023

* Biden’s Israel visit is a high-stakes gamble to reduce tensions

* China GDP growth beats forecasts for Q3

* The odds of a soft US economic landing continue to rise

* Homebuilder sentiment in US fades in October, falling to x-month low

* US industrial production rebounds in September

* US retail sales rise more than expected in September:

10-Year US Treasury Yield ‘Fair Value’ Estimate: 17 October 2023

The US 10-year Treasury yield continues to rise, pushing ever higher above above CapitalSpectator.com’s “fair-value” estimate, which is based on averaging three models. The trend highlights the limitations of models, at least in the short, for estimating near-term changes in bond yields. But reviewing the recent divergence reminds that the current spread, although extreme by the standards of recent years, isn’t unprecedented.

Macro Briefing: 17 October 2023

* Biden will visit Israel in bid to keep conflict from escalating

* Early data suggest the earnings recession is over for S&P 500 companies

* Higher-for-longer interest-rate outlook strengthens

* China Q3 economic data expected to show growth below target

* US holiday spending expected to rebound to pre-pandemic levels

* SEC chief warns AI-linked financial crisis is a threat in years ahead

* NY Fed Manufacturing Index edges down into contraction in October

* US oil production rises to record high in first week of October:

US Stocks Still Lead Global Assets In 2023

The Israeli-Palestinian conflict is a new risk factor for financial markets, but for now there’s no contest between US shares and other asset classes as the year moves into its final stretch, based on a set of ETFs through Friday’s close (Oct. 13).

Macro Briefing: 16 October 2023

* Outlook turns cautious for global economy as Israel-Gaza conflict rages

* Economic blowback from Israeli-Palestinian conflict still unclear, says Yellen

* House expected to vote Tuesday to elect a new speaker

* US oil production reached all-time high last week

* US home sales set for slowest year in more than a decade

* Rite-Aid pharmacy chain files for bankruptcy

* US consumer sentiment fell in October after two months of stability:

Book Bits: 14 October 2023

● Big Bets: How Large-Scale Change Really Happens

Rajiv Shah

Review via The Wall Street Journal

It turns out that the most useful steps toward reaching big goals often involve smaller ones—the snug, good actions that Mr. Goodman (in McGuffey’s dialogue) would have appreciated. In stopping the spread of Ebola, Mr. Shah reports, “among the most effective means” were new ways of burying victims of the disease, developed by community groups. And in response to the spread of Covid, the Rockefeller Foundation, under Mr. Shah’s leadership, focused on the practical step of improving diagnostic testing, a critical matter after the Center for Disease Control and Prevention’s tests proved unreliable.

Research Review | 13 October 2023 | Market Volatility

An ETF-Based Measure of Stock Price Fragility

Renato Lazo-Paz (University of Ottawa)

July 2023

A growing literature employs equity mutual fund flows to measure a stock’s exposure to non-fundamental demand risk – stock price fragility. However, this approach may be biased by confounding fundamental information, potentially leading to underestimating risk exposure. We propose an alternative estimation procedure incorporating readily available primary market data from exchange-traded funds (ETFs). Our proposed procedure significantly enhances the predictive power of fragility in forecasting stock return volatility. Moreover, we find that our measure captures the influence of increased ETF activeness while partially capturing the effect of institutional investors’ demand on price return volatility. Additionally, our analysis reveals a decrease in the explanatory power of mutual fund-based fragility. These results highlight the advantages of employing an ETF-based fragility measure that takes into account recent developments in the asset management industry, particularly the rise of passive investing.

Macro Briefing: 13 October 2023

* Scalise withdraws from Speaker race, leaving House in limbo

* Would wider war in Middle East tip world economy into recession?

* Oil prices jump after US tightens sanctions on sales of Russian crude

* US jobless claims remain steady, holding near multi-decade low

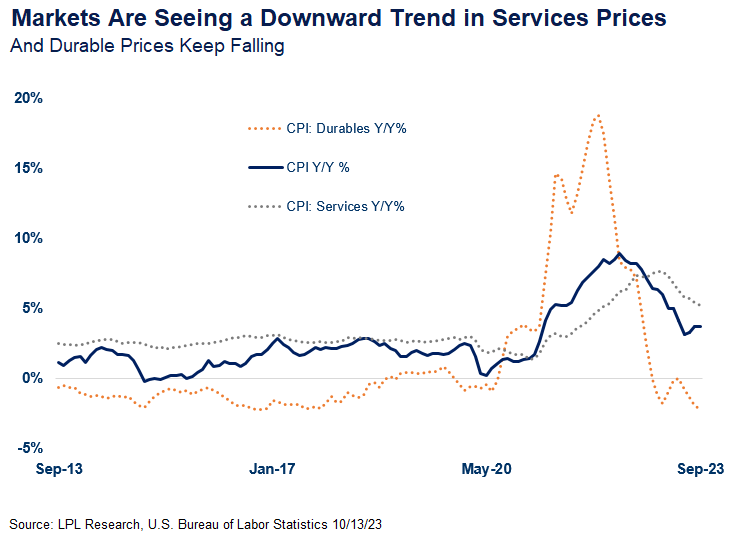

* US consumer price inflation unchanged at 3.7% annual pace in September:

Is This Year’s Rise In US Stocks A Bear-Market Rally?

Yesterday I reviewed numbers that show that the 2023 advance in the S&P 500 Index continues to post a high return when set against historical calendar-year results. Encouraging, but it’s still premature to dismiss the view that the market remains in a bear-market rally.