The expected return for the Global Market Index (GMI) ticked up in August from the previous month. Today’s revised long-run forecast for this benchmark — a market-value-weighted portfolio that holds all the major asset classes (except cash) via a set of ETF proxies — edged up to an annualized 6.6% return, the highest so far in 2023.

Monthly Archives: September 2023

Macro Briefing: 5 September 2023

* Will a strong job market immunize the US from recession? Maybe not

* China Composite PMI, a GDP proxy, indicates Aug growth slowest since Jan

* China’s Country Garden, a property developer, avoids default–again

* Eurozone economy contracts at faster pace in August via PMI survey data

* Modest global mfg contraction continued in August via PMI survey data

* US manufacturing activity contracted for 10th straight month in August

* US payrolls rose more than forecast in August

* Economists expect US economic growth will slow in 2024:

Labor Day Weekend 2023

The Capital Spectator never argues with long holiday weekends, and this Labor Day is no exception. The wheels for the machinery start turning again on Tuesday, Sep. 5. Meanwhile, Sophocles comes to mind: “Without labor nothing prospers.”

The Capital Spectator never argues with long holiday weekends, and this Labor Day is no exception. The wheels for the machinery start turning again on Tuesday, Sep. 5. Meanwhile, Sophocles comes to mind: “Without labor nothing prospers.”

Major Asset Classes | August 2023 | Performance Review

Cash led the performance race in August for the major asset classes, based on a set of proxy ETFs. In fact, most markets posted losses last month. The handful of winners, in addition to cash: a broad measure of commodities and US junk bonds.

Macro Briefing: 1 September 2023

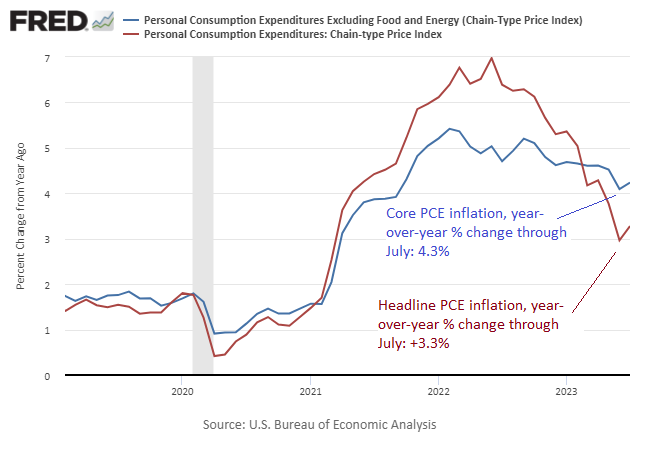

* US consumer spending accelerated in July

* Slowing sales at Dollar General suggest softer US consumer spending ahead

* Eurozone manufacturing PMI reflects “steepening downturn in August”

* China’s economic headwinds may be linked to the ‘paradox of thrift’

* China Manufacturing PMI shows stronger operating conditions in August

* US mortgage rates ease after 5 weeks of climbing

* US jobless claims eased last week, remaining near multi-decade low

* Chicago PMI survey data continues to indicate contracting mfg activity in August

* US PCE inflation edges up for 1-year change through July: