It’s been a strong year for American equities. Although US shares have been trading in a tight range recently, the market is holding on to the bulk of its robust year-to-date gain in 2023.

Monthly Archives: September 2023

Macro Briefing: 18 September 2023

* House GOP agrees on short-term deal to keep government open through Oct. 31

* Debate continues on odds that Fed can engineer a US ‘soft landing’

* Country Garden’s struggle to survive is China’s biggest property crisis to date

* Peak rates are expected to be near for major central banks

* Rising number young adults have given up on owning a home

* Median US home sales price rose 3% in Aug vs. year ago–biggest gain since Oct

* Net 51% of US banks tightening lending standards–highest since 2020

* US industrial production rises more than expected in August

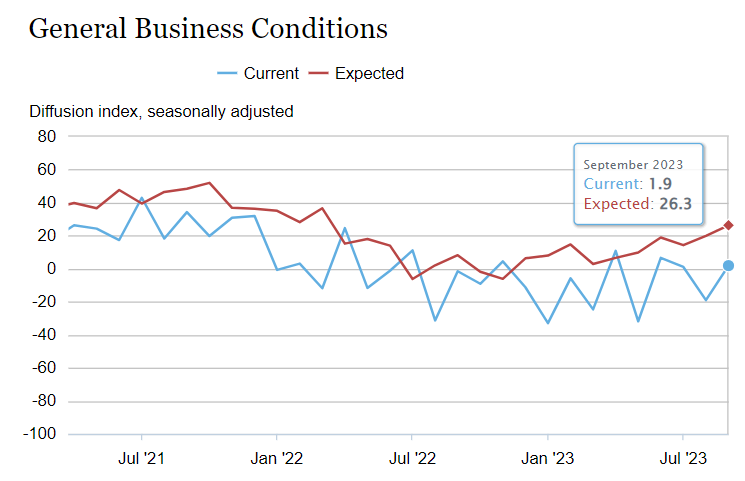

* NY Fed Mfg Index survey: firms “more optimistic” in Sep. for 6-month outlook:

Book Bits: 16 September 2023

● The Missing Billionaires: A Guide to Better Financial Decisions

Victor Haghani and James White

Summary via publisher (Wiley)

Over the past century, if the wealthiest families had spent a reasonable fraction of their wealth, paid taxes, invested in the stock market, and passed their wealth down to the next generation, there would be tens of thousands of billionaire heirs to generations-old fortunes today. The puzzle of The Missing Billionaires is why you cannot find one such billionaire on any current rich list. There are a number of explanations, but this book is focused on one mistake which is of profound importance to all investors: poor risk decisions, both in investing and spending. Many of these families didn’t choose bad investments– they sized them incorrectly– and allowed their spending decisions to amplify this mistake.

10-Year US Treasury Yield ‘Fair Value’ Estimate: 15 September 2023

The US 10-year Treasury yield continued to trend higher in August, rising further above CapitalSpectator.com’s “fair-value” estimate, which is based on averaging three models. It’s unclear if the mean estimate is wrong or the market’s experiencing an extended run of irrational exuberance. Perhaps it’s a bit of both. In any case, the widening spread in the market yield over the model’s estimate is striking from a historical perspective.

Macro Briefing: 15 September 2023

* US government still heading for a shutdown at end of September

* United Auto Workers union launches strike against Big Three automakers

* China reports signs of modest but fragile economic recovery in late-summer

* Oil prices rise above $90 a barrel for first time in 2023

* Current 2%-plus real yields for TIPS still look attractive

* 4-week average of US jobless claims falls to lowest level in 7 months

* Wholesale US inflation accelerated in August after historically slow pace

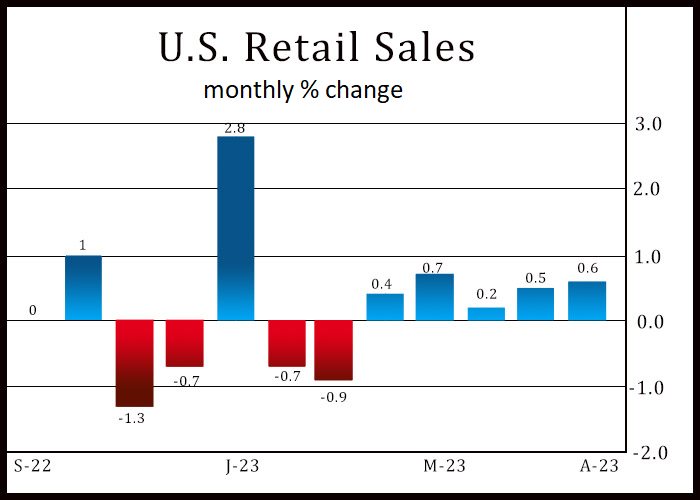

* US retail sales rise more than expected in August:

Markets Still Expect No Fed Rate Hike After Hot Inflation Report

US consumer inflation rose more than expected in August, but the surprise jump hasn’t persuaded markets to abandon expectations that the Federal Reserve will leave interest rates unchanged at next week’s policy meeting.

Macro Briefing: 14 September 2023

* US government shutdown risk in focus for September 30

* Over half (56%) of US employees say they use AI at work, survey finds

* US mortgage applications fall to lowest level since 1996

* Tech CEOs tell US senators it’s time to regulate AI

* Will Google antitrust trial lead to major changes for tech industry?

* Business inflation expectations unchanged at 2.5% in Sep: Atlanta Fed

* US consumer inflation rebounds in August to 3.7% annual rate:

US Recession Risk Is Still Low… For Now

Some analysts who favor one or two indicators to forecast US recessions have had a rough year. The reliance on a generally robust predictor may yet prove its worth in the months ahead. But so far the months-long calls by some pundits that recession is near have been wrong, or at least premature.

Macro Briefing: 13 September 2023

* United Auto Workers union plans for possible targeted worker strikes

* Congressional panel urges Wall Street execs to curb US investments in China

* European Union launches probe into China subsidies for electric vehicles

* Writers sue Meta AI Platform for copyright infringement

* UK economy shrinks in July at fastest pace in 7 months

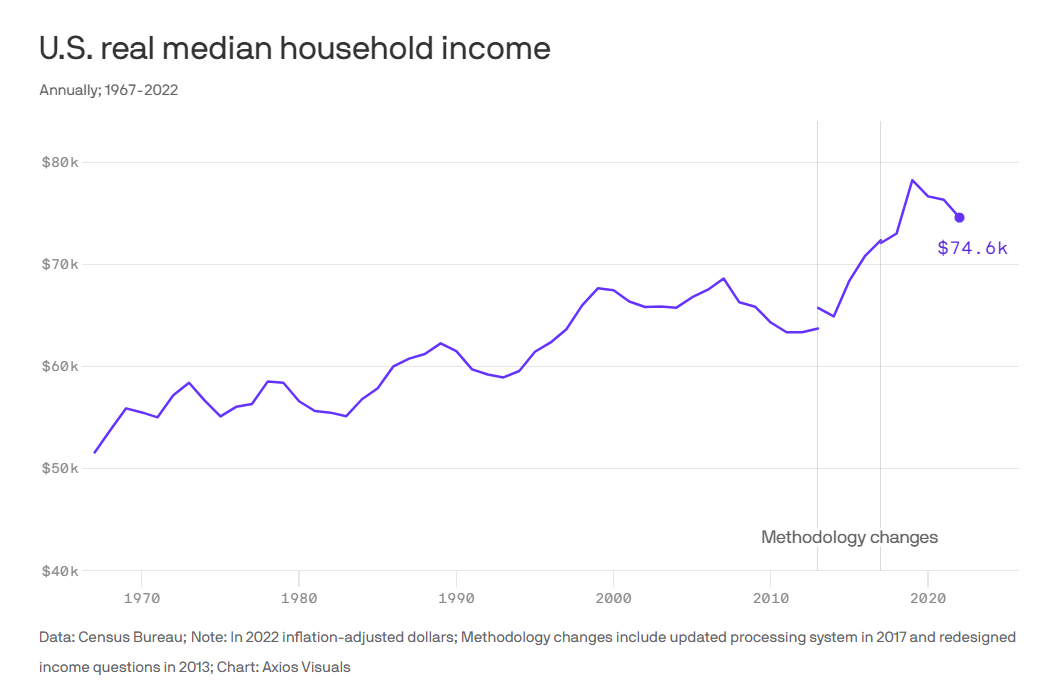

* Real household incomes for Americans fell for third straight year in 2022:

Desperately Seeking Yield: 12 September 2023

Current yields continue to show signs of peaking, based on a broad review of the major asset classes via a set of proxy ETFs. In each of our periodic updates of yields so far this year, the numbers reflect a decline from the previous review.