* Congress has one week left to avoid a government shutdown

* US economy set to weather four shocks in fourth quarter

* Oil prices rise amid tight supplies

* 3 reasons why bond yields keep rising

* US faces labor shortage for years to come

* Why isn’t interest expense a component in the Consumer Price Index?

* NY Fed’s Weekly Economic Index rises to 1-year high, but…

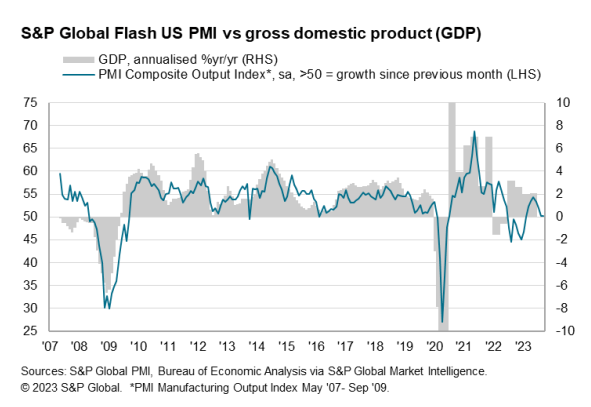

* US economic activity continues to stagnate in September via PMI survey data:

Monthly Archives: September 2023

Book Bits: 23 September 2023

● The Trade Trap: How To Stop Doing Business with Dictators

Mathias Döpfner

Adaptation via The Wall Street Journal

Creating a new trade architecture and redefining our relationship with autocracies wouldn’t simply be a form of damage limitation. It would also help us to avoid one of the biggest perils of our time: progressive and dangerously escalating deglobalization, and with it, a new and lasting rise of nationalism. Only when we proactively and jointly change our economic behavior will democracies truly prevail. The U.S. cannot go solo. If we let it happen or leave things up to the autocracies, we will either lose democracy, have to decouple unilaterally or be the ones being decoupled abruptly. In all cases the damage will be fundamental.

If we want to save democracy, we need a renaissance of truly free trade and a rebirth of “liberalism” in the spirit of Adam Smith. This is an American-European project. It can only be achieved together.

Treasury Market Plays Catch-Up With Higher-For-Longer Risk

The collective wisdom of the bond market for much of this year has been betting that interest rates would soon peak and fall. But those bets appear to be unwinding in the wake of Wednesday’s Federal Reserve meeting and press conference.

Macro Briefing: 22 September 2023

* US government remains on path to Sep. 30 shutdown amid GOP disarray

* Eurozone economy continues to contract in September: PMI survey data

* US existing home sales slide to 7-month low in August

* US Leading Economic Index in August “continue to signal recession ahead”

* Manufacturing activity in Philadelphia area contracted in September

* US jobless claims fell last week to lowest level since January:

Bank Loans And Junk Bonds Are Having A Good Year

Fixed-income investors looking for interest-rate cuts from the Federal Reserve are still waiting, but that hasn’t stopped low-rated bonds from posting strong gains in 2023.

Macro Briefing: 21 September 2023

* House Republicans outline to avert government shutdown

* Federal Reserve leaves interest rates unchanged at 5.25%-5.50% target range

* Fed’s Powell says soft economic landing is ‘primary objective’

* Fed signals interest rates may stay higher for longer

* Policy-sensitive 2-year Treasury yield rises to highest level since 2006

* Hedge funds increase bets that oil prices will soon pass $100 a barrel

* Fed funds futures lean toward rate-hike pause in upcoming FOMC meetings:

Government Shutdown Risk – The Sequel

It seems like ages ago that the US government flirted with a shutdown, but it was only this past spring when Washington danced on the precipice. A repeat performance is again approaching as political dysfunction in Congress leads to another game of chicken with a Sep. 30 deadline for passing a spending bill.

Macro Briefing: 20 September 2023

* GOP infighting is driving the government toward a shutdown on Sep. 30

* Fed expected to leave interest rates unchanged at today’s FOMC meeting

* China’s demand for oil may peak by end of the decade

* Biden’s manufacturing agenda threatened by auto workers’ strike

* Disinflation denial is easily refuted with a careful review of the data

* US housing starts fall to 3-year low in August as building permits rise:

US Median Q3 GDP Nowcast Rises Above 3%

The government’s third quarter economic report appears to be on track to report that US output accelerated to 3%-plus, based on the median estimate via several sources compiled by CapitalSpectator.com. Although some forecasters are still warning that a recession is lurking down the road, the latest numbers strongly suggest that it won’t start in Q3.

Macro Briefing: 19 September 2023

* US national debt tops $33 trillion for first time, but…

* Federal debt as % of economy has fallen from pandemic high

* Rising oil prices threaten soft-landing scenario for Fed policy

* Central banks should keep interest rates high until inflation tamed, says OECD

* OECD lifts global economic outlook for 2023 but cuts next year’s growth forecast

* Obscure corners of energy world benefit from West’s sanctions on Russian gas

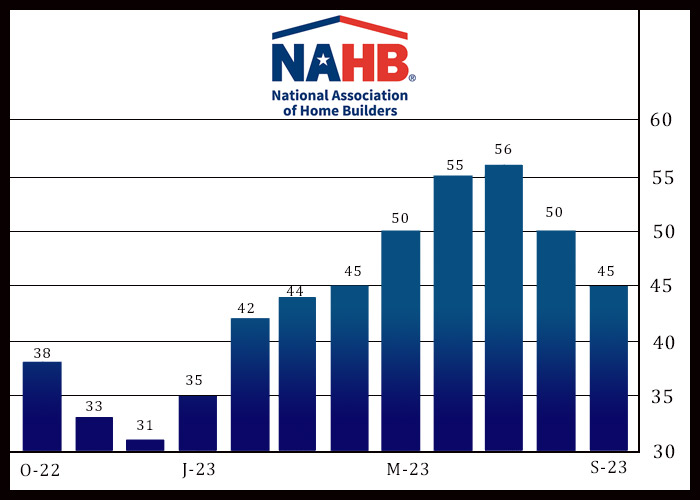

* US homebuilder confidence falls below neutral 50 mark in September: