The Federal Reserve raised interest rates for a 10th straight time on Wednesday, lifting its target by a 1/4-point to a 5.0%-to-5.25% range, the highest since 2007. But there are hints that the central bank may be set to pause at the next policy meeting in June and start cutting later in the year. Much depends on how the economic and inflation data compare in the updates during the weeks and months ahead. But for now, the crowd thinks the rate-hiking cycle may have peaked.

Monthly Archives: May 2023

Macro Briefing: 4 May 2023

* Federal Reserve raises its target rate 1/4-point to 5.0%-to-5.25% range

* Policy-sensitive 2-year Treasury slides after Fed hike

* PacWest Bancorp shares tumble; latest US bank to seek financial lifeline

* China manufacturing business conditions “moderate slightly in April”

* Eurozone economy in April grows at “strongest pace since May 2022”

* ISM Services Index ticks up in April, reflecting modest growth

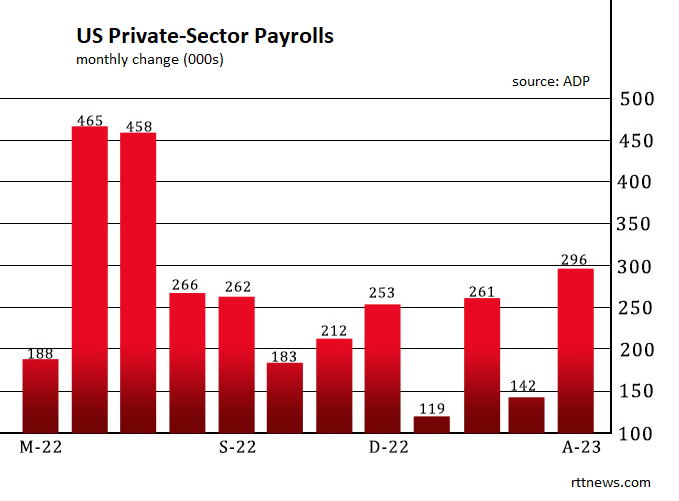

* US hiring at companies rebounds sharply in April via ADP data:

Fed Hike Expected Despite Ongoing Risks For Regional Banks

Raising interest rates always comes with risk for the economy, but the stakes are higher than usual at a time when banking turmoil appears to be reviving. Nonetheless, markets are expecting that the central bank will again lift rates at today’s policy meeting.

Macro Briefing: 3 May 2023

* Federal Reserve expected to raise interest rates again at today’s policy meeting

* Rate hikes should be put on pause after this week, says former Fed vice chair

* Regional US bank shares drop sharply despite rescue of First Republic

* House Democrats unveil plan to force vote on lifting US debt limit

* Leaders of top AI companies to meet at White House today

* Gold price rebounds above $2000 an ounce

* US factory orders recovered in March, boosted by aircraft bookings

* US job openings fell again in March, contracting at a deeper annual rate:

Total Return Forecasts: Major Asset Classes | 2 May 2023

The expected long-run return for the Global Market Index (GMI) ticked down to a 5.9% annualized pace in April, fractionally lower vs. last month’s estimate. The forecast, based on the average estimate for three models (defined below), is near the lower range for realized performance in recent history, based on a rolling 10-year return.

Macro Briefing: 2 May 2023

* US government could run out of cash by early June, advise Yellen and CBO

* IMF lifts growth outlook for Asia, citing China recovery

* Eurozone manufacturing activity falls in April–first decline since January

* Eurozone annual inflation in April ticks up for first time in six months

* Actively-run ETFs are a small niche but growing rapidly

* US construction spending rose in March, first gain in four months

* US ISM Mfg Index edges higher, which suggests sector recession is easing:

Major Asset Classes | April 2023 | Performance Review

Most of the major asset classes continued to rebound in April, led by property shares ex-US, based on a set of ETF proxies. The downside outliers: foreign government bonds in developed markets, stocks in emerging markets and commodities.

Macro Briefing: 1 May 2023

* JPMorgan acquires failed First Republic Bank

* Fed report finds fault with its oversight in collapse of Silicon Valley Bank

* China manufacturing unexpectedly contracted in April

* South Korea’s exports fell for seventh straight month in April

* Hefty churn in jobs expected in next 5 years, economic report predicts

* Charlie Munger sees trouble ahead for US commercial property market

* US consumer spending was flat in March, reflecting slowing economy

* Fed’s preferred inflation metric slows in April, but just barely: