Rarely in the history of US economic analysis have recession forecasts been so plentiful and widely embraced. All the more extraordinary is the ongoing resilience of the economy that defies the gloomy expectations. There are real and present dangers lurking that could quickly alter current conditions, but new numbers published this week reaffirm that business activity in May indicates that recession risk is still low.

Monthly Archives: May 2023

Macro Briefing: 24 May 2023

* Debt-limit talks in Washington stumble as time runs out for deal

* US economy in ‘much better shape’ vs. gloomy forecasts: BlackRock’s bond chief

* US Navy increase efforts to stop Iran’s ship seizures in Strait of Hormuz

* Debt-ceiling risk inspires investors to look for new safe havens

* More work needed to tame inflation, says former Fed chief Ben Bernanke

* Chip war with China risks ‘enormous damage’ to US tech, warns Nvidia chief

* New US home sales rise more than expected in April

* Richmond Fed Mfg Index continues to post steep contraction in May

* Apple announces US-based computer chips deal with Broadcom

* US economic activity picks up to 13-month high in May via PMI survey data:

Have Rate Hikes Ended? Fed Officials Leave Room For Debate

Federal Reserve Chairman Jerome Powell on Friday spoke the words that investors have longed to hear: the rate-hiking cycle is ending. Except that maybe it isn’t.

Macro Briefing: 23 May 2023

* Biden-McCarthy debt-ceiling meeting is ‘productive’ but no deal yet

* Treasury Sec. Yellen again warns that US will run out of funds as early as June 1

* US Treasury will issue up to $700 billion in T-bills after debt ceiling is raised

* Pause on rate hikes in June wouldn’t signal end to hiking cycle: Fed’s Kashkari

* Fed’s Bullard says two more rate hikes needed this year

* Share of Americans feeling worse about their finances at 9-year high

* Japan growth will outpace US and Europe over next 2 years, predicts CLSA Ltd

* Can Australia end its lithium-export dependence to China? It aims to try

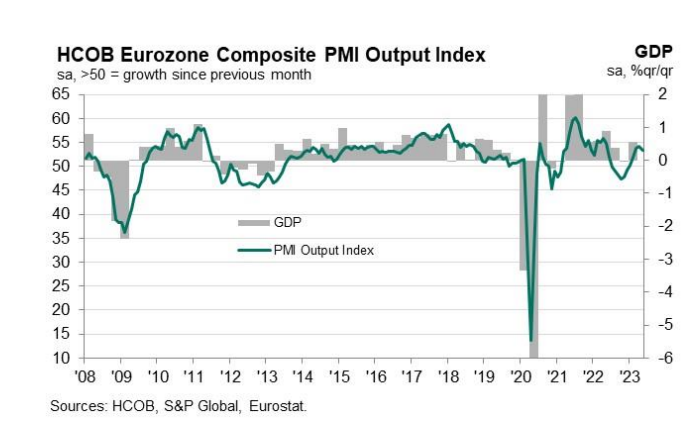

* Weak mfg activity pulls Eurozone economic growth down to 3-month low in May:

Global Equities Rose Last Week As Bonds, Commodities Fell

US shares led rallies in equities markets around the world in the trading week through Friday, May 19, based on a set of ETFs. The rest of the major asset classes lost ground.

Macro Briefing: 22 May 2023

* Biden and McCarthy will meet again today for debt-ceiling talks

* Goldman Sachs estimates X-date for debt ceiling at June 8-9

* Economists expect inflation to remain high this year via NABE survey

* Ukraine secures F-16 fighters, more military aid at G-7 summit

* Biden expects imminent ‘thaw’ in US-China relations

* China says chip maker Micron is a national security risk

* Greece’s center-right prime minister re-elected but without majority for party

* Meta fined $1.3 billion in EU for personal data violation

* US 10-year Treasury yield rises to two-month high:

Book Bits: 20 May 2023

● The Yellow Pad: Making Better Decisions in an Uncertain World

Robert E. Rubin

Review via The Wall Street Journal

These are uniquely uncertain times, says former Treasury Secretary Robert Rubin. From his office at the Council on Foreign Relations in Manhattan, where he serves as chairman emeritus, he rattles off a list of challenges facing the U.S.: friction with China and Russia, Iran’s pursuit of nuclear weapons, rising economic inequality and the “existential threat” of climate change. As for American politics, he describes it as “about as dysfunctional as it has ever been in my lifetime.”

Even more troubling, Mr. Rubin, 84, suggests that our collective ability to make sound decisions is getting worse.

US Q2 GDP Nowcasts Point To Pickup In Growth

The risk of recession remains elevated, according to several indicators, but the soft-landing scenario isn’t dead. Support for the relatively upbeat outlook includes estimates for second-quarter economic activity, based on current GDP nowcasts via data compiled by CapitalSpectator.com.

Macro Briefing: 19 May 2023

* House could vote on debt ceiling next week, says House Speaker McCarthy

* If the US defaults, it would be ugly. Here’s how it would unfold

* Two-thirds of North America could face blackouts in next few months

* Walmart Q1 sales beat expectations as firm lifts full-year outlook

* US Treasury yields rebound on upbeat economic, inflation outlook

* US jobless claims fell last week as bogus data muddle recent trend

* Philly Fed Mfg Index continues to indicate contraction for sector in May

* Existing home sales in US ease for a second month in April

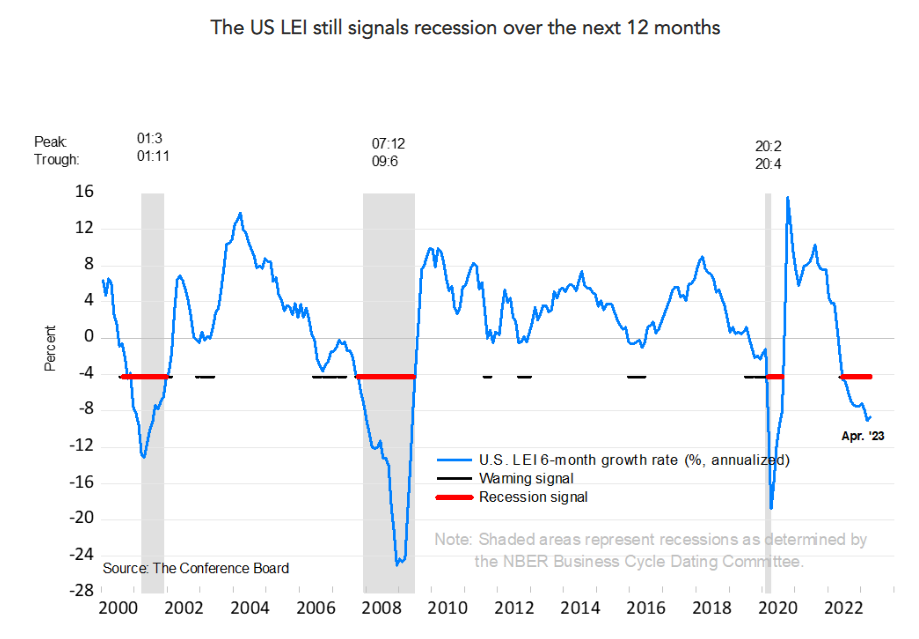

* US Leading Economic Index for April continues to forecast high recession risk:

Long Treasuries Top Bond Market Returns This Year

Last year’s famine has turned to feast in the bond market in 2023 as the riskiest slice of fixed income tops year-to-date results through yesterday’s close (May 17), based on a set of proxy ETFs.