● These Are the Plunderers: How Private Equity Runs―and Wrecks―America

Gretchen Morgenson and Joshua Rosner

Review via Business Insider

According to the authors, private equity firms “buy companies and load them with debt while bleeding them of assets and profits,” only to, within a few years, “sell these same companies off to new owners … at a substantial gain.”

On its face, the idea that one could regularly flip unprofitable businesses drained of productive assets for spectacular gains just doesn’t make sense. Sure, you could find a few anecdotes in which an aggressive private equity firm successfully foisted an overleveraged company it had subjected to excessive cost-cutting onto an unsuspecting buyer. But is this credible as a strategy for deploying trillions of dollars of capital? No way.

Monthly Archives: April 2023

US Growth Is Slowing, But Recession Doesn’t Appear Imminent

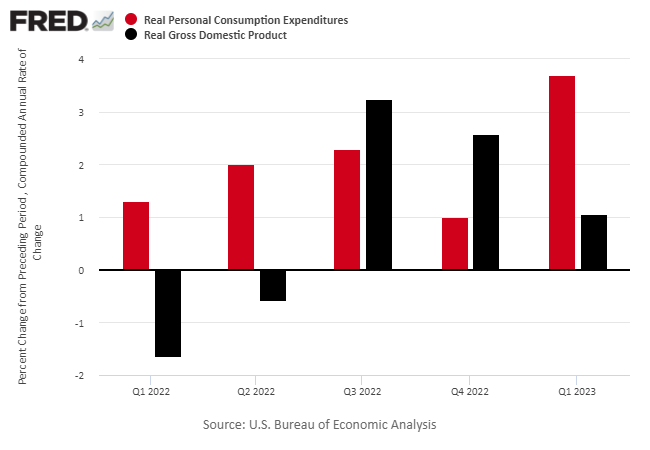

The US economy expanded at a much slower rate than expected in the first quarter, a prelude to recession, according to some forecasters. It would naïve to rule out the possibility in the current climate, but there’s also a case for expecting the economy to muddle onward with a sluggish expansion.

Macro Briefing: 28 April 2023

* US officials working with private sector to rescue First Republic Bank

* Eurozone economy continued to stagnate in Q1

* China raises pressure on foreign companies, posing new risks for Western firms

* Pending US home sales fell in March, first decline since November

* US jobless claims fell last week, staying low despite softer economic growth

* US growth slows more than expected in Q1 as consumer spending ramps up:

Tech And Communications Still Lead US Equity Sectors In 2023

There’s no shortage of things to worry about in the months ahead, but you wouldn’t know by reviewing year-to-date returns for the leading equity sectors. Tech and communications services are still red-hot this year, leaving the rest of the field – the stock market overall – in the dust, based on a set of ETFs through yesterday’s close (Apr. 26).

Macro Briefing: 27 April 2023

* House Republicans pass debt-ceiling and spending-cuts plan, but…

* The GOP debt-ceiling bill is expected to be dead on arrival in the Senate

* Weak tax collections suggest US may default on its debt as soon as early June

* US and S. Korea unveil landmark deal to counter N. Korean nuclear threat.

* The risk from ‘shadow banks’ has increased in wake of SVB collapse

* US durable goods orders rebound sharply but business investment falls again

* Atlanta Fed’s GDPNow model sharply downgrades Q1 growth estimate:

Large-Cap Growth Retakes Lead For Equity Factor Returns In 2023

Big-cap growth is back. After taking a back seat to various flavors of small-cap and value factors earlier in 2023, the large-company growth risk factor is again leading the horse race, based on year-to-date returns for a set of ETF proxies through yesterday’s close (Apr. 25).

Macro Briefing: 26 April 2023

* Uncertainty persists for House Speaker McCarthy’s debt-ceiling bill

* US debt default would trigger ‘economic catastrophe’, warns Treasury Sec. Yellen

* First Republic Bank’s stock falls 50% as depositors flee

* The troubles in the banking industry expected to weigh on economic growth

* US consumer confidence eased in April, near recent low

* US home prices rose in February–first monthly increase since June

* US money supply’s 1-year decline continues to deepen through April 3:

Moderate Growth Expected For Thursday’s US Q1 GDP Report

Forecasts of recession seem to be flowing from all corners these days, but this week’s initial estimate of economic activity for the first quarter (Apr. 27) is expected to show that growth prevails.

Macro Briefing: 25 April 2023

* GOP works to secure support for this week’s vote on debt ceiling package

* Commercial property faces harsh climate amid rising rates and remote work

* Deflation risk is rising in China

* Chile set to nationalize its lithium industry, which controls 30% of global supply

* First Republic, a troubled regional bank, says deposits fell 41% in Q1

* “Crypto is dead in America,” predicts longtime bitcoin bull

* Texas factory activity is flat in April after modest growth in March

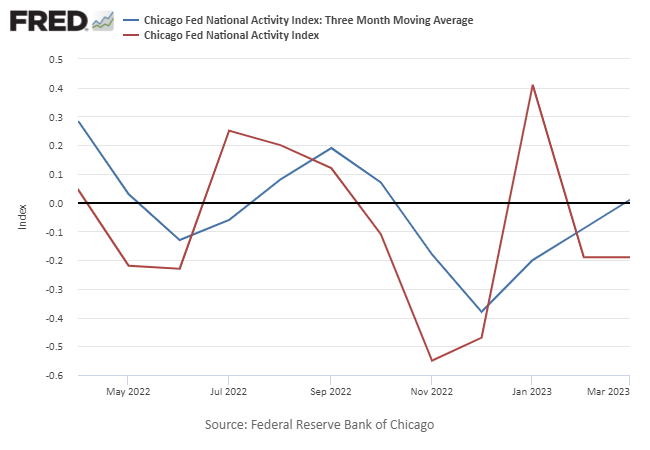

* US economic activity was below trend in March, but recession risk is still low:

US REITs Rebound, But Bearish Trend Still Weighs On Sector

US-listed real estate investment trusts (REITs) posted the strongest gain for the major asset classes in last week’s mostly quiet trading, based on a set of ETF proxies. A solid gain is welcome news for REITs, which have been sliding for more than a year, but it’s debatable if the rally signals an end for the sector’s bear market.