Government bonds recovered last week, leading the risk-off trade in global markets amid the second-largest bank failure in US history on Friday.

Monthly Archives: March 2023

Macro Briefing: 13 March 2023

* All SVB depositors will be protected, say US regulators

* US regulators close another bank: Signature Bank

* Wall Street considers how far the banking panic will spread

* US Banks have $620 Billion in unrealized losses, raising contagion worries

* North Korea fires submarine missiles ahead of US-South Korea military drills

* Biden bars oil drilling for nearly 3 million acres in Alaska

* Goldman Sachs no longer sees a Fed rate hike for the March 22 policy meeting

* Appeal of cash will increase in years ahead, predicts co-CIO at Bridgewater

* US payrolls rose more than expected in February

* US 10-year Treasury yield falls sharply amid SVB bank failure:

Book Bits: 11 March 2023

● Crash Landing: The Inside Story of How the World’s Biggest Companies Survived an Economy on the Brink

Liz Hoffman

Summary via publisher (Crown/Penguin Random House)

In Crash Landing, award-winning business journalist Liz Hoffman shows how the pandemic set the economy on fire—but if you look closely, the tinder was already there. After the global financial crisis in 2008, corporate leaders embraced cheap debt and growth at all costs. Wages flatlined. Millions were pushed into the gig economy. Companies crammed workers into offices, and airlines did the same with planes. Wall Street cheered on this relentless march toward efficiency, overlooking the collateral damage and the risks sowed in the process.

Research Review | 10 March 2023 | ETFs

ETF Dividend Cycles

Pekka Honkanen (University of Georgia), et al.

February 2023

Exchange-traded funds (ETFs) collect approximately 7% of all U.S. corporate dividends, which they are required to redistribute to investors. How do the funds manage these dividend flows, and does such management have spillover effects on other financial markets? In this paper, we document a new stylized fact of the “ETF dividend cycle:” ETFs gradually invest in money market funds (MMFs) when they accumulate dividend receipts and periodically withdraw from MMFs when they distribute dividends. This cycle creates periodic liquidity shocks to MMFs and, consequently, to the Treasury markets as the affected MMFs liquidate some of their short-term Treasury holdings to satisfy ETFs’ dividend-driven withdrawals. As a result, ETF dividend cycles can explain flows to MMFs and fluctuations in Treasury yields.

Macro Briefing: 10 March 2023

* China’s Xi Jinping secures unprecedented third term as president

* Selling of bank shares spreads as troubles for tech lender SVB deepen

* UK reports stronger-than-expected growth for January GDP

* OPEC is again the main factor influencing global oil supply

* Credit card debt reaches new high, putting consumers at ‘breaking point’

* US jobless claims rise to 2023 high but remain historically low

* US stock market falls to lowest level since late-January:

Median US GDP Estimate For Q1 Ticks Slightly Positive

Several indicators are flashing recession warnings for the US, but the median estimate for economic activity in the first quarter leaves room for doubt about the timing, suggests the median for a set of GDP nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 9 March 2023

* White House set to release deficit-cutting budget proposal

* Netherlands joins US in banning key microchip exports to China

* Markets cautiously await tomorrow’s payrolls report for February

* Markets see higher recession odds after Fed Chair Powell’s hawkish testimony

* Housing shortage persists in US by 6.5 million units, realty firm estimates

* China consumer inflation eases to slowest pace in a year in February

* Crypto bank Silvergate is shutting down, marking latest FTX aftershock

* US firms hire more workers than expected in February, ADP reports

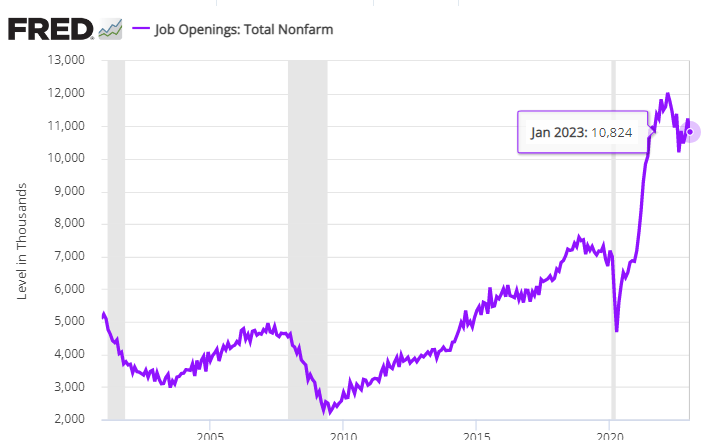

* US job openings eased in January, but remain elevated vs. history:

The Best Solution For Reducing Noise In Recession-Risk Estimates

US recession risk is high, unless it’s not. After months of conflicting signals from various business-cycle indicators, debate and disagreement reign supreme in the land of nowcasting and forecasting the odds for an economic downturn. In other words, the value of combination forecasting in the current environment has rarely been higher.

Macro Briefing: 8 March 2023

* Fed’s Powell says rate hikes may go higher than previously expected

* 2yr/10yr Treasury yield spread falls deeper into below-zero readings

* Workers across France protest pension reform proposal

* China announces shake-up of government oversight of financial system

* Eurozone GDP change revised down to zero for Q4

* US shale-oil boom appears close to peaking

* Buffett’s Berkshire Hathaway buys more Occidental Petroleum shares

* US 2-year Treasury yield (proxy for rate expectations) rises to 5%, a 16-year high:

Markets Continue To Flirt With Risk-On Signals

There’s no shortage of threats lurking, ranging from inflation, elevated interest rates that may go higher still, and various geopolitical threats. But market sentiment has improved recently, climbing a wall of worry and suggesting that investors are presuming that the worst has passed for the world economy, based on various ETF pairs through yesterday’s close (Mar. 6).