* China says it will ‘take countermeasures’ against US in balloon saga

* European Union bans sales of gas-powered cars starting in 2035

* ‘Earnings recession’ expected for US companies

* Small US business sentiment ticks up but remains below 49-year average

* Logistics managers warn of persistent inflation risk in supply chains

* Rally in emerging markets faces headwinds as US economy remains resilient

* Aggressive regulatory actions from US authorities rattle crypto markets

* US consumer inflation’s one-year trend continued to ease in January:

Monthly Archives: February 2023

Foreign Stocks Are Hot Again. Will It Last?

Diversifying into global markets ex-US has been a frustrating choice for asset allocation for much of the past decade. Standard portfolio theory recommends holding an international mix of shares, but the advice has been a dud in recent memory as US stocks have dramatically outperformed broad measures of offshore securities. But the rally in foreign stocks so far in 2023 suggests the tide may finally be turning in favor of global investing strategies.

Macro Briefing: 14 February 2023

* Biden to name Fed Vice Chair Brainard as top White House economic adviser

* Fed will hold rates higher for longer, predicts Wells Fargo economist

* So-called supercore inflation will be in focus in today’s CPI report

* US consumers still spending despite higher inflation

* Japan’s economy expands 1.1% in 2022, down from 2.1% rise in 2021

* New head of Japan’s central bank announced, first change in a decade

* Ford will build $3.5 billion battery plant in Michigan for electric vehicles

* Policy-sensitive 2-year US Treasury yield ticks up to 3-month high:

Global Markets Post Widespread Losses Last Week

This year’s rebound in global markets hit some turbulence last week, with the exception of commodities, based on a set of ETFs through Friday’s close (Feb. 10).

Macro Briefing: 13 February 2023

* US shoots down several aerial objects over North America

* Some economists consider possibility of an economic growth upturn for US

* Fears of a US debt crisis are overblown, writes economist Barry Eichengreen

* This week’s US consumer inflation data will test disinflation optimism

* Recession risk is lower due to labor hoarding, analyst reasons

* Will higher yields in Japan pull back assets invested overseas?

* US home prices set to fall further despite lower rates, says market expert

* Half of Americans say they’re worse off vs. year ago, survey finds

* US consumer inflation revised up for December

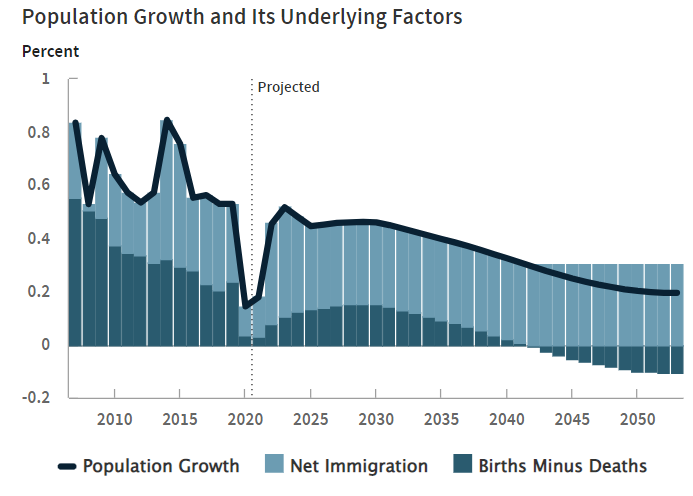

* Population growth in US is increasingly driven by net immigration, CBO projects:

Book Bits: 11 February 2023

● At Work in the Ruins: Finding Our Place in the Time of Science, Climate Change, Pandemics and All the Other Emergencies

Dougald Hine

Summary via publisher (Chelsea Green Publishing)

In eloquent, deeply researched prose, Hine demonstrates how our over-reliance on the single lens of science has blinded us to the nature of the crises around and ahead of us, leading to ‘solutions’ that can only make things worse. At Work in the Ruins is his reckoning with the strange years we have been living through and our long history of asking too much of science. It’s also about how we find our bearings and what kind of tasks are worth giving our lives to, given all we know or have good grounds to fear about the trouble the world is in.

Will This Year’s Recovery In US Bonds Continue?

After taking a beating last year, US fixed income securities have clawed back some of the losses so far in 2023, based on a set of ETFs through yesterday’s close (Feb. 9). But with the Federal Reserve still intent on lifting interest rates to tame inflation, the outlook for bonds is still murky.

Macro Briefing: 10 February 2023

* US looks set to further restrict tech exports to China after balloon incident

* Russia will cut oil output by 5% in response to West’s price cap

* UK economy stagnates in Q4

* China inflation edges higher as economy reopens

* Recession risk for US appears to be falling, analysts predict

* Will the rush into artificial intelligence be the next bubble on Wall Street?

* US Energy Dept. will loan $2 billion to battery recycling firm

* Yahoo reportedly will cut 20% of its staff this year

* US jobless claims remain low, but are rising again on a year-over-year basis:

Is It Risk-On Again?

This year’s rebound in asset prices around the world suggests that investor sentiment is shifting to risk-on after a year of playing defense. Trying to divine the future for pricing is always precarious, especially in the near term. But there’s no charge for looking at proxies of key market trends through various ETF pairs. As we’ll see, certain slices of markets are predicting a new bull run, but it’s still early to ring the all-clear signal, according to a broad measure of US stocks relative to US bonds, which is arguably a more reliable indicator. But let’s start with the sizzle.

Macro Briefing: 9 February 2023

* US-China tensions are high, but so is commerce between the two nations

* Fed officials reaffirm that higher rates needed to tame inflation

* China deploys surveillance balloons worldwide, say US officials

* Disney announces 7,000 job cuts as streaming business falters

* Credit Suisse reports huge annual loss as it continues with reforms

* Mortgage refinance demand ticks up as mortgages rate fall for fifth week

* JPMorgan reportedly cuts hundreds of mortgage employees

* Commodities prices near lowest level in over a year: