* Biden to meet eastern NATO flank after Poland visit

* US may impose new sanctions on China for its economic support of Russia

* Russia will suspend last remaining U.S.-Russia arms control treaty

* Walmart turns cautious on economic outlook

* Amazon has approval from FTC to acquire One Medical primary-care clinics

* Existing home sales in US fall for 12th straight month in January

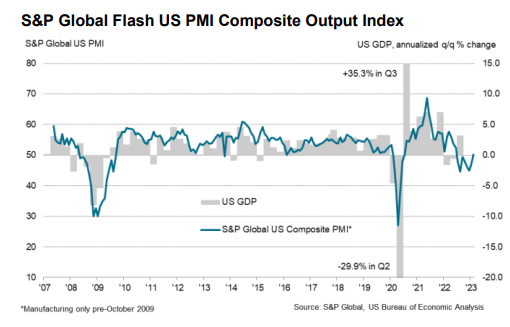

* US business activity rebounds in February via PMI survey data:

Monthly Archives: February 2023

Oversold-Overbought Watch: S&P 500 Index | 21 February 2023

The low-hanging fruit has been picked. Casual observation suggests as much. The S&P 500 Index has rebounded sharply off its previous low in October, closing up 14% on Friday (Feb. 17) since October’s trough.

Macro Briefing: 21 February 2023

* Supreme Court case could change immunity standard for Big Tech’s social media

* China is mobilizing its courts to undermine foreign intellectual-property rights

* The Fed’s preferred inflation gauge is expected to run hot in Friday’s update

* Eurozone rebound in business activity accelerates in February

* UK private sector grows in February after six-month decline

* US earnings decline for companies expected in Q1 and Q2, analysts predict

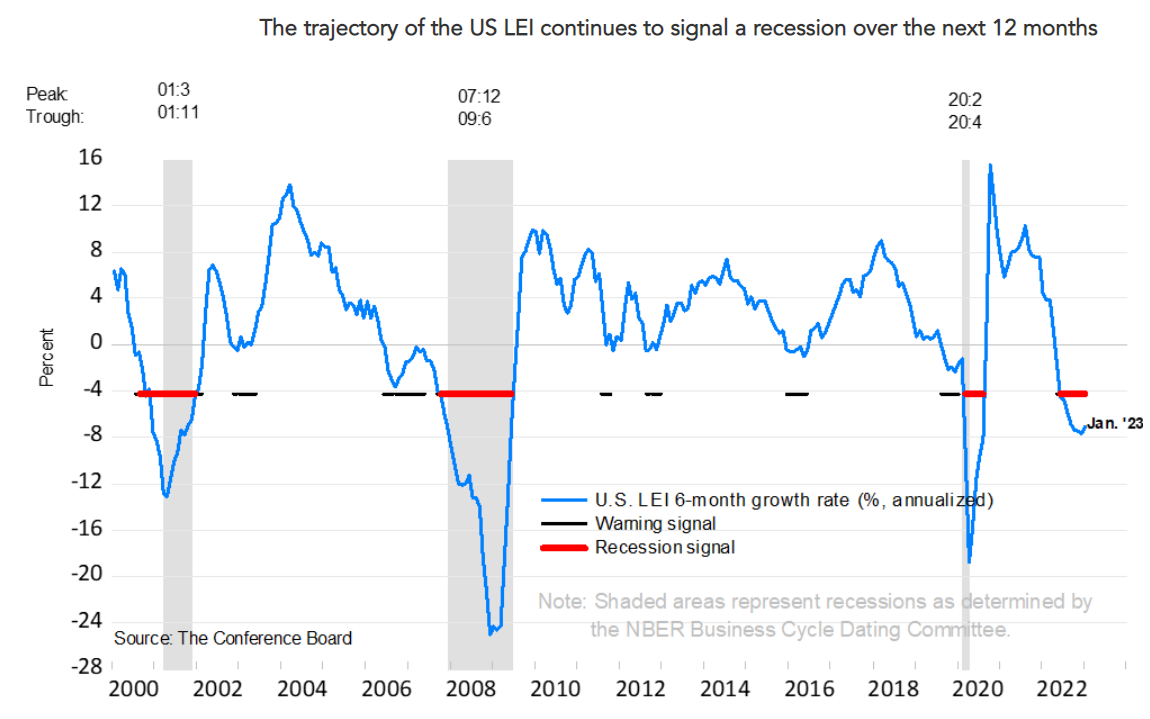

* US Leading Economic Index continues to signal high recession risk, CB reports:

Happy President’s Day!

“You cannot escape the responsibility of tomorrow by evading it today.”

– Abraham Lincoln

Book Bits: 18 February 2023

● Deconstructing Credit Cycles

Steven Ricchiuto

Interview with author via Yahoo Finance

Financial markets are being driven by excessive liquidity at a time when both bond and equity markets are expensive, said Steven Ricchiuto, U.S. chief economist at Mizuho Securities USA LLC in New York. “As people come to the realization that the Fed is going to be higher for longer and we don’t yet know what the higher is, even if they pause I still think the next move is a rate hike, not a rate cut,” he said.

Research Review | 17 February 2023 | Risk Analysis

Submergence = Drawdown Plus Recovery

Dane Rook (Stanford University), et al.

February 2023

Drawdowns and recoveries are often analyzed separately – yet doing so can leave investors with a distorted view of risk. Indeed, this problem is so commonplace that there’s no consistently-used term for the joint event of a drawdown plus its subsequent recovery. We propose the term ‘submergence’ for such events, and present a new risk metric to help investors analyze them: submergence density. Submergence density overcomes pitfalls of existing metrics, and also allows investors to inject elements of their own risk tolerances, thereby ‘personalizing’ it to their own contexts. Submergence density also offers an alternative method for risk-adjusting returns (with multiple advantages over current methods, such as Sharpe ratios). We use our new risk-adjustment approach to study key markets, and show how it leads to novel diversification strategies. We compare these strategies with other defenses against submergence risk, and conclude that submergence-based diversification is likely the best way for most investors to handle the threat of drawdowns.

Macro Briefing: 17 February 2023

* Pentagon’s top China official is visiting Taiwan

* US mortgage rates rise for second week–average 30-year fixed at 6.32%

* Consumer sector in US showing new signs of resilience

* Will optimism in financial markets strengthen Fed’s hawkish monetary bias?

* US wholesale prices re-accelerate in January–new warning sign for inflation

* Philly Fed Manufacturing Index falls sharply in February

* US housing starts fall in January–lowest level since pandemic was raging in 2020:

Strong Rebound In Retail Sales Gives Fed More Room To Lift Rates

Economists were expecting a sharp recovery in US retail spending in January, but the actual number blew past even the most optimistic forecast. One month could be noise, but for the moment it appears that the Federal Reserve’s aggressive campaign to tame inflation by slowing economic activity is faltering.

Macro Briefing: 16 February 2023

* Embattled World Bank president, David Malpass, will resign early

* Homebuilder sentiment for US rebounds sharply in February

* US Q1 GDP nowcast revised up to +2.4% via Atlanta Fed’s GDPNow model

* US budget deficit set to deepen to 6.9% of GDP by 2033, CBO projects

* US may default in July if debt-ceiling standoff isn’t resolved, CBO warns

* NY Fed Mfg Index rebounds in February but remains in negative territory

* US industrial output flat in January, but rises 0.8% vs. year-ago level

* US retail sales surge in January, in nominal and inflation-adjusted terms:

10-Year Treasury Yield ‘Fair Value’ Estimate: 15 February 2023

US consumer inflation continues to ease, but less so than expected in January. Yesterday’s update suggests that the Federal Reserve will see the latest numbers as new sign that pricing pressure isn’t cooling fast enough. In turn, the case may have strengthened at the central bank for keeping interest rates higher for longer.