* Will Biden’s document problems spiral into a political crisis?

* US debt-ceiling fight brewing for later this year

* US and Japan strengthen military alliance to deter China

* Analysts expect corporate profits to fall for first time since pandemic’s start

* China consumer inflation picks up to annual 1.8% pace; still below 2% target

* Recent economic pessimism may have been too extreme: JP Morgan’s Dimon

* European stocks may outperform US shares this year, analysts advise

* Business inflation outlook continues to ease in January via Atlanta Fed survey:

Monthly Archives: January 2023

Looking For Risk-On Signals

Mr. Market doesn’t explain himself, but he does drop clues about preferences. Interpretation is mostly art, but it can be worthwhile when there are clear signs of trend changes. One approach for monitoring such events is comparing ETF pairs.

Macro Briefing: 11 January 2023

* World Bank sharply lowers growth outlook for world economy in 2023

* Powell says Fed may need to make unpopular decisions to stabilize prices

* West’s war on Russia’s oil revenues is starting to take toll on country’s finances

* US and allies preparing new sanctions on Russian oil industry

* Cryptocurrency exchange platform Coinbase is laying off 950 employees

* Narrower measures of core inflation are in focus for tomorrow’s CPI report

* First AI-powered robot lawyer to make debut in a US court

* Policy-sensitive 2-year US Treasury yield remains relatively steady at ~4.2%:

The US Dollar’s Influence On The Stock Market Isn’t Trivial

How many factors influence the equity market’s performance through time? It’s a long and variable list and no one’s ever sure about the exact inventory in real time, except for Mr. Market, who never speaks on such things. But through the process of reverse engineering we can guesstimate what’s relevant, and what’s not. Among the factors that deserve to be on the short list: the ebb and flow of the US dollar.

Macro Briefing: 10 January 2023

* Biden meets with Mexican president and discusses migration crisis at border

* Nearly half of national security experts see risk of Russia collapse in next decade

* US consumers extend historic increase in credit in November

* Small business sentiment index falls in December, near 10-year low

* McCarthy’s concessions raise fears of potential default, government shutdown

* US banking giants are expected to report shrinking profits

* Consumer inflation expectations fall again in December via NY Fed survey:

Global Markets Rally In First Trading Week Of 2023

Nearly all the major asset classes posted solid gains in the kickoff to the new year, based on a set of proxy ETFs. The lone exception: commodities.

Macro Briefing: 9 January 2023

* Thousands of protesters storm Brazil’s government buildings

* Biden meets with Mexico president today: focus on migration, supply chains

* Precarious GOP House majority raises risk of debt-ceiling battle

* China stages large-scale military exercises around Taiwan

* This week’s consumer inflation report will influence size of next Fed rate hike

* Tech industry layoffs are accelerating

* Goldman Sachs to start cutting thousands of jobs this week

* Eurozone unemployment rate holds at record low in November: 6.5%

* Gold rises to eight-month high in early Monday trading:

Book Bits: 7 January 2023

● The Market Power of Technology: Understanding the Second Gilded Age

Mordecai Kurz

Summary via publisher (Columbia U. Press)

Kurz demonstrates that technological market power tends to rise, increasing inequality of income and wealth. Unchecked inequality threatens the foundations of democracy: public policy is the only counterbalancing force that can restrain corporate power, attain more egalitarian distribution of wealth, and make democracy compatible with capitalism. Presenting a new paradigm for understanding today’s vast inequalities, this book offers detailed proposals to redress them by restricting corporate mergers and acquisitions, reforming patent law, improving the balance of power in the labor market, increasing taxation, promoting upward mobility, and stabilizing the middle class.

Upbeat Q4 GDP Nowcasts For US Conflict With Recession Warnings

Several estimates of fourth-quarter economic activity for the US have turned higher recently. The improvements clash with ongoing recession forecasts, but for the upcoming Q4 report the outlook remains positive, based a set of estimates compiled by CapitalSpectator.com.

Macro Briefing: 6 January 2023

* House remains paralyzed as McCarthy fails to win vote for 3rd day

* Ukraine dismisses Putin’s Russian Orthodox Christmas truce

* Global economic activity continues to contract in December via PMI survey data

* US trade deficit narrows sharply on cooler global demand

* Eurozone inflation eases as prices for energy retreat

* US jobless claims fall to four-month low

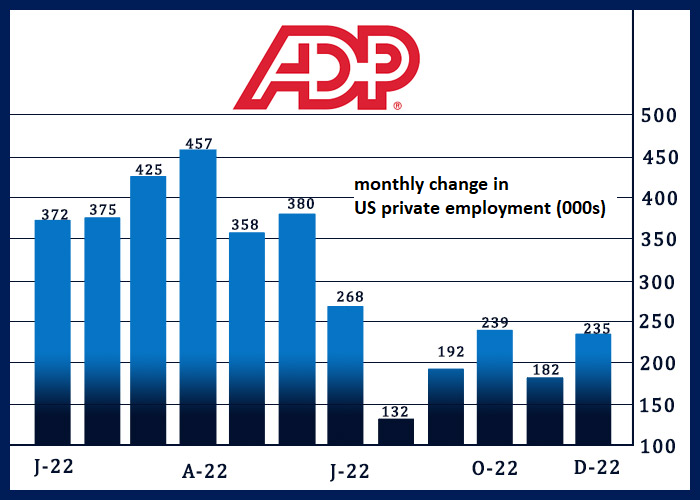

* US hiring by companies rebounds in December via ADP estimate: