* US and Germany set to announce sending tanks to Ukraine

* Treasury takes another “extraordinary” step to buy time in debt-ceiling impasse

* Senators consider Social Security reforms as GOP House members weigh cuts

* A warning for the labor market: companies cutting temporary workers

* Deciding if recession is high is unusually tricky this time

* Climate change may trigger new era of trade wars

* Justice Dept. sues Google, claiming it dominates digital advertising

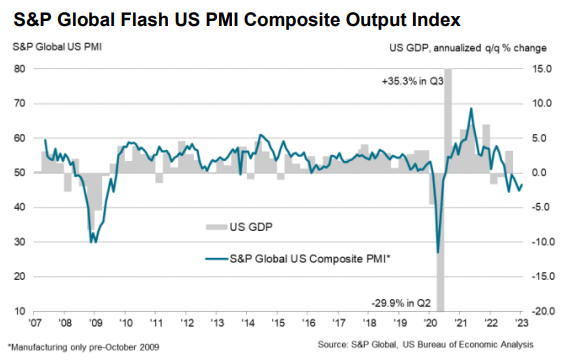

* US economic contraction continues in January via PMI survey data:

Monthly Archives: January 2023

US Q4 GDP Nowcasts Project Solid Rise For Thursday’s Report

Recession worries continue to swirl, but the outlook remains upbeat for this week’s initial estimate of fourth-quarter GDP, based on a set of estimates compiled by CapitalSpectator.com.

Macro Briefing: 24 January 2023

* Eurozone economic activity edges back to growth in January via PMI survey data

* UK continues to post “sustained downturn” in January via PMI survey data

* US investment firms look to Europe for growth, start turning away from China

* Analysts expect US stocks will continue to underperform global peers

* The end of easy money is “particularly painful” for tech companies

* Microsoft will invest billions of dollars in OpenAI, creator of ChatGPT

* US Leading Economic Index fell sharply again in December:

Foreign Stocks Continue To Rally As US Shares Retreat

Diversifying into equities ex-US has been a disappointment in recent years, but January suggests the tide may be turning in favor global investing strategies.

Macro Briefing: 23 January 2023

* Bipartisan lawmakers prepare plan to defuse debt-ceiling crisis

* China’s reopening may boost global inflation

* Market-based gauges of inflation project rapid inflation slide in months ahead

* The first ETF celebrates its 30th birthday this week

* Banks set for deepest layoffs since the financial crisis

* The long and winding road to the US government’s $31 trillion pile of debt

* Big tech’s big reversal linked to mistaken bets on pandemic-fueled growth

* Fed’s Waller supports slowing next rate hike to 25 basis points

* US existing home sales fell again in December, lowest since November 2010:

Book Bits: 21 January 2023

● Edible Economics: A Hungry Economist Explains the World

Ha-Joon Chang

Summary via publisher (Public Affairs Books)

For decades, a single, free-market philosophy has dominated global economics. But this intellectual monoculture is bland and unhealthy. Bestselling author and economist Ha-Joon Chang makes challenging economic ideas delicious by plating them alongside stories about food from around the world, using the diverse histories behind familiar food items to explore economic theory. For Chang, chocolate is a lifelong addiction, but more exciting are the insights it offers into postindustrial knowledge economies; and while okra makes Southern gumbo heart-meltingly smooth, it also speaks of capitalism’s entangled relationship with freedom. Myth-busting, witty, and thought-provoking, Edible Economics serves up a feast of bold ideas about globalization, climate change, immigration, austerity, automation, and why carrots need not be orange.

Research Review | 20 Jan 2023 | ETFs and Related Strategies

Do Sector ETFs Outperform Treasury Bills?

Gow-Cheng Huang (Tuskegee U.) and Kartono Liano (Mississippi State U.)

June 2022

Unlike individual stocks, more than 67% of sector ETFs have lifetime buy-and-hold returns that are higher than the T-bill rates. Thus, the majority of sector ETFs outperform T-bills. However, less than 26% of sector ETFs have lifetime buy-and-hold returns that are higher than SPY, an index ETF that is a proxy for the overall stock market. Consequently, most sector ETFs underperform the market index.

Macro Briefing: 20 January 2023

* US government hits debt ceiling, begins “extraordinary measures” to pay bills

* NATO meets amid dissent over sending tanks for Ukraine

* Global economic outlook improves but “doesn’t quite yet mean good:” IMF chief

* Big oil is moving into the electric-vehicle charging industry

* Google will cut about 12,000 jobs, or 6% of its workforce

* Japan inflation reaches 41-year high

* US jobless claims fall to 190,000, lowest in 15 weeks

* Philly Fed Mfg Index: softer pace of contraction in January

* US housing starts and building permits continue to slide in December:

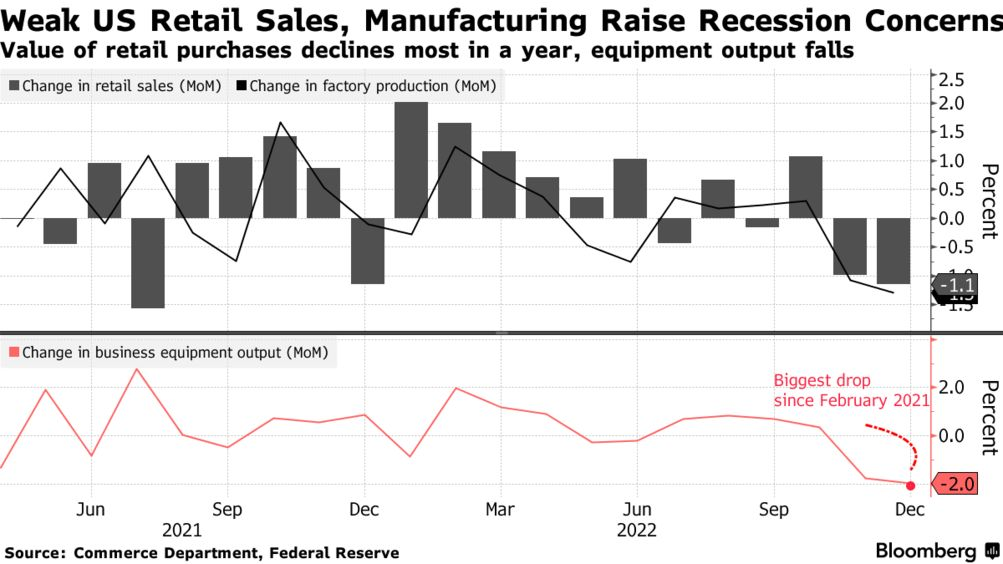

Falling US Retail Sales Raise Warning Flag For Consumer Sector

Economists were expecting a decline, but the 1.1% slide in retail spending in December was deeper than expected. Even worse, the monthly slide marks the second straight decline. It could be noise, but in the current climate it’s reasonable to read yesterday’s news on the consumer sector as a new warning that business-cycle risk remains elevated.

Macro Briefing: 19 January 2023

* US Treasury’s “extraordinary measures” start today for paying government’s bills

* US producer price inflation cooled in December

* Job cuts in tech industry spread as Microsoft plans to lay off 10,000 workers

* Fed chairman Jerome Powell tests positive for coronavirus

* Cryptocurrency firm Genesis Global Capital set to file for bankruptcy

* Global bond sales surge to record start in 2023: nearly $600 Billion

* US industrial output falls more than expected in December

* Fed’s Beige Book: inflation slowing while job market remains tight

* Home builder sentiment rises in January–first monthly gain in a year

* US retail sales decline for second month in December: