The energy sector has been red hot for much of the past year, but there are still pockets in this corner that remain battered, at least in relative terms. Notably, oil and gas equipment stocks remain deep in the red in absolute and relative terms, based on relative rankings for a set of 145 ETFs that cover the waterfront for the major asset classes.

Monthly Archives: January 2023

Macro Briefing: 31 January 2023

* China’s economy grows in January (PMI survey)–first expansion since September

* Is a bull market returning to China’s stock market?

* Will China’s reopening keep global inflation higher for longer?

* Biden reportedly moves to halt US exports to Huawei, according to reports

* Eurozone GDP posts slight growth in Q4, beating expectations of a dip, but…

* German economy unexpectedly shrinks in Q4, raising risk of recession

* Demand for oil and gas will drop dramatically by 2050, BP projects

* IMF raises growth outlook for world economy in 2023:

US Real Estate Stocks Led Broad Rally Across Markets Last Week

Most of the major asset classes scored gains last week, led by US real estate investment trusts, based on a set of ETFs through Friday’s close (Jan. 27).

Macro Briefing: 30 January 2023

* Israel executes drone strike targeting defense compound in Iran

* German economy unexpectedly contracts in Q4

* Will wages or low unemployment drive Fed’s inflation-taming policy?

* Japan and Netherlands join US to limit chip tech exports to China

* Fed’s preferred inflation gauge eased again in December

* Pending home sales in US rose in December for first time since May

* US consumer spending fell for second month in December:

Book Bits: 28 January 2023

● The Aftermath: The Last Days of the Baby Boom and the Future of Power in America

Philip Bump

Review via The Washington Post

If you’re looking for the highly detailed, data-driven, definitive story of how baby boomers changed America and a little forecasting of what might come next, Philip Bump’s “The Aftermath: The Last Days of the Baby Boom and the Future of Power in America” is it. Generational analyses can often be a bit pat and reductive, with cherry-picked numbers leveraged to support a too-tidy narrative (wealthy and venal boomers screwing the rest of us; avocado-toast-eating millennial snowflakes woke-ing themselves broke). Bump, a national columnist for The Washington Post, offers the opposite: a deep and complicated interrogation of his subject, often challenging his own assumptions, with detailed forecasts of what could lie ahead — all illustrated with charts and visuals to drive a huge amount of data home.

Is US Recession Risk High, Low… Or Both?!?

There’s an old joke in the world of statistics that says if you torture the data long enough, it’ll say anything you want. But sometimes torturing is redundant. Consider the art/science of deciding how to read the state of US business cycle at the moment. Is recession risk high, low or somewhere in between? Yes, yes and yes.

Macro Briefing: 27 January 2023

* US jobless claims fall, highlighting tight labor market conditions

* US durable goods orders rose in December, fueled by aircraft orders

* Chicago Fed Nat’l Activity (3mo avg) falls in December; new economic warning

* Money supply data is back in focus after inflation roller coaster

* Big oil firms expected to report record annual profits

* 10yr US Treasury yield rises above 3.5% after better-than-expected GDP report

* US economy rose 2.9% in fourth quarter, beating expectations:

Is Rally In Communications Stocks Sign Of New Sector Leadership?

Energy was the hot sector last year, but so far in 2023 it looks like a shift in leadership could be unfolding, based on a set of sector ETFs through the close of trading on Jan. 25.

Macro Briefing: 26 January 2023

* Russia launches new attacks on Ukraine, which lauds West’s plan to send tanks

* Hiring surge by small firms complicates Fed’s plans to cool inflation

* Sen. Manchin seeks delay in new tax credits for electric vehicles

* Will a gain in today’s Q4 GDP report minimize recession risk?

* Consumer prices remain high despite softer inflation data

* Investors eye layoffs at investment banks as recession indicator

* Does Google antitrust investigation threaten its dominance in search business?

* Smartphone shipments plunge in Q4, largest decline on record

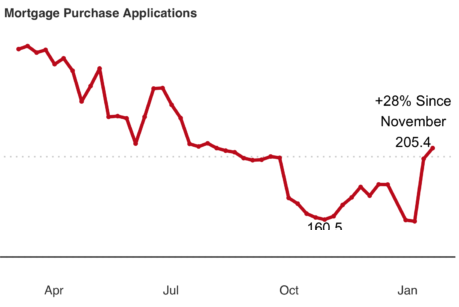

* US housing demand showing signs of rebounding, advises Redfin:

Fed Pivot Watch: 25 January 2023

The Federal Reserve is expected to slow its next rate hike to a quarter-point increase, which would be the smallest since it began lifting rates in March 2022. The outlook has sparked debate on whether the central bank’s policy tightening will end after the upcoming Feb. 1 FOMC meeting.