* Ukraine drones extend attacks into Russia

* Global economic activity deepened during November, PMI survey data reports

* US factory orders rise more than forecast in October

* Global manufacturing operations shifting away from China

* Oil prices rise as new cap starts on the price of Russian crude

* Renewables will be biggest source of electricity generation by 2025, IEA says

* CEO optimism is waning on the outlook for 2023

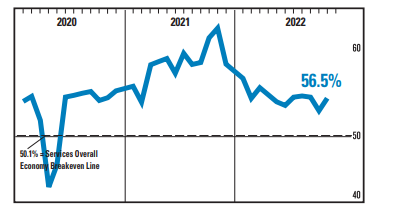

* US Services PMI: “Business activity contraction gains pace” in November, but…

* ISM US Services Index reports stronger growth in November:

Monthly Archives: December 2022

Emerging Markets Stocks Top Last Week’s Rebound For Risk Assets

Stocks in emerging markets extended their recent recovery and posted the strongest gain in a wide-ranging bounce for the major asset classes for the trading week through Friday, Dec. 2, based on a set of ETFs.

Macro Briefing: 5 December 2022

* Stronger-than-expected jobs report keeps pressure on Fed to extend tight policy

* China’s services activity in November declines at steepest level since May

* US manufacturing orders in China have dropped 40 percent

* Eurozone retail sales in October post biggest monthly decline so far in 2022

* OPEC maintains oil-supply cuts as West tightens sanctions on Russian oil

* BP bets big on hydrogen as fuel of the future

* Developing nations facing a debt crisis in coming months

* Global food prices continued falling in November

* No actively run mutual funds consistently beat their benchmark, study finds

* US payrolls beat forecasts and post solid gain for November:

Book Bits: 3 December 2022

● Escape from Model Land: How Mathematical Models Can Lead Us Astray and What We Can Do About It

Erica Thompson

Review via The Economist

The author calls on data geeks to improve their solutions to real-world issues, not merely refine their formulae—in other words, to escape from model land. “We do not need to have the best possible answer,” she writes, “only a reasonable one.” Before there is a statistical model, she notes, there is a mental version. Data scientists need self-awareness and empathy as well as mathematical skill.

Total Return Forecasts: Major Asset Classes | 2 December 2022

Expected long-run returns for most of the major asset classes remain relatively attractive, based on updates of models run by CapitalSpectator.com. The outlier: US stocks, which are posting the softest relative performance forecast compared with the trailing 10-year return.

Macro Briefing: 2 December 2022

* Fed’s preferred inflation gauge shows signs of slowing in October

* US consumer spending accelerated in October

* OPEC+ considers deeper oil output cuts

* Construction spending in US fell sharply in October due to weak homebuilding

* Atlanta Fed’s Q4 GDP nowcast revised down sharply to still-solid +2.8%

* Global manufacturing conditions deteriorated again in November

* US mfg activity contracts in November via ISM Mfg Index:

Major Asset Classes | November 2022 | Performance Review

The rebound in global markets strengthened and broadened in November, building on October’s rebound. Only commodities lost ground last month. Otherwise, all the major asset classes posted gains, based on a set of proxy ETFs.

Macro Briefing: 1 December 2022

* Smaller rate hikes may start as early as Dec. 14 meeting, says Fed’s Powell

* House votes to block rail strike

* China signals slight easing of Covid policy after protests

* Pending home sales in US fall for fifth straight month in October

* Mortgage rates drop for third week but housing demand weakens further

* US job openings cooled in October

* Fed’s Beige Book: economic uncertainty rises as economic growth eases

* Q3 GDP growth is revised up to +2.9%

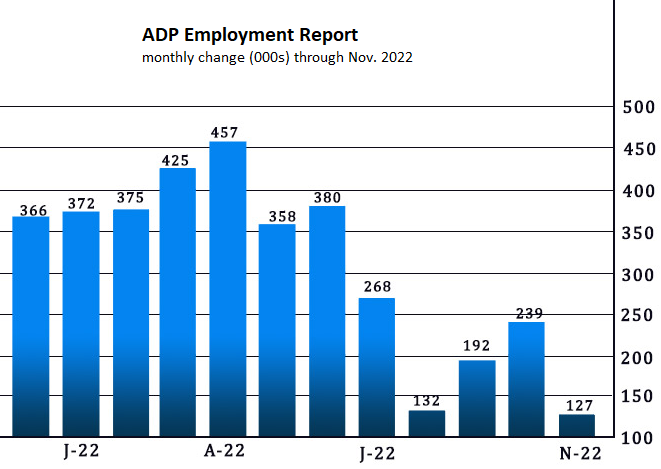

* US private employment growth slows sharply in November via ADP data: