There are no shortage of risks weighing on markets and economies these days, but perhaps the first question that’s on every investor’s mind: When will the Fed pivot? Everyone has a view, but no one has a clue, which is why monitoring the ebb and flow of key indicators is the first stop on the road to guesstimating when the tide will turn. As the data below suggests, however, a pause in Federal Reserve rate hikes – much less a rate cut – still looks like a low probability event for the immediate future.

Daily Archives: October 21, 2022

Macro Briefing: 21 October 2022

* UK Prime Minister Liz Truss quits but political and economic turmoil will persist

* High inflation is raising political risk for governments in Europe

* 10-year US Treasury yield on track for 12th straight weekly increase

* US home sales continue to fall, dropping for eighth straight month in September

* Philly Fed Manufacturing Index continued to signal sector weakness in October

* US jobless claims fell last week, indicating tight labor market persists

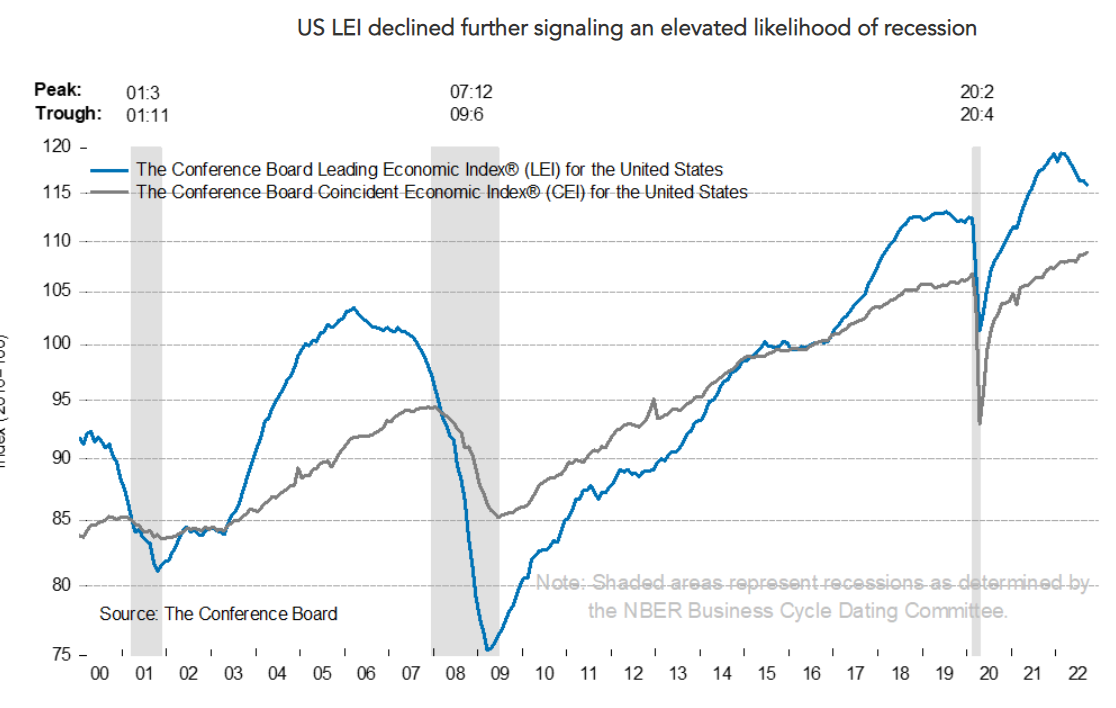

* Leading Economic Index fell again in September, reflecting rising recession risk: