● The Invention of Tomorrow: A Natural History of Foresight

Thomas Suddendorf, et al.

Review via Psychology Today

Human foresight obviously has its flaws, and try as we might, we can’t predict the future with certainty. However, the fact that we can even imagine and speculate about the future is nothing short of extraordinary. This ability is what has allowed humans to achieve the seemingly unachievable. The Invention of Tomorrow: A Natural History of Foresight by Suddendorf, Redshaw, and Bulley (out now, from Basic Books) delves into foresight, exploring how it works, how it develops, and how it evolved. The book is meticulously researched, thought-provoking, and engrossing, and I highly recommend it.

Monthly Archives: September 2022

When Will Stocks Hit Bottom? Rate Cuts May Be The Best Signal

As evidence piles up that the stock market is caught in a bear market, the focus inevitably turns to analytics that will signal a high-confidence forecast that the selling has reached exhausted itself and a bottom has arrived. There are many possibilities for crunching the data and all come with caveats. But perhaps the leading first approximation is the start of interest-rate cuts.

Macro Briefing: 23 September 2022

* Kremlin-run voting begins Friday in Russia-held regions of Ukraine

* Central banks around the world hike rates after Fed increase

* US Leading Economic Index fell for sixth straight month in August

* Investor pessimism returns to 2008-era high via BoA survey

* Eurozone contraction deepens in September, according to PMI survey data

* UK business activity falls at quickest rate since January 2021 via PMI survey data

* US jobless claims edged up last week but remain near historic lows:

When Will Bonds Become A “Buy”?

As comments from heads of central banks go, yesterday’s press conference was relatively lucid. For anyone who remains confused about the likely path ahead for monetary policy, well, they probably weren’t listening.

Macro Briefing: 22 September 2022

* NATO chief condemns Putin’s latest threat of nuclear war

* Federal Reserve lifts interest rates with third straight 1/4-point hike

* Fed’s Powell suggests recession may be price for taming inflation

* Fed anticipates lifting rates as high as 4.6% to tame inflation

* Bank of England under pressure to follow Fed with big rate hike

* Home sellers are scarce as rising rates convince homeowners to stay put

* Yen rises after Japan intervenes in currency market for first time since 1998

* After Switzerland’s rate hike, Japan is last country with negative rates

* US existing home sales fell for seventh straight month in August:

Guesstimating The Terminal Rate For Fed Policy

The Federal Reserve is expected to raise interest rates today and another 75-basis-points hike is widely expected. What’s less clear is how long and how fast the central bank tightens policy. No one knows the answer at this point, not even the Fed and so the path ahead is arguably the main known risk factor for the markets. In turn, pondering where the terminal rate lies is the burning question for investors and analysts trying to forecast economic activity.

Macro Briefing: 21 September 2022

* Russia announces ‘partial mobilization’ of citizens in escalation of Ukraine war

* Federal Reserve expected to raise interest rates 75 basis points today

* US and Canadian warships sail through Taiwan Strait

* Germany nationalizes energy giant Uniper amid energy crisis

* Asia’s developing economies set to grow faster than China’s

* European businesses rethink plans for a ‘closed’ China

* Disinflation may return, predicts economist at Capital Economics

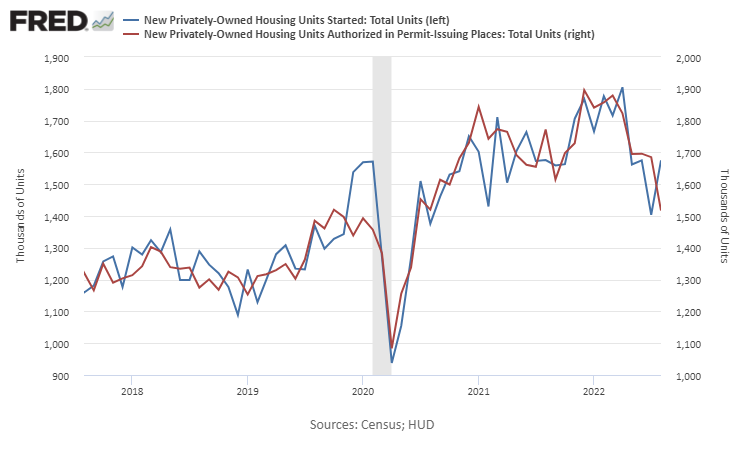

* US housing starts rebounded in August as new permits plunged:

10-Year Treasury Yield ‘Fair Value’ Estimate: 20 September 2022

The Federal Reserve is widely expected to lift its target interest rate by 75 basis points tomorrow (Wed., Sep. 21). The question is whether the bond market has priced in the change? That’s a tough call until there’s deeper clarity on where inflation is headed.

Macro Briefing: 20 September 2022

* Wall Street is anxious ahead of another expected rate hike on Wednesday

* Policy-sensitive 2yr Treasury yield set to rise above 4%

* Rate hikes by central banks may bring ‘string of financial crises,’ says World Bank

* US arrests at southwestern border exceed 2 million in a year for first time

* Mortgage rates rise to new 14-year high

* Sweden’s central bank lifts policy rate 100bps to fight surging inflation

* US Housing Market Index (homebuilder sentiment) fell again in September:

Clean Sweep Of Losses For Major Asset Classes Last Week

Bearish expectations for growth, interest rates and inflation took another toll on markets around the world last week, based on a set of proxy ETFs representing the primary asset classes as of Friday’s close (Sep. 16).