US economic activity is still expected to post a rebound in the upcoming third-quarter GDP report, but the projected bounced has faded to a crawl, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com.

Monthly Archives: September 2022

Macro Briefing: 30 September 2022

* Russia set to formally annex parts of Ukraine

* Hurricane Ian heads to Carolinas after hammering Florida

* Eurozone inflation soars to record high of 10% in September

* US GDP 0.6% decline is confirmed in revised data

* US gross domestic income (GDI) revised down for Q2

* China manufacturing activity fell for a second month in September

* China services sector slows in September, highlighting struggling economy

* US jobless claims fall to 5-week low, suggesting labor market strength:

Nominal vs. Real Treasury Yields: A Primer

Real (inflation-adjusted) yields have surged in recent weeks, raising the question of whether it’s timely to buy inflation-indexed Treasuries (a.k.a. TIPS)? Maybe, but before you dive in keep in mind that real Treasury yields a particular mix of opportunity and risk that contrasts with standard Treasuries. Accordingly, it’s crucial to pick the right tool based on what you’re looking to achieve (or avoid) at the right time.

Macro Briefing: 29 September 2022

* More than 2.5 million Florida customers without power from Hurricane Ian

* Fed’s Bostic favors a fourth 75-basis-points rate hike in November

* Federal Reserve is exporting inflation to economies around the world

* Deficits are more threatening now that inflation has surged

* China’s new fiscal stimulus exceeds amount issued in 2020

* Eurozone economic sentiment continues its steep decline in September

* UK Prime Minister Liz Truss vows to press on with tax cuts despite blowback

* US pending home sales fell for a third straight month in August

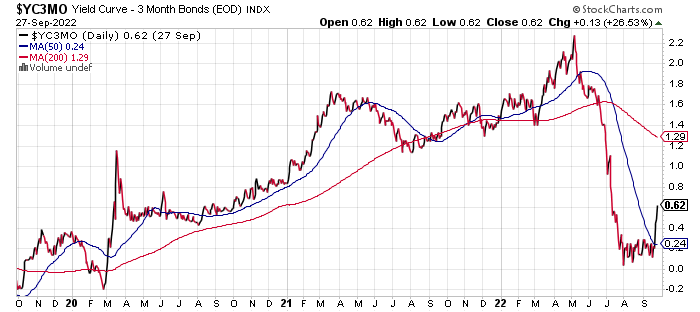

* 3mo/10yr Treasury yield curve up for fourth day, rising to highest since July:

High Dividend Yield Is Leading Edge Of Defense For US Shares

There’s nowhere to hide in US stocks from a risk-factor perspective, but high-dividend-yielding shares are still the first line for blunting losses year to date, based on a set of proxy ETFs through yesterday’s close (Sep. 27).

Macro Briefing: 28 September 2022

* Will UK Prime Minister Liz Truss’s economic gamble sink her goverment?

* IMF urges UK to ‘reevaluate’ tax cuts amid inflation concerns

* Hurricane Ian threatens to be one of the costliest storms in US history

* Sabotage is suspected in leaking Russian gas lines to Europe

* China’s current falls to record low against US dollar

* US core durable goods orders continued rising in August

* US home prices eased in July at fastest rate in history of S&P Case-Shiller Index

* New home sales in US rebounded in August, rising nearly 29% vs. July

* San Francisco Fed president: central bank doesn’t intend to tip US into recession

* US Consumer Confidence Index rose for a second month in September:

Surging Real Yields Are A Critical Risk Factor… Again

Inflation-adjusted interest rates are rising, rapidly. It wasn’t all that long ago that pundits and markets were worrying about the fallout from negative real rates. In short order, the risk has reversed as the Federal Reserve persists with a hawkish-policy run to tame inflation.

Macro Briefing: 27 September 2022

* US faces government shutdown without new funding deal

* Hurricane Ian batters Cuba; Florida’s west coast is next

* Global economy is slowing more than expected, advises OECD

* China’s economic output expected to lag rest of Asia for first time since 1990

* China’s currency falls to near 14-year low vs. US dollar

* Bank of England says it will ‘not hesitate’ to lift rates despite plunge in pound

* New Boston Fed president: More rate hikes needed to cool inflation

* Growth in Texas factory activity picked up in September

* Wall Street’s ‘fear gauge’, a.k.a. VIX Index, surges to 3-month high

* Chicago Fed Nat’l Activity Index highlights ongoing growth slowdown for US:

Another Week Of Across-The-Board Losses For Major Asset Classes

For a second straight week, all the major asset classes fell in trading through Friday’s close (Sep. 23), based on a set of ETF proxies. From bonds to stocks, along with real estate shares and commodities, red ink swept across global markets.

Macro Briefing: 26 September 2022

* US warns Russia of ‘horrific’ consequences if nuclear weapons used in Ukraine

* Far-right leader looks set to become Italy’s next prime minister

* Tropical Storm Ian, expected to become hurricane, heading to Florida

* British pound tumbles to record low vs. the dollar

* War in Ukraine to cost global economy $2.8 trillion by 2023’s end: OCED

* Buying the dip isn’t working this time… at least not yet

* US business activity continued contracting in September via PMI survey data: