* US Leading Economic Index falls for fifth straight month

* US jobless claims edged lower last week, continue to reflect low level of layoffs

* Philly Fed Manufacturing Index rebounded in August

* Norway and New Zealand’s central banks announce latest rate hikes

* Turkey’s central bank cuts interest rates despite surging inflation

* Extreme heat strikes world’s three largest economies simultaneously

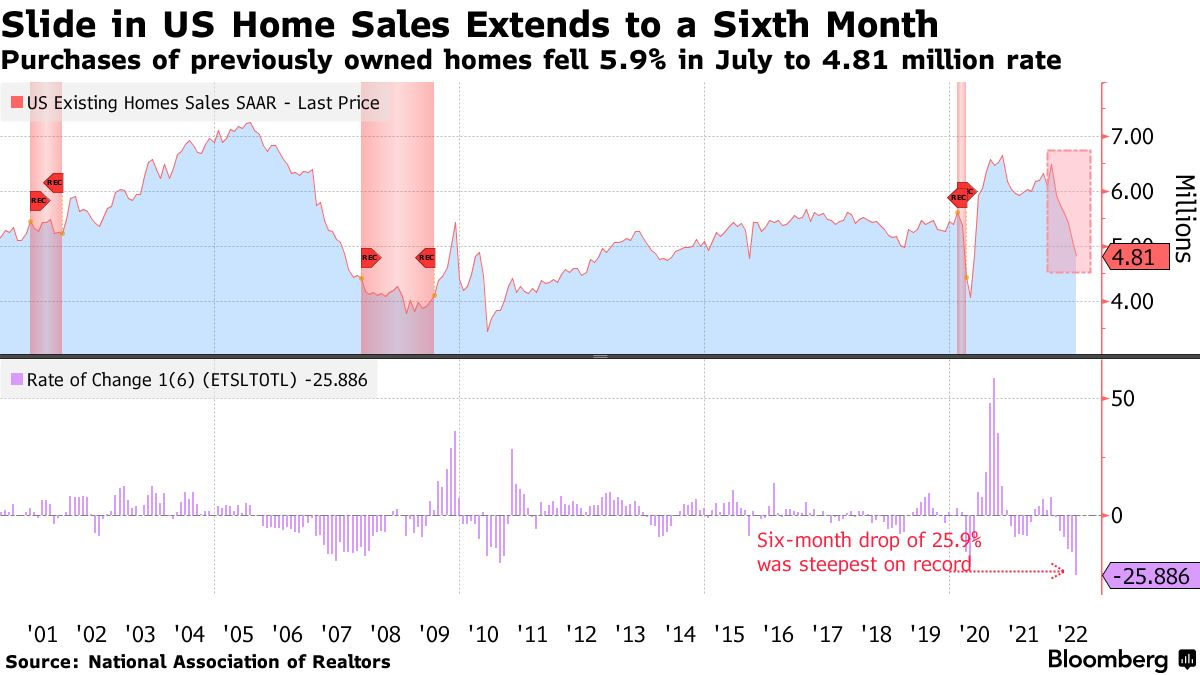

* US existing home sales fell for sixth straight month in July:

Monthly Archives: August 2022

Is The Fed Making Progress On Taming Inflation?

Yesterday’s release of Federal Reserve minutes for the July FOMC meeting reaffirms that the central bank won’t ease off on interest-rate hikes until inflation is tamed. Good thing, too, since the latest inflation data suggests there’s still a long road ahead before policy goals and pricing pressures are aligned. But the Treasury market is always looking ahead and at the moment it seems to be hinting at the possibility that hawkish monetary policy may be close to peaking, based on comparing the 2-year yield with effective Fed funds rate (EFF).

Macro Briefing: 18 August 2022

* US government will hold trade talks with Taiwan to counter China

* Renewed Iran nuclear deal appears “closer than we’ve been before”

* Fed minutes: rate hikes will continue until inflation slows substantially

* Nearly 3/4 of US farmers say drought is damaging their harvests

* Europe’s summer heat is exacerbating energy challenges

* China deploys cloud seeding to ease toll from record heat wave

* Mortgage boycotts spread across China

* US retail sales were flat in July but spending ex-gas and autos is still solid:

S&P 500 Risk Profile: 17 August 2022

After stabilizing in late-June/early July, the US stock market has continued to rebound. The S&P 500 appears on track to post its fifth straight weekly advance, based on trading through yesterday’s close (Aug. 16). Encouraging, although all the risk factors that unleashed a powerful run of selling in the first half of the year are still lurking. That includes high inflation, rising interest rates and elevated geopolitical tension vis-à-vis Russia and China. But for the moment, the trend if friendly, leaving the crowd to decide if this is a bear market rally or the start of a new extended bull run.

Macro Briefing: 17 August 2022

* Biden signs climate and health care bill into law

* Ukraine widens attacks on Russian-controlled territory in Crimea

* America’s retirement crisis is getting worse

* China’s stimulus efforts to boost slowing economy are relatively mild

* UK inflation reaches another new 40-year high in July

* US industrial production rebounds more than expected in July

* Heatwave in China is forcing factories to close

* Q3 GDP rebound for US revised down to +1.8% via GDPNow model

* US housing starts continue to weaken, falling to slowest pace since early 2021:

Short-Term Bonds Are Savior For Fixed-Income Strategies This Year

The rout in bonds so far in 2022 has been deep and wide, with a notable exception: short maturities, which have provided valuable stability that’s otherwise in short supply.

Macro Briefing: 16 August 2022

* Russian military base in Crimea hit by a series of explosions

* Recession worries take a bite out of oil prices

* China’s housing market weakens in July after briefly stabilizing

* Weak economic data in US and China weigh on commodities prices

* US gasoline prices may continue falling to $3 a gallon, says analyst

* German sentiment among financial analysts near all-time low in August

* US homebuilder sentiment points to recession for housing sector

* NY Fed Mfg Index falls re: current conditions, indicating contraction in August:

Global Markets Continued To Rebound Last Week

Nearly all the major asset classes posted gains in the trading week through Friday, Aug. 12, based on a set of proxy ETFs. Despite the upside bias in prices, the crowd will continue to wrestle with deciding if the recovery is a bear market rally for risk-on or the start of a new bull market.

Macro Briefing: 15 August 2022

* China conducts military drills around Taiwan as US lawmakers visit

* US will roll out new Taiwan trade support and conduct air, sea transits

* China cuts interest rates as economic slowdown deepens

* Will Fed’s Powell outline new thinking on quantitative tightening at Jackson Hole?

* US employers struggle to find workers

* Most traders see a recession starting this year, survey finds

* US consumer sentiment rebounds in August, rising to 3-month high:

Book Bits: 13 August 2022

● The Price of Time: The Real Story of Interest

Edward Chancellor

Review via The Economist

The critics who label as artificial the low interest rates that have prevailed in the world economy in recent decades must therefore answer the question: low relative to what?

“The Price of Time” is the answer of Edward Chancellor, a historian and financier who has written a book by that name. Humans prefer jam today to jam tomorrow. Interest rates are the reward for deferring gratification, for renting out money that could have been spent today. When rates fall too low, grave consequences follow: financial instability, higher inequality and pain for savers. As he makes his case, Mr Chancellor’s panoptic survey of the history of interest, and what classical economists said about it, will not fail to dazzle. The argument, however, is seriously flawed.