In a year of upheaval, including worries about conventional energy supplies, the prospects for alternative energy sources should be front and center for investors. Or so one might think. But using a set of ETFs to gauge sentiment suggests the crowd is still lukewarm at best in embracing industries in the alternatives space vs. old-school fossil-fuels stocks.

Monthly Archives: August 2022

Macro Briefing: 25 August 2022

* Biden announces student loan forgiveness plan

* California expected to ban sales of new gasoline cars starting in 2035

* China announces more stimulus to support economy

* German leading indicator forecasts continued weakness for economy

* Despite war in Ukraine, Russian goods continue to reach US

* Pending home sales fell again in July but economist says a bottom may be near

* US home prices fell in July–first monthly slide in three years

* New orders for US durable goods flat in July as core orders continue rising:

Rebound Expected For US Q3 GDP, Based On Median Outlook

After two quarters of contraction, US gross domestic product (GDP) is on track to recover in the third quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. But there’s a joker in the deck: the implied Q3 estimate based on the latest PMI survey data points to an accelerating slide in output that anticipates a deep recession.

Macro Briefing: 24 August 2022

* Ukraine war at six-month mark, with no end in sight

* Putin reportedly thinks winter will favor Russia in its Ukraine war efforts

* US plans for $3 billion in new aid for Ukraine

* US military strikes target Iran-linked targets in Syria

* More Americans fall into poverty from inflation vs. pandemic or Great Recession

* Streak of falling US gasoline prices offers relief for drivers

* New home sales in US continue to slide in July

* US PMI survey data shows further contraction in business activity in August:

Monitoring Investment Trends With ETF Pairs: 23 August 2022

Markets are still struggling to price in a variety of risk factors, including: How long and how far will interest rates rise? When will inflation peak? How will the war in Ukraine evolve? Is a global recession fate, and if so how deep will it be? No one has a crystal ball and the future’s always uncertain, but trending behavior in markets can offer some useful perspective, particularly when debates about the future are unusually stark.

Macro Briefing: 23 August 2022

* US natural-gas futures reach 14-year high

* Eurozone economic activity fell for second month in August via survey data

* Euro at two-decade low vs. US dollar

* UK economic activity near virtual standstill in August, PMI data shows

* Pimco analyst predicts great moderation for inflation is “fully behind us now”

* Strong US dollar takes a toll on gold and silver prices

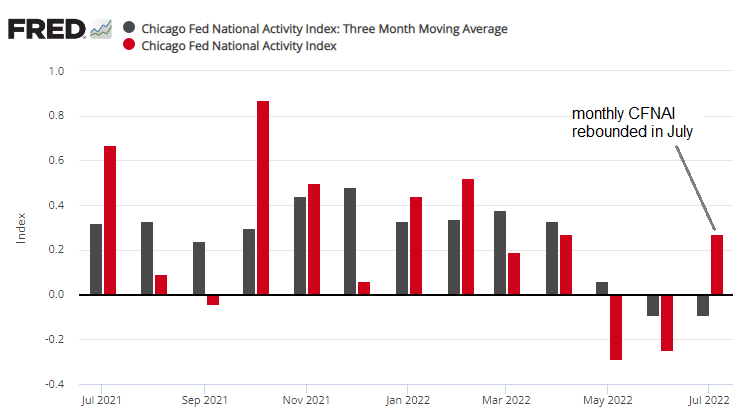

* US economic activity rebounded in July via Chicago Fed Nat’l Activity Index:

All The Major Asset Classes Lost Ground Last Week

A clean sweep of red ink washed over all the major asset classes for the trading week through Friday, Aug. 19, based on a set of ETFs.

Macro Briefing: 22 August 2022

* US delegation including Indiana’s governor in Taiwan for trade talks

* Russia sees no chance for diplomatic solution to end the war in Ukraine

* Daughter of Putin ally killed in car explosion near Moscow

* US, S. Korea start biggest military drills in years amid threats from N. Korea

* China cuts lending rates again, following a cut last week

* Germany likely headed for recession, Bundesbank predicts

* US ‘effectively peak employment,’ says ZipRecruiter CEO Ian Siegal

* Severe droughts snarling supply chains and lifting food prices

* Fed expected to slow rate hikes to 50 basis points in September

* Business community overwhelmingly expects a recession within next 18 months

* US Dollar Index near 20-year high:

Book Bits: 20 August 2022

● Danger Zone: The Coming Conflict with China

Michael Beckley and Hal Brands

Excerpt via Foreign Policy

The greatest geopolitical catastrophes occur at the intersection of ambition and desperation. Xi Jinping’s China will soon be driven by plenty of both.

In our new book, Danger Zone: The Coming Conflict with China, which this article is adapted from, we explain the cause of that desperation: a slowing economy and a creeping sense of encirclement and decline. But first, we need to lay out the grandness of those ambitions—what Xi’s China is trying to achieve. It is difficult to grasp just how hard China’s fall will be without understanding the heights to which Beijing aims to climb. The Chinese Communist Party (CCP) is undertaking an epic project to rewrite the rules of global order in Asia and far beyond. China doesn’t want to be a superpower—one pole of many in the international system. It wants to be the superpower—the geopolitical sun around which the system revolves.

The Hierarchy of Portfolio Decisions: Part I

Portfolio design and management tends to fare best when the rules and structure are relatively simple. But there are limits and so deciding on the degree of simplicity can be a gray area, depending on your definition of “simple” and “complicated,” along with expectations and investment goals. The debate on how far to go with simplicity inspires a fresh look at what I call the hierarchy of decisions in the process of building and managing portfolios through time.