The US 10-year Treasury yield continues to trade below its recent peak. Yesterday’s softer-than-expected rise in consumer inflation for July supports a case for expecting the 10-year rate to stay below 3% for the near term. A similar analysis can be made based on today’s update of CapitalSpectator.com’s fair-value ensemble model for this benchmark yield.

Daily Archives: August 11, 2022

Macro Briefing: 11 August 2022

* More rate hikes needed despite slowing inflation, say Fed officials

* Traders downgrade expectations for a 75-basis-points rate hike in September

* Atlanta Fed’s GDPNow model raises Q3 nowcast to solid +2.5%

* US average gasoline prices below $4 a gallon for first time in months

* Ford CEO doesn’t see lower costs for electric vehicle batteries on horizon

* Hot inflation could boost Social Security payments by $1700 on average in 2023

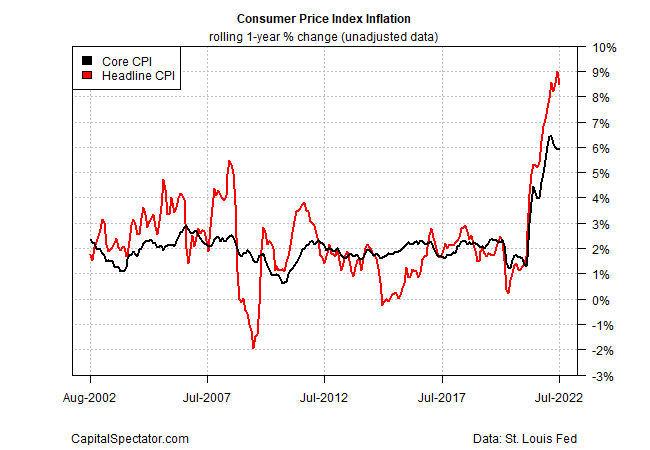

* July data for US consumer price data suggests inflation may have peaked: