* Worst is yet to come for global energy crisis, predicts IEA

* Strong US dollar expected to take a toll on corporate earnings

* Dividend payouts on track for another record in the second quarter

* US small business sentiment slips to 48-year low in June

* Do abortion bans in certain US states have an economic cost?

* Collapse of large crypto hedge fund highlights counterpart risk alert

* Americans cancel home-purchase deals at highest rate since start of pandemic

* US Dollar Index rises to new 20-year high:

Monthly Archives: July 2022

US Stocks Rose Last Week Amid Widespread Losses Elsewhere

American shares continue to trade in a tight range, posting a modest gain last week. But for most global markets, the trading week through Friday, July 8, delivered losses, based on a set of ETFs.

Macro Briefing: 11 July 2022

* Ukraine hit with expanded shelling from Russia

* Russia temporarily halts gas flows to Europe via major pipeline

* Biden’s visit to Middle East this week confronts challenges

* New coronavirus mutant raises concerns among scientists

* Texas at risk of rolling blackouts during heatwave

* Analysts consider how UK economy will change with Johnson’s successor

* China violently dispersed peaceful protest by hundreds of depositors

* Strong US jobs market is good for economy, but small firms are struggling

* US payrolls continue to increase at solid pace in June:

Book Bits: 9 July 2022

● Cloudmoney: Cash, Cards, Crypto, and the War for Our Wallets

Brett Scott

Reference via New York Magazine

There is an undeniable measure of convenience to digital payment. At its best: beep, buzz, go. Convenience, however, rarely comes without a cost, and here there are a few. In his book, Cloudmoney: Cash, Cards, Crypto, and the War for Our Wallets, journalist and former derivatives broker Brett Scott sets out to convince the reader that we all have something at stake in the war on cash. Scott’s target is the campaign to computerize all transactions and the corresponding vision of a predestined historical arc from cha-ching to beep-boop, as promoted by anti-cash interests. What he shows is that a cashless society would be so fast it’s guaranteed to leave some people behind.

Research Review | 8 July 2022 | Factor Investing

Investing in Deflation, Inflation, and Stagflation Regimes

Guido Baltussen (Erasmus University Rotterdam), et al.

July 2022

We examine asset class and factor premiums across inflationary regimes. As periods of high inflation and deflation are relatively uncommon in recent history, we use a deep sample starting in 1875. Moderate inflation scenarios provide the highest returns across asset class and factor premiums. During deflationary periods, nominal returns are low, but real returns are attractive. By contrast, real equity and bond returns are negative during a high inflation regime, and especially so during times of stagflation. During these ‘bad times’ factor premiums are positive, which helps to offset part of the real capital losses.

Macro Briefing: 8 July 2022

* Former Japan Prime Minister Abe assassinated during during speech

* Johnson steps down at a vulnerable moment for the UK economy

* Putin warns Russia’s war on Ukraine has only just started

* US trade deficit narrowed for a second month in May

* Mortgage rates drop for a second week, posting largest decline since 2008

* US jobless claims remain low and stable, implying strong labor market:

Monitoring Investment Trends With ETF Pairs: 7 July 2022

Risk-off sentiment continues to dominate market behavior. In other words, nothing much has changed vs. recent history.

Macro Briefing: 7 July 2022

* Boris Johnson to resign as UK prime minister as scandals mount

* Another 75-basis-point rate hike appears likely for July 26-27 Fed meeting

* Fed minutes show policymakers are focused on fighting inflation

* Growth for US services industry slows to 2-year low

* Demand for mortgages falls despite drop in mortgage rates

* Euro continues to slide against US dollar

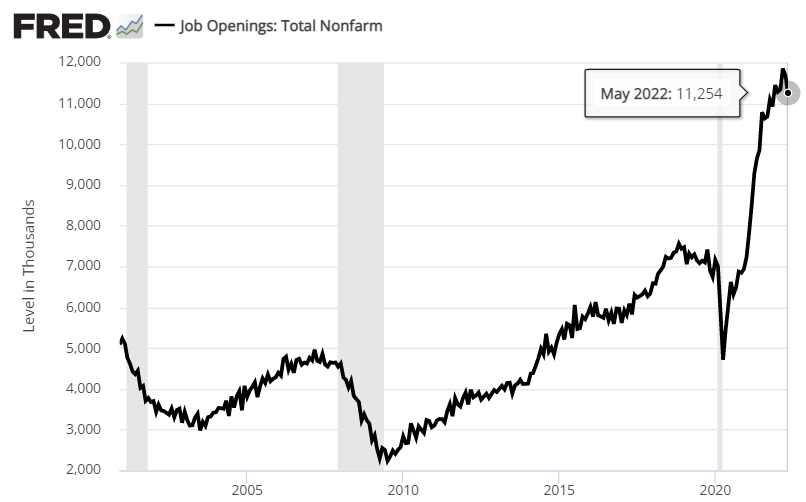

* US job openings fell in May but still exceed available workers by 2 to 1:

Risk Premia Forecasts: Major Asset Classes | 6 July 2022

The estimated risk premium for the Global Market Index (GMI) continues to ease. The revised long-term outlook projects an annualized return of 4.9%. Echoing previous updates in recent history, today’s estimate reaffirms the case for managing expectations down for globally diversified multi-asset-class portfolios relative to realized returns in previous years.

Macro Briefing: 6 July 2022

* UK Prime Minister Johnson’s leadership is hanging by a thread

* Demand for US workers still robust, according to private-sector estimates

* New covid outbreaks in China put millions under lockdown In China

* Will today’s release of Fed minutes support another 75-basis-point rate hike?

* US dollar’s international status remains unchallenged, Fed study finds

* Chinese automaker BYD overtakes Tesla world’s largest electric vehicle seller

* Oil fell below $100 on Tuesday for first time in almost two months

* US factory orders rose more than expected in May: