Fixed-income markets in the US reverted to their traditional role of delivering upside support when the rest of the portfolio tanks. It’s too soon to say if this is a return to form for bonds for an extended period, but with more rate hikes expected there’s still plenty of room for debate.

Monthly Archives: July 2022

Macro Briefing: 18 July 2022

* Russia’s war against Ukraine looks increasingly like terrorism

* US retail sales rose more than expected in June

* Fed officials signal they are likely to raise interest rates by 0.75 percentage point

* Economic pain is sweeping across Europe (and Russia)

* Consumer sentiment ticked up in July but remains near record low

* US industrial output fell in June–first monthly decline this year

* Earnings season off to slow start, adding new headwind for stocks

* Strong dollar could help the Fed fight inflation

* Mixed jobs data lift uncertainty for US labor market outlook

* Real wage growth is taking a hit from inflation:

Book Bits: 16 July 2022

● The Win-Win Wealth Strategy: 7 Investments the Government Will Pay You to Make

Tom Wheelwright

Summary via publisher (Wiley)

The government wants your help, and it’s willing to pay handsomely. You just need to know what to do. In The Win-Win Wealth Strategy: 7 Investments the Government Will Pay You to Make, celebrated entrepreneur, investor, and bestselling author Tom Wheelwright, CPA, transforms the way you think about building wealth and challenges the paradigm that tax incentives are immoral loopholes. Backed by deep research in 15 countries, he identifies seven investing strategies that are A-OK with governments worldwide and will fatten your wallet while making the world a better place.

S&P 500 Risk Profile: 15 July 2022

The US stock market has stabilized in recent weeks, but the downside bias still appears intact. Several risk factors support this outlook, including a weak technical profile; high inflation that will likely convince the Federal Reserve to continue raising interest rates; a rising if not yet decisive threat of a US recession; and the ongoing uncertainty/blowback for the global economy due to war in Ukraine.

Macro Briefing: 15 July 2022

* China GDP growth slows to weak 0.4% annual increase in Q2

* China reports highest daily Covid cases in 7 weeks as lockdowns spread

* Italy in political crisis as prime minister urged to rethink resignation

* Joe Manchin, key Democrat vote in US Senate, rejects climate, tax measures

* US jobless claims rise to highest level in nearly 8 months

* Despite expectations of more Fed rate hikes, US 10yr yield holds below 3%:

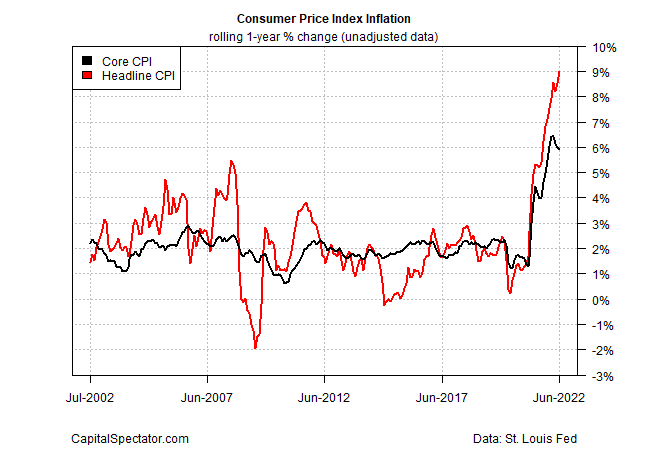

Peak Inflation Watch: 14 July 2022

Yesterday’s US consumer inflation data for June surprised analysts with a hotter-than-expected report. The news has convinced the market that the Federal Reserve will ramp up the pace of rate hikes to a 100-basis-point increase at the July 27 FOMC meeting. Peak inflation, it seems, remains elusive as ever. Perhaps, but there are still some hints that turning point is near. The question is how much weight to assign to these relatively encouraging hints?

Macro Briefing: 14 July 2022

* A glimmer of hope emerges that Ukraine grain exports can resume

* Fund funds futures estimate high probability for 100-basis-point rate hike

* Fed Beige Book highlights concerns about price increases

* Major US crypto lender Celsius Network files for bankruptcy

* Atlanta Fed business inflation expectations survey is stable at +3.7% for July

* Rents in US rise at fastest pace since 1986

* US headline consumer inflation continues to accelerate for annual rate:

Is Leadership For US Equities Vulnerable In A High-Risk World?

Favoring American shares has long been a winning strategy, but nothing lasts forever. Timing, of course, is the great mystery.

Macro Briefing: 13 July 2022

* Biden heads to Saudi Arabia with high-stakes agenda

* Russia and Ukraine set to negotiate restart of Ukrainian grain exports

* Global oil-supply crisis appears to be easing

* Quarter of Americans say they’ll purchase an electric vehicle

* Rising housing prices expected to keep upward pressure on inflation this year

* Eurozone industrial output posts solid gain in May

* S. Korea raises interest rates by 50 basis points to fight inflation

* US 2yr/10yr Treasury yield curve stays inverted, signaling elevated recession risk:

How To Estimate Recession Risk In Real Time? Pick Your Poison

Recession risk is rising, which inevitably leads to a discussion and debate about what exactly defines such an event. There’s no single definitive rule, at least nothing that can be easily summarized that’s also widely accepted by economists. But there are many theories. Ergo, it’s easy to become confused as you slip down this rabbit hole.