● China’s Next Act: How Sustainability and Technology are Reshaping China’s Rise and the World’s Future

Scott M. Moore

Summary via publisher (Oxford U. Press)

In China’s Next Act, Scott M. Moore re-envisions China’s role in the world, with a focus on sustainability and technology. Moore argues that these increasingly pressing, shared global challenges are reshaping China’s economy and foreign policy, and consequently, cannot be tackled without China. Yet sustainability and technology present opportunities for intensified economic, geopolitical, and ideological competition–a reality that Beijing recognizes. The US and other countries must do the same if they are to meet ecological and technological challenges in the decades ahead. In some areas, like clean technology development, competition can be good for the planet. But in others, it could be catastrophic — only cooperation can lower the risks of artificial intelligence and other disruptive new technologies.

Monthly Archives: July 2022

Arguing Over Recession Definitions – The New New Thing

US gross domestic product (GDP) fell 0.9% in the second quarter, the Bureau of Economic Analysis reports. The slide in real (inflation adjusted) output, calculated at an annual rate, follows a 1.6% decline in Q1. The back-to-back decreases immediately triggered calls that the US is in recession. But there’s also pushback from some analysts, advising that there’s room for debate. The militant wing of recessionistas quickly cried foul, and in the blink of an eye both sides are attacking the other as delusional.

Macro Briefing: 29 July 2022

* China President Xi warns Biden on interference with Taiwan

* Biden and China President Xi, after call, plan to meet in person

* China signals no big stimulus planned to support slowing economy

* Is the US in a recession? Answer depends on the analyst you ask

* Inflation in Eurozone in July reaches record-high 8.9% for past year

* Eurozone GDP growth picked up to +0.7% in Q2, but…

* German GDP ground to a halt in Q2

* Big tech looks resilient as economy weakens

* US jobless claims edge lower but remain near 2022’s highest level

* US Q2 GDP declines, marking second straight quarterly loss:

Peak Inflation Watch: 28 July 2022

The inflation battle continues. The Federal Reserve yesterday raised interest rates by a hefty 75 basis points, again, in a renewed effort to tame inflation’s recent surge. The key question: When will we start to see results?

Macro Briefing: 28 July 2022

* Federal Reserve raises interest rates 75 basis points… again

* Senator Joe Manchin, key Democrat vote, agrees to climate legislation

* Senate passes $52 billion bill supporting US semiconductor production

* North Korea returns to saber rattling with new threat

* CBO predicts sharp increase in US public debt burden and deficit

* Eurozone economic sentiment falls sharply in July, signaling recession is near

* US 10yr Treasury yield holds below 2.8% after another Fed rate hike:

Energy Holds On To Hefty Lead For US Equity Sectors In 2022

Energy stocks have stumbled in recent weeks, but this sector is showing signs of regaining its mojo. It could be noise or even a last gasp after an extraordinary bull run. But for the moment, shares in this corner remain the clear leader year to date, based on a set of sector ETFs through Tuesday’s close (July 26).

Macro Briefing: 27 July 2022

* Biden to speak with Chinese counterpart Xi as tensions rise

* Global growth slowing, raising recession risk, IMF warns

* Fed may be just getting started in battling inflation

* Fed-induced recession is worse than inflation, writes former Fed economist

* Recession in Europe is all but assured as Russia squeezes gas flow

* US home prices post second month of slower but still strong growth in May

* New home sales in US fell more than expected in June

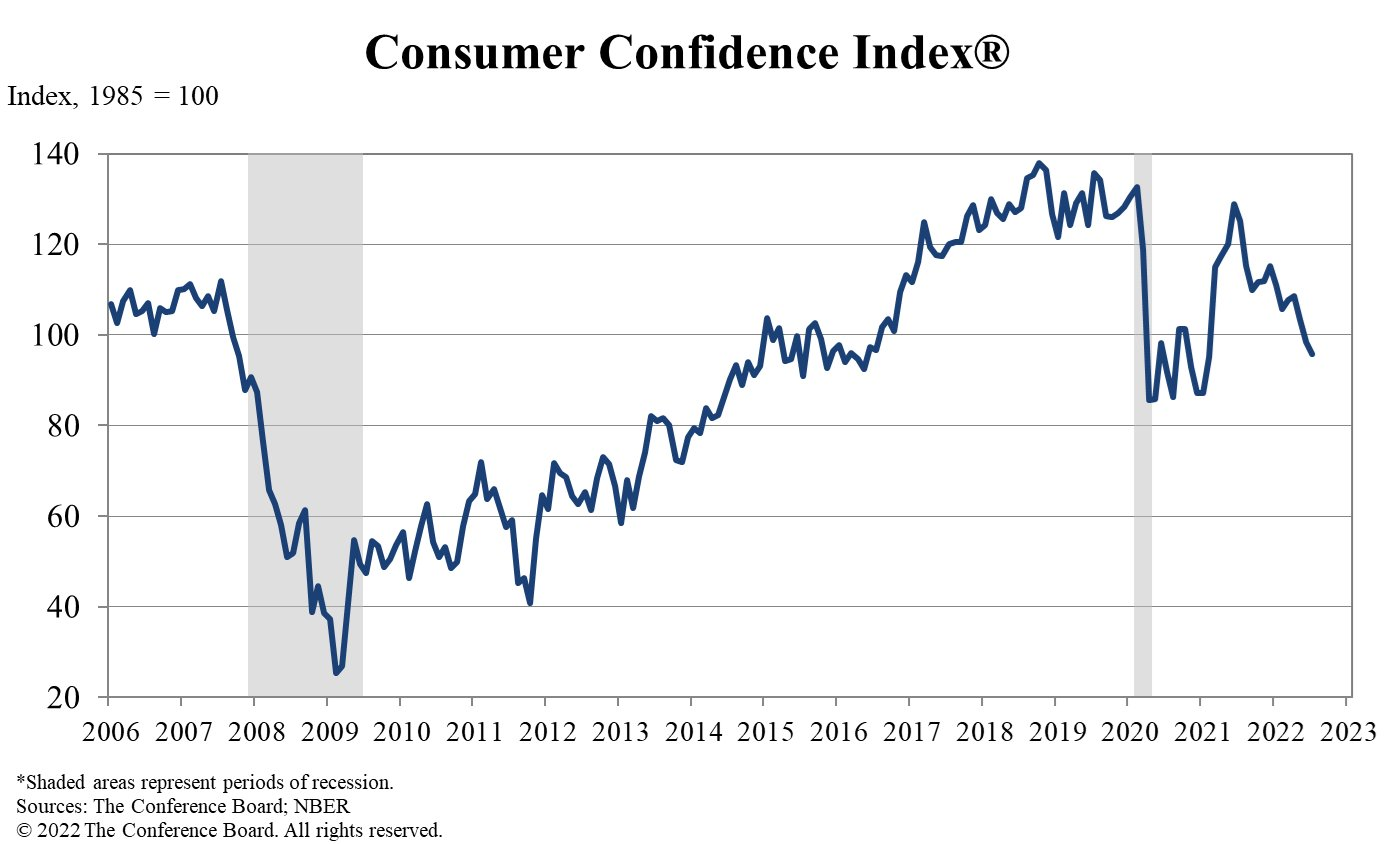

* US consumer confidence falls for third straight month in July:

Is There A Case For A Return Of Disinflation/Deflation?

It’s all about high inflation at the moment. The Federal Reserve is certainly focused on inflation risk and is set to raise interest rates again in tomorrow’s policy announcement (Wed., July 27). The view that “inflation is transitory” is all but dead as a viable narrative on Wall Street and beyond and so the future looks obvious. Considering the potential for a return of disinflation/deflation (D/D) risk, in other words, appears clueless in the extreme. For that reason alone, let’s consider its likelihood at some point in the near future, if only as an exercise in contrarian thinking.

Macro Briefing: 26 July 2022

* Tensions rise between US and China over planned Taiwan trip by Pelosi

* Russia set to further cut gas deliveries to Germany

* Is the US recession? Deciding yea or nay is tricky at the moment

* Economist Nouriel Roubini predicts deep recession due partly to high debt loads

* Supply of negative-yielding debt has fallen sharply since late-2020

* US growth running below historical average for second month in June:

Across-The-Board Rebounds For Major Asset Classes Last Week

One solid weekly bounce doesn’t mean much after months of losses, but hope still springs eternal. Only time will tell if the latest bounce marks a turning point, or not. But for one week, at least, global markets delivered something other than gloom via a uniform rise in prices for the major asset classes over the trading week through Friday, Jul. 22, based on a set of proxy ETFs.