Inflation as the Source of the Bond, Equity, and Value Premia

Martin Tarlie (GMO)

May 2022

A no-arbitrage pricing model with inflation as the only priced risk factor explains the bond, equity, and value premia observed in the United States over the past sixty years. Even though inflation is the only priced factor, in an economy with three state variables – inflation, the real rate, and corporate profitability – the real rate and profitability play a crucial role because of their sensitivity to inflation shocks. For bonds, the shape of excess returns with respect to maturity depends on the dynamic interactions between the three state variables. For stocks, the equity and value premia are largely explained by exposure of cash flows to profitability, whereas growth stocks’ excess returns are largely explained by cash flow exposure to the real rate. With respect to inflation risk, stocks writ large are a store of value, and value stocks are a strong hedge as their dividends move more than one for one with inflation.

Monthly Archives: June 2022

Macro Briefing: 10 June 2022

* Treasury Sec. Yellen says US will probably avoid a recession

* US gasoline price average approaching $5 a gallon

* Rising fuel costs rippling across industries and affecting consumer behavior

* China consumer inflation is stable in May as factory-gate prices ease

* ECB says it will raise interest rates next month–first time hike in 11 years

* FTC chair issues a regulatory warning to the tech industry

* Big US banks look set for earnings boost from pickup in credit card use

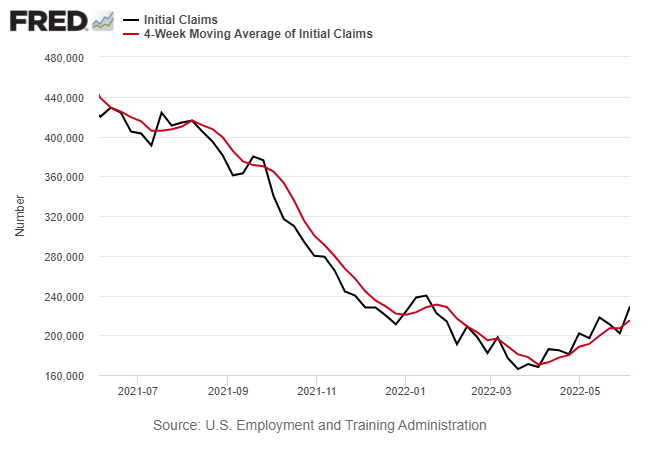

* US jobless claims rise to five-month for week through June 4:

US Economic Activity Still Expected To Post Rebound For Q2 GDP

Recession talk has spread like Covid recently, but next month’s initial estimate of US economic activity for the second quarter remains on track to post a robust rebound after Q1’s loss, based on a set of nowcasts.

Macro Briefing: 9 June 2022

* US and allies looking for ways to limit further surges in global oil prices

* Inflation is an increasingly challenging subject for the White House

* China’s appetite for key commodities remained subdued in May

* ECB expected to confirm intent to raise interest rates next month

* China appears intent on maintaining a permanent zero-Covid policy

* Battery shortage is constraining US switch to wind and solar power

* “Dangerous and deadly heat wave” on the way for the US Southwest

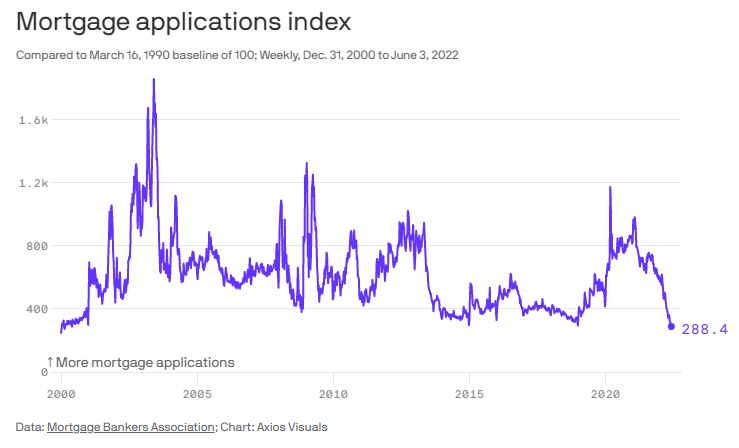

* US mortgage application activity falls to 22-year low for week through June 3:

Dividend-Yield Factor Offers Port In Equity Storm This Year

It’s been a rough year to date for US stocks overall, but within the equity-factor space the modest rise for shares with relatively high dividend payouts are a conspicuous counterpoint.

Macro Briefing: 8 June 2022

* OECD cuts global growth estimate for 2022: +2.9% vs. January’s +4.1% forecast

* Inflation will remain high, Treasury Sec. Yellen tells Senators

* Progressive politics takes a hit in California’s Democratic primaries

* Tech’s decade of dominating the stock market appears to be over

* Eurozone economic growth revised up for Q1: +0.6% vs. +0.3% previously

* Japan Q1 GDP revised up to +0.5% from 1% loss in previous estimate

* Global supply chain pressures ease in May, reversing April’s jump:

Macro Briefing: 7 June 2022

* Johnson survives vote of confidence and remains UK prime minister

* Taiwan prepares for a possible invasion from China

* Treasury Sec. Yellen faces tough questions on inflation in Congress this week

* Global growth remains weak but was slightly stronger in May

* China services-sector business activity “continues to fall markedly in May”

* Rising interest rates are taking a toll on commercial properety sales

* World has passed ‘peak agricultural land’

* Germany manufacutring orders fall for third month in April

* US 10yr Treasury yield rebounds, rising above 3% again:

In Transit…

Update: Miracle of miracles — my flight from Honolulu to Newark (with a connection in San Francisco) arrived early in Newark, a.k.a. hitting the airline lottery jackpot. In short, back to business a bit earlier than expected.

No updates today as the Capital Spectator is somewhere over these United States, returning from a week-plus of Waikiki, heading back to the Gah-den State, a.k.a. NJ. Debriefing to resume a Northeast lifestyle already in progress. The usual routine resumes tomorrow, Wed., June 8. Meantime, a last look at what I’m leaving behind in exchange for a non-descript location roughly 30 miles southwest of Wall Street.

Macro Briefing + Notes: 6 June 2022

* Russia strikes Kyiv with missiles as Putin warns West on arms

* US and S. Korea launch missiles in response to N. Korea missile launches

* US can avoid a recession if the Fed’s policy choices are timely and effective

* Cleveland Fed president says series of aggressive rate hikes needed

* US services sector growth eases to slowest pace in over a year in May

* Solid gain in US payrolls in May keeps Fed on track for 50-basis-point rate hikes

* US payrolls growth remains strong in May, rising 390,000:

Book Bits: 4 June 2022

● Direct: The Rise of the Middleman Economy and the Power of Going to the Source

Kathryn Judge

Review via The Economist

In 2011 there was an outbreak of E. coli in Germany. Thousands of people fell ill. The authorities suspected that salad ingredients were to blame, but did not know which ones were contaminated with the bacteria. Their initial guess was Spanish cucumbers—and so European consumers avoided that country’s fresh produce. Only later did the authorities find that salad sprouts grown in Germany were to blame.

The reason for the confusion, argues Kathryn Judge, a professor at Columbia Law School, was the complex supply chains that have developed in the global economy. It is not easy for regulators, let alone consumers, to know where goods come from. She draws a parallel with the subprime-mortgage crisis of 2007: loans had been repackaged so many times that investors were far from sure which financial products, and which banks, were safe. So they avoided them all, thereby exacerbating the panic.