* EU leaders offer Ukraine and Moldova candidate member status

* Recession risks for US and Europe have picked up sharply, warn economists

* China and India become Russia’s financiers to evade sanctions

* Copper, an economic bellwether, falls to 16-month low

* KC Fed Mfg Index shows further growth slowdown in June

* A $100 million crypto hack reported by Horizon, a so-called blockchain bridge

* US Energy Secretary asks oil firms to combat high gasoline prices

* US economic growth slows sharply in June via PMI survey data:

Monthly Archives: June 2022

Peak Inflation Watch: 23 June 2022

The question of when inflation will peak consumes financial and commodity markets, and with good reason. When pricing pressure finally ebbs, the pressure on rate hikes and the headwinds for the economy will ease, if only on the margins. But every thousand-mile journey has to start somewhere.

Macro Briefing: 23 June 2022

* Powell tells Congress Fed is “strongly committed” to fighting inflation

* Powell returns to Capitol Hill today for testimony as rates stay in focus

* European leaders set to accept Ukraine as candidate to join EU

* Eurozone growth slows to 16-month low in June as demand weakens

* Germany lifts level of alarm over Russia gas disruption

* UK growth unchanged at 15-month low in June via PMI survey data

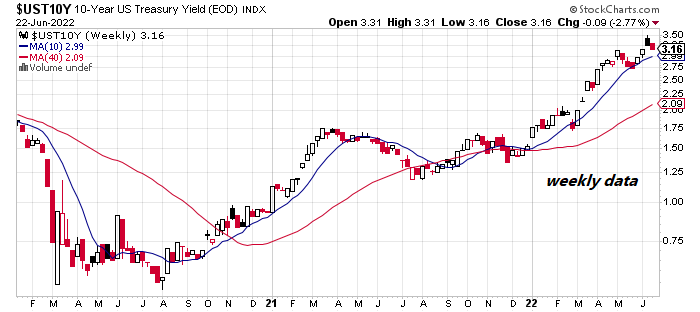

* US 10-year Treasury yield eases to 3.16%, lowest in nearly two weeks:

Macro Briefing: 22 June 2022

* Tensions rising between Moscow and NATO over Russia’s Kaliningrad enclave

* Japan on high alert amid activity by Chinese and Russian warships near its coast

* IEA warns Europe to prepare for total shutdown of Russian gas exports

* Russia earns more oil revenue than before war due to China and India

* Biden expected to call for 3-month suspension of gas tax

* Fed expected to lift rates by 3/4 percentage point again in July

* UK inflation ticks up to new 40-year high: +9.1% annual pace in May

* Existing home sales in US fell for fourth straight month in May

* US growth slowed in May via Chicago Fed business-cycle index:

Monitoring Fed Policy Expectations With The 2-Year Treasury Yield

Markets-based forecasts aren’t flawless, but for some projects in finance these estimates are the baseline estimates that are often tough to beat. An example is monitoring the outlook for trends and changes in Fed monetary policy. On that front, you could do a lot worse than keeping a close eye on the 2-year Treasury yield.

Macro Briefing: 21 June 2022

* European Central Bank plans two rate hikes this summer

* Goldman Sachs raises US recession-risk probability to 30% for 2023

* China’s economy continues to face downside risks

* Fed’s rate hikes are starting to slow borrowing and spending

* Israel’s gov’t collapses, new elections set

* New US ban on imports from the China’s Xinjiang region has started

* German 10-year yield rebounds to highest since 2014:

All The Major Asset Classes Lost Ground Last Week

Markets suffered a clean sweep of losses last week. It’s a rare event, but it happens, as the trading week through Friday, June 17 reminds in the wake of all the major slices of global markets posting simultaneous declines, based on a set of ETFs.

Macro Briefing: 20 June 2022

* Ukraine war could last years, says NATO’s secretary-general

* France’s newly-elected President Macron loses absolute majority in parliament

* EPA’s power over greenhouse gases at stake in upcoming Supreme Court ruling

* Emerging markets face rising pressure from higher interest rates and inflation

* Apple workers in Maryland vote to unionize

* Bitcoin rebounds after a sharp slide below $18,000 over the weekend

* US Treasury real yields rebound to positive terrain but still below 2018 peak:

Book Bits: 18 June 2022

● Money, Magic, and How to Dismantle a Financial Bomb: Quantum Economics for the Real World

David Orrell

Review via Irish Tech News

David Orrell argues that the emerging discipline of quantum economics, of which he is at the forefront, is the key to shattering the illusions that prevent us from understanding money’s true nature. In this colourful tour of the history, philosophy and mathematics of money, Orrell demonstrates how everything makes much more sense when we replace our classical economic models with ones based on quantum probability – and reveals the explosive reality of what is left once the illusions are stripped away.

Recession Watch: 17 June 2022

The outlook is turning grim for the US economy, or so a range of soft data and forecasts advise. But while expectations are deteriorating at the moment, the hard data continues to reflect a growth bias. Short of an epic, sudden (and at this point unexpected) collapse in business activity and/or consumer spending, the US economy will continue to expand for the near term. What happens beyond the next several months is unclear, which is par for the course. The crowd, however, is becoming increasingly pessimistic, which raises the question: Will the next recession become a self-fulfilling prophecy?