Inflation as the Source of the Bond, Equity, and Value Premia

Martin Tarlie (GMO)

May 2022

A no-arbitrage pricing model with inflation as the only priced risk factor explains the bond, equity, and value premia observed in the United States over the past sixty years. Even though inflation is the only priced factor, in an economy with three state variables – inflation, the real rate, and corporate profitability – the real rate and profitability play a crucial role because of their sensitivity to inflation shocks. For bonds, the shape of excess returns with respect to maturity depends on the dynamic interactions between the three state variables. For stocks, the equity and value premia are largely explained by exposure of cash flows to profitability, whereas growth stocks’ excess returns are largely explained by cash flow exposure to the real rate. With respect to inflation risk, stocks writ large are a store of value, and value stocks are a strong hedge as their dividends move more than one for one with inflation.

Daily Archives: June 10, 2022

Macro Briefing: 10 June 2022

* Treasury Sec. Yellen says US will probably avoid a recession

* US gasoline price average approaching $5 a gallon

* Rising fuel costs rippling across industries and affecting consumer behavior

* China consumer inflation is stable in May as factory-gate prices ease

* ECB says it will raise interest rates next month–first time hike in 11 years

* FTC chair issues a regulatory warning to the tech industry

* Big US banks look set for earnings boost from pickup in credit card use

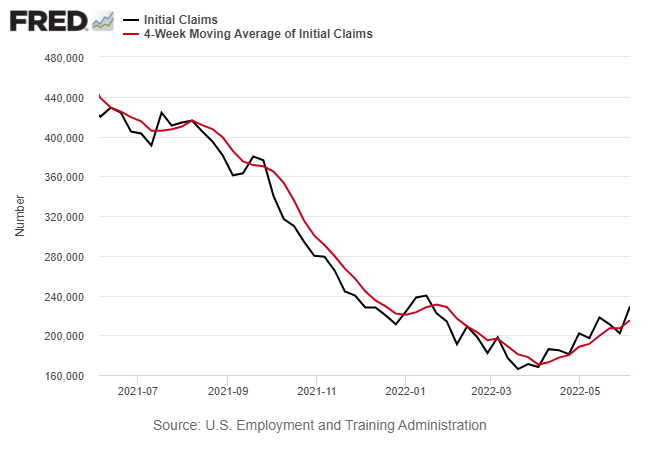

* US jobless claims rise to five-month for week through June 4: