US economic activity is expected to bounce back in the second quarter following Q1’s contraction, according to a set of GDP nowcasts compiled by CapitalSpectator.com. The estimates should be viewed cautiously this early in the quarter, but the initial outlook is encouraging.

Monthly Archives: May 2022

Macro Briefing: 17 May 2022

* Turkey threatens to block Finland and Sweden from joining NATO

* Former Fed Chair Bernanke sees stagflation risk rising for US

* Food-supply chains in focus after India bans wheat exports

* US gasoline prices may soon reach $5 a gallon, energy analyst predicts

* Buffett’s Berkshire Hathaway loads up on energy stocks as inflation soars

* Strong US dollar raises headwinds for emerging markets, analyst advises

* US officials announce plans to ease tough sanctions imposed on Cuba

* NY Fed Mfg Index shows sector activity contracts in May:

Bonds Bounced As Stocks, Commodities And REITs Fell Last Week

Fixed income showed some of its traditional diversification edge last week as selling took a toll elsewhere for the major asset classes, based on a set of ETFs through Friday’s close (May 13). It’s too early to confirm that bonds have started an extended rebound after a rough year, but last week’s bounce opens the door for debate.

Macro Briefing: 16 May 2022

* Ukraine can win this war, says NATO chief

* Wheat prices rise globally after India’s export ban

* US consumer spending slowing, predicts Goldman Sachs economists

* China retail sales and industrial output fell more than expected in April

* Crypto prices show little diversification benefit vs. stocks and bonds

* US consumer sentiment falls to 11-year low in early May

* Is the policy-sensitive 2yr US Treasury yield peaking?

Book Bits: 14 May 2022

● Don’t Trust Your Gut: Using Data to Get What You Really Want in Life

Seth Stephens-Davidowitz

Summary via publisher (Dey Street/HarperCollins)

Big decisions are hard. We consult friends and family, make sense of confusing “expert” advice online, maybe we read a self-help book to guide us. In the end, we usually just do what feels right, pursuing high stakes self-improvement—such as who we marry, how to date, where to live, what makes us happy—based solely on what our gut instinct tells us. But what if our gut is wrong? Biased, unpredictable, and misinformed, our gut, it turns out, is not all that reliable. And data can prove this. In Don’t Trust Your Gut, economist, former Google data scientist, and New York Times bestselling author Seth Stephens-Davidowitz reveals just how wrong we really are when it comes to improving our own lives.

Managing Expectations As The S&P 500 Tumbles

The US stock market is sliding in what may or may not presage an extended decline. Whatever unfolds in the weeks and months ahead, the first order of business is recognizing that we’ve been here before by putting the current correction into historical perspective. There’s nothing new under the sun for market corrections, but it can appear otherwise if you’re overwhelmed with recency bias.

Macro Briefing: 13 May 2022

* Russia says it will “retaliate” if Finland Joins NATO

* Finland wants to join NATO. Sweden may be next

* Fed Chair Powell says soft economic landing may be beyond Fed’s control

* US housing market showing nascent signs of cooling

* US wholesale inflation continues to accelerate in April

* Oil giant Saudi Aramco overtakes Apples as world’s most valuable company

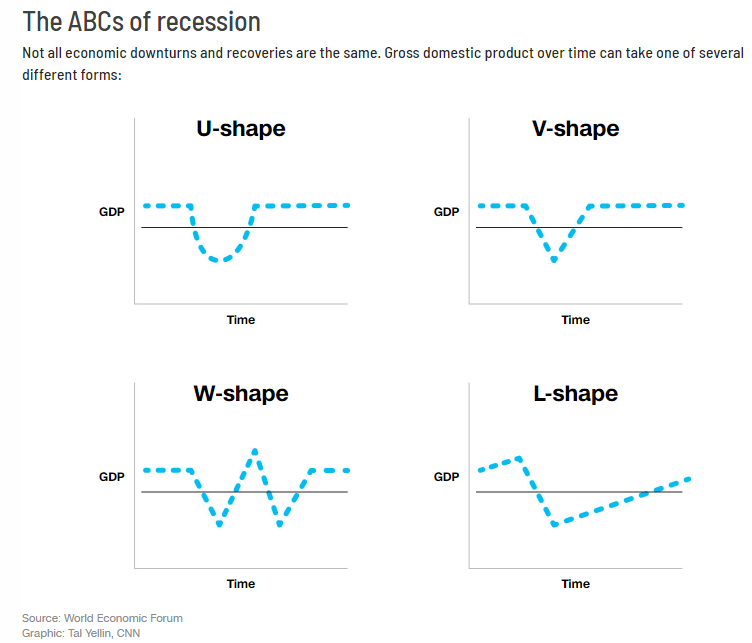

* How will the next recession unfold? Here are several possibilities:

10-Year Treasury Yield ‘Fair Value’ Estimate: 12 May 2022

For the first time in 11 months, the US Treasury 10-year yield is above CapitalSpectator.com’s fair-value model estimate of the benchmark rate. That doesn’t ensure that the 10-year yield will stop rising, of course, but it provides a new talking point for considering why this key rate’s upward bias may moderate or even reverse in the near term.

Macro Briefing: 12 May 2022

* Finland’s prime minister and persident announce support for joining NATO

* Will a prolonged Ukraine war and its economic fallout strain Western resolve?

* China’s economic slowdown is creating headwinds around the world

* China sticks with costly ‘zero Covid’ policy despite economic costs

* UK economy contracts in March as consumers reduce spending

* Bitcoin tumble continues, falling below $27,000 in early Thursday trading

* US annual consumer inflation eases in April but still near 40-year high:

Outlier Risk, Part V: Largest Difference From Average Value

In recent updates to this series (see list below) I’ve been looking at various methodologies to identify extreme values in a time series, such as the S&P 500 Index. One motivation for this analysis is that detecting so-called outlier values offers context for deciding if the risk of trend reversion is relatively high. Let’s add another metric to the tool-kit for this task: finding the value that marks the largest difference vs the average value over a trailing period.