● The Rise and Fall of the Neoliberal Order: America and the World in the Free Market Era

Gary Gerstle

Review via Financial Times

It’s rare that one can use the term “instant classic” in a book review, but Gary Gerstle’s latest economic history, The Rise and Fall of the Neoliberal Order, warrants the praise.

It puts neoliberalism, defined as a “creed that prizes free trade and the free movement of capital, goods and people,” as well as deregulation and cosmopolitanism, in a 100-year historical context, which is crucial for understanding the politics of the moment, not just in the US but globally. The book also knits together a century of very complicated economic, political, and social trends, which are often siloed but are in fact quite interrelated, creating a new and important narrative about where America has been, and where it may be going.

Monthly Archives: April 2022

Are Financial Market Returns Randomly Distributed? Yes And No

The art and science of modeling returns of financial assets is forever unsatisfying because no one model fully captures the true behavior of asset performances. As a result, there comes a point when researchers are forced to pick a poison that appears less wrong than the alternatives.

Macro Briefing: 29 April 2022

* NATO says it’s prepared to support Ukraine for years

* Is it time to position portfolios for recession, Fed failure? Not yet, says UBS

* Eurozone inflation again reaches record high in April

* Stagflation risk rising for Europe as growth slows

* Jobless claims in US remain near 50-year low

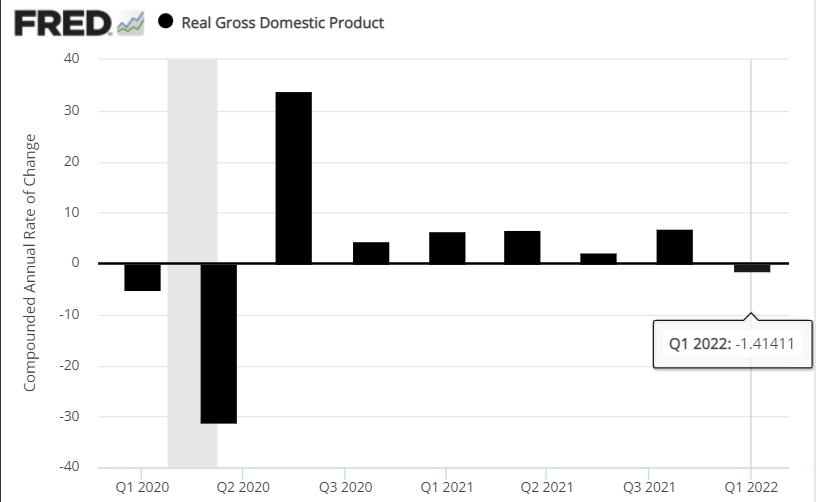

* Despite GDP slide in Q1, economists expect rebound in growth for rest of 2022

* US economy contracted 1.4% in first quarter, well below expectations:

S&P 500 Risk Profile: 28 April 2022

US stocks continue to show a downside bias as the S&P 500 Index retests the lows of 2022. Headwinds continue to blow from a familiar mix of threats: blowback from the Ukraine war, elevated inflation, rising interest rates and slowing economic growth. All these risk factors appear set to continue for the near term, which implies that the market will remain on the defense in the foreseeable future.

Macro Briefing: 28 April 2022

* Ukraine war at risk of spilling across borders

* European leaders say Russian gas cutoff is economic ‘blackmail’

* Ukraine will cause ‘largest commodity shock’ since 1970s, World Bank warns

* Economists expect global growth to slow further via new Reuters poll

* Southern California imposes unprecedented water restrictions

* Yen at 20-year low vs. dollar as Bank of Japan stays committed to low rates

* Sweden’s central bank announces sudden policy U-turn and raises rates

* US pending home sales fell in March, marking five straight monthly declines:

US Growth Set For Sharp Slowdown In Tomorrow’s Q1 GDP Report

Tomorrow’s initial first-quarter estimate of US GDP from the government (scheduled for Thurs., Apr. 28) is expected to reveal a sharp deceleration in growth, based on a set of nowcasts compiled by CapitalSpectator.com.

Macro Briefing: 27 April 2022

* Russia cuts off natural gas supplies to Poland and Bulgaria

* Poland’s gov’t says its energy supplies are secure despite loss of Russian gas

* German consumer sentiment falls to record low in estimate for May

* Deutsche Bank economists raise severity of its US recession forecast

* Fed is now forced to keep raising interest rates, strategist advises

* World Bank expects largest commodity shock since the 1970s

* US home prices rose nearly 20% in year-over-year change through February

* New, single family home sales fell 8.6 percent in March

* US consumer confidence fell in April, based on consumers’ short-term outlook

* US durable goods orders rebounded in March:

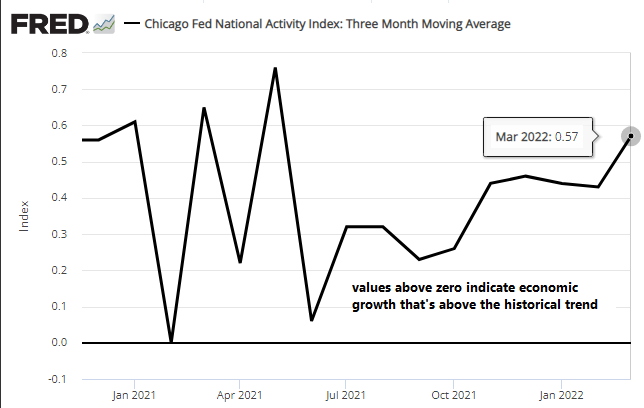

Waiting For The US Economy To Cry “Uncle”

You can’t swing a cat without hitting a commentator discussing recession risk these days. And for good reason: there’s a growing list of potential threats to the economy. But forecasting a possible contraction in the future and monitoring events in real time are two different things and there’s always ambiguity about whether the two become one and the same. Hold that thought as we consider some of the evidence that while the potential for a new recession is lurking, the numbers published to date still indicate that the expansion is very much alive and kicking.

Macro Briefing: 26 April 2022

* Russia warns that nuclear war risks should not be underestimated

* Central banks need to aggressively fight inflation, says Man Group’s CEO

* Treasury real yields moving closer to zero after extended run in negative terrain

* The case for a possible return of the bond bull market

* US consumers’ discretionary spending fell in March, consultancy estimates

* Potential for more China lockdowns raises risk for global supply chains

* Twitter accepts Elon Musk’s $44 billion takeover offer

* Dallas Fed Mfg Index continues to indicate softer growth in April

* US economy continued to grow at solid pace in March, Chicago Fed data shows:

Broad Sell-Off Continued To Weigh on Global Markets Last Week

Widespread selling in the major asset classes rolled on in last week’s trading through Friday’s close (Apr. 22), based on a set of ETFs. The upside outliers: US real estate investment trusts (REITs) and inflation-protected Treausuries.