Energy stocks are enjoying the mother of all upside outlier performances for US equity sectors this year, based on a set of ETFs through Mar. 30. Only two other sectors are posting year-to-date gains, but at levels that barely register relative to energy’s run.

Monthly Archives: March 2022

Macro Briefing: 31 March 2022

* Russian military continues to attack Ukraine after promising to scale back

* Biden may release 1 million barrels a day from Strategic Petroleum Reserve

* Export boom for US natural-gas is pinching supply and lifting prices

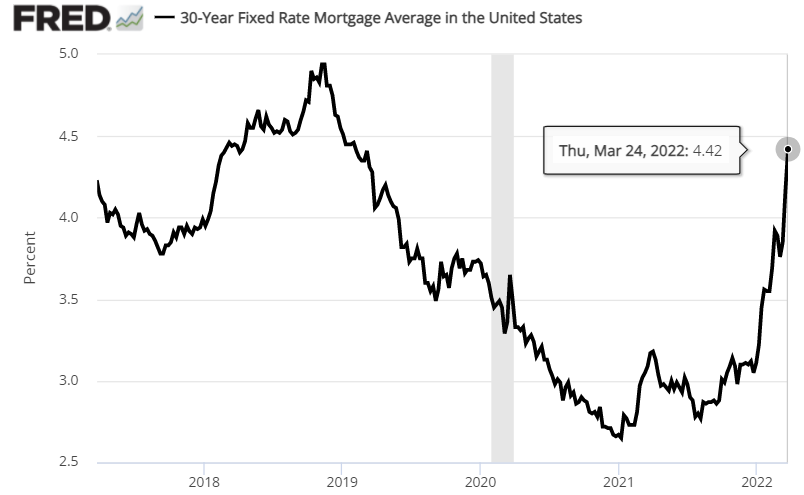

* Will rising mortgage rates cool the red-hot rise in US home prices?

* Economists see signs of a US housing bubble

* Rising wages could complicate progress on cooling US inflation

* China manufacturing and services activity contract in March via survey data

* Germany and Austria take steps toward rationing gas

* US private payrolls continue increasing a solid pace in March, ADP reports

* US Q4 GDP growth revised down slightly to still-strong +6.9%

* 2yr/10yr US Treasury curve slips again, close to inverting at +4 basis points:

Exploring Alternatives To The US 60/40 Benchmark: Part III

In a recent backtest of adding a dedicated allocation to volatility (VIX) via a specialty ETF for enhancing risk management in a traditional 60/40 stock/bond strategy, the results were encouraging, or at least intriguing. Given a new round of extreme shifts in financial markets this year, an update seems in order.

Macro Briefing: 30 March 2022

* Russia will “drastically reduce” combat operations in two key areas of Ukraine

* Russia’s pledge to reduce military operations in Ukraine elicits skepticism

* Is it premature to conclude that Putin’s miscalculated?

* Germany takes a step toward rationing gas amid payment stand-off with Russia

* Russia’s loss is Canada’s gain for commodities exports

* Highly contagious BA.2 subvariant of Covid-19 is now dominant strain in US

* Rising number of Americans worry about inflation, according to new survey

* 2yr/10yr Treasury yield curve inverted on Tuesday, signaling recession risk

* Pimco says yield-curve inversion may not be reliable recession indicator this time

* US home prices reacceleated in January, up 19.2% from year-ago level

* Job openings in US remain near record high in February

* US Consumer Confidence Index rose slightly in March:

Will Low US Recession Risk Rise In The Months Ahead?

The odds of a US economic contraction in the immediate future remain low, but blowback from the Ukraine war and elevated inflation risk could quickly change the calculus. Data published to date, however, still indicates that the economy will continue to expand for the near term.

Macro Briefing: 29 March 2022

* New round of peace talks between Ukraine and Russia begin

* Joe Biden’s $5.8 trillion budget for next year would trim federal deficits

* US job openings still exceed job takers, private data show for March

* Global supply chain risk is rising again

* Possible strike by West Coast dockworkers looms for supply-chain risk

* China’s planned lockdown of Shanghai raises concerns about energy demand

* German consumer sentiment falls to lowest level since Feb 2021

* Dallas Fed Mfg Index continues to show moderate growth for March

* US goods trade deficit narrows in Feb, but remains near record

* US 2-year Treasury yield continues rising, reaching new three-year high:

Price Surge For Commodities Resumed Last Week

A broad mix of commodities topped returns for the major asset classes for the trading week through Friday, Mar. 25, based on a set of ETFs. The gain marks a shift for raw materials after declines for two weeks in a row.

Macro Briefing: 28 March 2022

* Ukraine asks for more help, says Russia wants to split nation

* Territorial integrity is essential, Ukraine insists ahead of talks with Russia

* Biden’s remark on Putin creates anxiety for allies in West

* Defense companies eye rising military budgets sparked by Ukraine invasion

* Europe’s economy slows as Ukraine war takes a toll

* India buys discounted Russian oil and China may follow

* Part of the Treasury yield curve inverts for first time since 2006

* US average 30-year mortgage rate rises to three-year high:

Book Bits: 26 March 2022

● In Defence of Wealth: A Modest Rebuttal to the Charge the Rich Are Bad for Society

Derek Bullen

Q&A with author via Grit Daily

Q: When you speak of wealth creators you refer to “the few who can invest, take risks, innovate and transform their ideas into successful businesses that create wealth and employ others.” Do you think that would grind to a halt if the earnings of hedge fund managers were taxed as income instead of as capital gains, or if the marginal tax rate were increased a few percent?

A: Yes, I do believe that unfair taxation is extremely costly to the society that imposes it. Taxing the rich has been popular over the centuries, yet always with disastrous consequences. Wealthy people know when they are overtaxed and either move or stop buying. This isn’t my opinion, this is fact. Here are two recent examples of how a tax increase of a few percent was enormously costly to the governments of France and the US….

US Economy Appears Resilient As Headwinds Strengthen

The blowback from the war in Ukraine has only just started to rock the global economy, but the early clues for the US remain encouraging. There’s a long road ahead and it’s too early to make high-confidence forecasts, but preliminary data for March suggest that growth still has the upper hand.