Markets tried to look through Russia’s invasion of Ukraine last week, but as the brutal reality of war becomes clearer, and economic blowback spreads across the global economy, sentiment will come under increased pressure in the days ahead.

Monthly Archives: February 2022

Macro Briefing: 28 February 2022

* Russian and Ukrainian officials will meet for talks as war rages on

* Next 24 hours will be crucial for Ukraine, says country’s president

* The West adds more sanctions on Russia but largely exempts energy exports

* Putin puts nuclear forces on high alert

* Russian currency plunges amid expanding financial sanctions from the West

* JP Morgan advises that selling equities now faces whipsaw risk

* Geopolitical storm will test consumers’ appetite and ability to spend.

* US consumer spending posts robust gain in January as inflation picked up

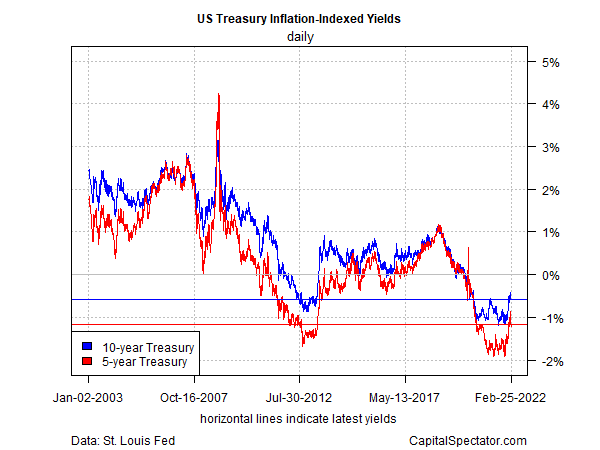

* US real Treasury yields are rebounding but still deeply negative:

Book Bits: 26 February 2022

● The Next Age of Uncertainty: How the World Can Adapt to a Riskier Future

Stephen Poloz

Interview with author via Financial Post

Stephen Poloz, who spent seven years as the Bank of Canada governor before stepping down in July 2020… identifies five “tectonic” forces — an aging population, technological progress, rising inequality, rising debt and climate change — that are going to interact under the surface and create new crises for at least a decade.

We talked about how this will work, the energy transition, inflation, rising interest rates, why he thinks employees will gain an edge over employers and much more.

How Will Russia’s Invasion Of Ukraine Change The Risk Calculus?

Europe’s violent history had been in remission, but it returned with a vengeance this week when Russia invaded Ukraine. It’s been comforting to assume that decades of relative peace on the Continent and its near-periphery had become the new norm and that centuries of war had passed into history as a real and present danger. But the world has been reminded anew that the long arc of history isn’t easily dispatched.

Macro Briefing: 25 February 2022

* Russian forces moving in on Ukrainian capital of Kyiv

* Kremlin will analyze Ukraine’s offer to discuss a non-aligned status

* Countries around the world continue to pile new sanctions on Russia

* Ukraine war reshuffles risk outlook for global economy

* Will the Russian invasion of Ukraine change the Fed’s rate-hike plans?

* EU set to sever 70% of Russia’s banking system from global markets

* US officials asked China for help to avoid war in Ukraine. China said no

* Russia’s invasion of Ukraine threatens exports of critical commodities

* US growth picked up in January via Chicago Fed Nat’l Activity Index

* US jobless claims fell last week; Q4 GDP growth revised slightly higher

* Brent oil surged on Thursday before ending just below $100/bbl:

Russia Invades Ukraine. What Comes Next?

If there was any subtlety to Russia’s increasingly intimidating behavior toward Ukraine in recent weeks, it gave way today as Putin launched a full-scale military invasion of its neighbor. How this plays out is unclear, except that whatever unfolds it’s obvious that a major geopolitical regime shift has been triggered. Exactly what this means for the global economy, markets, international relations and beyond is hazy at best this morning. Meanwhile, here are three key questions to ponder as a needless war begins just across Europe’s eastern border.

Macro Briefing: 24 February 2022

* Russia invades Ukraine with barrage of missile, artillery and air attacks

* Easing energy price shock by raising output will be limited due to pinched supply

* Gold rises above $1900/oz, highest in over a year, as Russia invades Ukraine

* Oil’s surge will bring double shock of slowing growth and raising inflation

* US and allies poised to roll out further, sweeping sanctions against Russia

* China refuses to condemn Russia’s attack on Ukraine

* Oil prices soar amid worries about future energy supplies:

Inflation Outlook: 23 February 2022

US inflation remains elevated and appears on track to remain so for the immediate future. There are hints in some corners that the annual pace of consumer inflation will ease, but the modest optimism for this outlook, which is based on previously published data, is complicated if not eradicated due to the fast-moving Ukraine-Russia crisis.

Macro Briefing: 23 February 2022

* US and its allies prepare to step up sanctions pressure on Russia

* Germany halts approval of Russia-supplied Nord Stream 2 gas pipeline

* Russia’s economy is prepared for the worst amid new sanctions

* Ukraine crisis raises economic risk, says Atlanta Fed’s Bostic

* Should portfolios prepare for recession? No, advises JP Morgan strategist

* US consumer confidence fell again in February

* Home prices rose 18.8% in 2021, highest in 34 years

* Russia threat to Ukraine may complicate Fed’s plans for rate hikes

* US growth accelerates in February to a 2-month high via PMI survey data:

Geopolitical Risk Rises As Russia Orders Troops Into Ukraine

It’s not an invasion, but it’s no longer the status quo of recent history. Let’s call it taking the asymmetric-warfare playbook up several notches and raising the threat of conventional military combat closer to Europe’s eastern border. Whatever you call it, the decision by President Putin to send Russian troops into eastern Ukraine on a “peacekeeping” mission substantially raises uncertainty and increases risk for the global economy and financial markets.