Shares in US companies and inflation-protected Treasuries managed to post gains last week as the rest of the major asset classes lost ground, based on a set of ETFs through Friday’s close (Jan. 28).

Monthly Archives: January 2022

Macro Briefing: 31 January 2022

* White House says Omicron spike could affect this week’s update on jobs data

* Atlanta Fed’s Bostic says central bank could hike rates by a half-point if needed

* China manufacturing sector contracted in January–weakest reading in 23 months

* Bank of England may be moving closer to first back-to-back rate hikes in 17 years

* Eurozone growth slowed in Q4

* Surging prices for construction materials appear to restrain housing-bubble risk

* US consumer spending fell in December as inflation hit 40-year high

* US 10yr-2yr Treasury yield spread at lowest level since Oct. 2020:

Book Bits: 29 January 2022

Nicholas Mulder

Review via Foreign Affairs

For those who see economic sanctions as a relatively mild way of expressing displeasure at a country’s behavior, this book, charting how they first emerged as a potential coercive instrument during the first decades of the twentieth century, will come as something of a revelation. In an original and persuasive analysis, Mulder shows how isolating aggressors from global commerce and finance was seen as an alternative to war that worked precisely because of the pain it imposed on the target society.

Performance Divide Persists For Old vs. New Energy Stocks In 2022

Green energy may be the future, but it’s still having a rough time in the present while shares of conventional fossil fuel companies extend last year’s strong bull run.

Macro Briefing: 28 January 2022

* Biden focuses on presenting united front with Europe re: tensions with Russia

* Russia says it won’t start a war over Ukraine

* US employers dealing with highest labor costs in 20 years

* Petro states set to supply rising share of West’s fossil fuels

* German economy shrank 0.7% in Q4 while France’s economy rebounded

* Apple reports strong quarterly revenue gain as supply-chain crunch eases

* Jobless claims in US eased last week–first decrease in four weeks

* US pending home sales fell again in December amid shrinking inventory

* US durable goods orders fell in December — first decline in 3 months

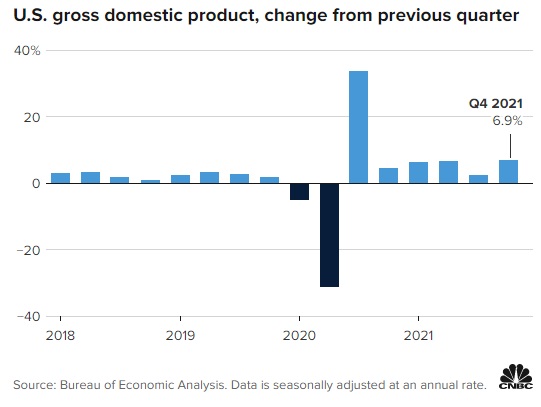

* US economic growth accelerated in Q4 — faster than expected:

US Equity Factors Post Wide Range Of Losses So Far In 2022

Minds will differ on the case for factor diversification in equity portfolios, but advocates will find a degree of support for the idea in year-to-date performances, based on a set of ETFs through yesterday’s close (Jan. 26).

Macro Briefing: 27 January 2022

* Justice Breyer to retire, giving Biden a choice for shaping Supreme Court

* Federal Reserve hints at possibility of several interest rate hikes this year

* US formally rejects Russian demand to bar Ukraine from NATO

* Russia and Ukraine will continue ceasefire talks

* N. Korea continues ballistic missile tests–its sixth round of launches this month

* Will Taiwan’s key role in producing computer chips trigger US-China conflict?

* UBS agrees to buy robo adviser Wealthfront for $1.4 billion

* New US home sales rose to a 9-month high in December:

Will Putin Invade Ukraine? Weighing The Risks, Gauging The Odds

The facts on the ground look ominous. Russia has deployed more than 100,000 troops on Ukraine’s border. The US, Europe and NATO have responded by warning Moscow that there will be a price to pay if President Vladimir Putin decides to invade. The situation has become a major risk factor for the global economy, financial markets and beyond,

Macro Briefing: 26 January 2022

* US working to supply Europe with energy supplies to blunt a Russian gas cutoff

* New omicron variant discovered and it’s spreading fast but little is known of risks

* Fed expected to signal a March interest rate hike today

* Gold is rising this year amid increased geopolitical tensions and market turmoil

* IMF says global recovery is ‘disrupted’ and cuts global growth forecast

* Falling stock prices may not delay the Fed’s hawkish policy choices this time

* US computer chip supplies near extreme lows

* US Consumer Confidence Index fell in January after gains in 2021’s Q4

* US home prices ease on year-over-year basis but still running hot:

US GDP Growth Set To Pop In Q4 Report But Q1 Outlook Is Sliding

Economic growth is expected to accelerate in this week’s initial estimate of fourth-quarter gross domestic product (GDP). The Bureau of Economic Analysis appears set to report a strong rebound in output for Q4 in Thursday’s release (Jan. 27). But the recovery will be short-lived, based on recent downgrades for the US outlook in early 2022.