US junk bonds and several slices of foreign fixed-income markets led a mixed run of returns for the major asset classes last week, based on a set of ETFs through Friday’s close (Dec. 3).

Monthly Archives: December 2021

Macro Briefing: 6 December 2021

* Goldman Sachs cuts forecast of US 2022 GDP growth due to Omicron

* US health experts say early signs suggests Omicron less dangerous than delta

* China’s economic influence on global economy has been fading

* China’s central bank eases banking reserve requirement to boost liquidity

* China Evergrande Group is again on the brink of default; shares plunge

* German industrial orders fell sharply in October due to soft foreign demand

* US payrolls grew much less than expected in November

* Services PMI reaches record high in US, reflecting strong sector activity

* US 10yr-2yr Treasury yield curve narrows to smallest spread in over a year:

Book Bits: 4 December 2021

Ray Dalio

Review via Forbes

America’s domestic issues and decline as the world’s leading superpower are more than simply a matter for debate to Dalio. They underpin the core thesis of his latest book, Principles for Dealing with the Changing World Order: How and Why Nations Succeed and Fail, that comes out on November 30. In it, he builds the case that the confluence of rising U.S. debt and income disparities, along with America’s diminished influence, has put the country at risk of not just economic hardship but war. Specifically, he points to growing debt and near-zero interest rates that have led to a massive printing of money ($16 trillion of debt at negative interest rates this year, by Dalio’s estimates), increased conflict and polarization due to widening wealth gaps and China’s increased ability to challenge U.S. hegemony on the world stage.

Major Asset Classes | November 2021 | Risk Profile

If genius is a bull market, it’s been easy to look smart in recent years by holding a multi-asset-class portfolio. That’s been true in total-return terms and the profile holds up after adjusting for risk. But there are hints that the bull run for risk-adjusted performance may be peaking for globally diversified strategies.

Macro Briefing: 3 December 2021

* Senate OKs short-term funding bill to avoid government shutdown

* Fed governor Quarles says rate hikes needed to cool inflation

* Worldwide computer chip shortage lifting inflation will persist ‘deep into 2022’

* China’s modest growth eased in Nov, according to Composite Output Index

* Eurozone growth strengthened in November via PMI survey data

* Chinese ride-hailing giant Didi will delist from NYSE

* Apples reports waning demand for its iPhone 13

* US jobless claims rose last week after reaching 52-year low

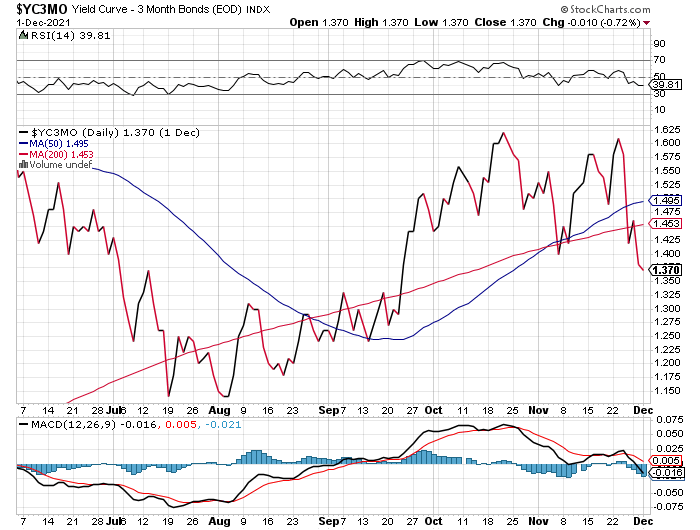

* 10yr-3mo Treasury yield curve narrows to 2-month low:

Risk Premia Forecasts: Major Asset Classes | 2 December 2021

The expected risk premium for the Global Market Index (GMI) ticked lower in November, but remains elevated relative to recent history. Today’s revised estimate is 6.0% annualized, down slightly from the previous forecast.

Macro Briefing: 2 December 2021

* Government-shutdown risk is rising again as Congressional negotiations stumble

* First US case of Omicron coronavirus variant detected

* Does Omicron pose a risk to the economic recovery?

* Is OPEC’s power over oil prices rebounding?

* UN gauge of global food prices near record high, boosting inflation anxiety

* Global mfg continues to expand at moderate pace amid supply shortages

* US ISM Mfg Index increases in November, signaling stronger sector growth

* Execs of major cryptocurrency firms called to testify in Congress

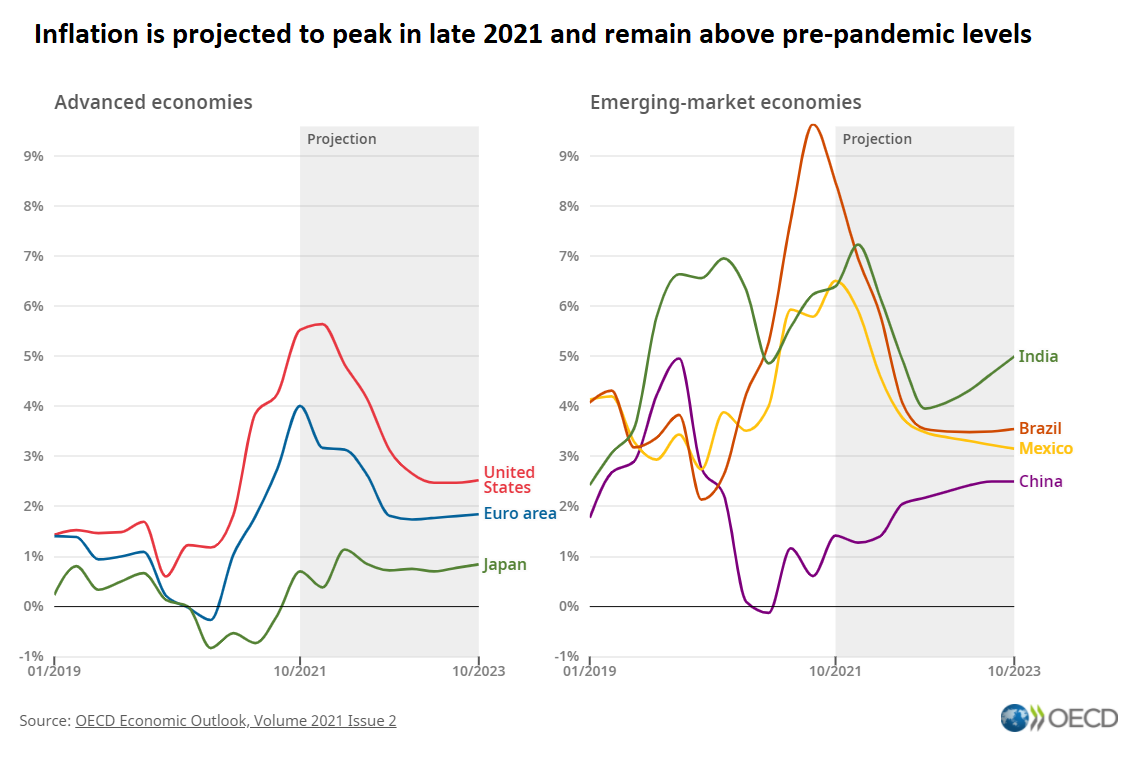

* OECD forecasts inflation will peak in late-2021:

Major Asset Classes | November 2021 | Performance Review

Red ink swept over monthly results for most of the major asset classes in November. The two exceptions: US investment-grade bonds and inflation-indexed Treasuries. Otherwise, losses dominated global markets last month, based on a set of proxy ETFs.

Macro Briefing: 1 December 2021

* Fed prepared for quicker end to stimulus program, Powell says

* Omicron raises uncertainty around inflation risk, warns Fed chair

* Russian President Putin warns West on ‘red line’ for NATO, Ukraine

* Could oil surge to $150? It’s possible, says analyst at Jefferies

* China mfg activity expanded slightly in November

* Eurozone mfg output stabilized in November at solid growth rate

* UK mfg grew at strong rate in November as input prices surged

* US home prices continue to run hot, but growth rate eased in September

* Chicago PMI reflects softer growth in November

* US Consumer Confidence Index slipped to 9-month low in November: