I heard the bells on Christmas Day

I heard the bells on Christmas Day

Their old, familiar carols play,

And wild and sweet

The words repeat

Of peace on earth, good-will to men!

“Christmas Bells”, Henry Wadsworth

Monthly Archives: December 2021

‘Tis The Season…

Research Review | 23 December 2021 | ETFs

Trading Down: The Effects of Active Trading on One-Month ETF Returns

Ian Gray (Loyola Marymount University)

December 15, 2021

Ark Investment Management (ARK), led by CIO Cathie Wood, has risen to prominence over the past few years because of its remarkable performance. Because of requirements for active ETFs to publish daily holdings, market participants have gained unprecedented access to following the path to market-beating performance. ARK is celebrated for both its stock picking and active trading abilities. In this paper, I study how active trading affects alpha from ARK’s funds, and I create static synthetic portfolios to strip out the effects of active trading. I find that active trading on average reduces ARK’s one-month returns by 1.36 percentage points.

Macro Briefing: 23 December 2021

* New studies show Omicron infections appear to be relatively milder

* Biden says he’ll run for re-election

* Russia and Ukraine restore a 2020 ceasefire deal in eastern Ukraine

* Saudi Arabia building ballistic missiles with China’s help, intel shows

* Reducing inflation may raise recession risk, predicts economist Larry Summers

* Chinese yuan is having a greater influence on emerging-market currencies

* US GDP growth in Q3 revised modestly higher

* Existing home sales continued rising in the US in November

* US growth moderate in Nov via Chicago Fed Nat’l Activity Index

* US Consumer Confidence rose in December to highest level since July:

US Economy Remains Resilient But Headwinds May Be Brewing

The world’s largest economy continues to post upbeat economic data as 2021 draws to a close, but there are hints that growth may suffer in the new year.

Macro Briefing: 22 December 2021

* Biden says government will provide 500 million free Covid home-testing kits

* Putin warns of possible military response to what he sees as NATO pressure

* Moderna may produce Omicron booster within weeks, says company CEO

* Israel begins offering a fourth dose of coronavirus vaccine

* US life expectancy slipped 1.8 years in 2020, reports CDC

* Shipping giant Maersk to acquire Hong Kong-based LF Logistics

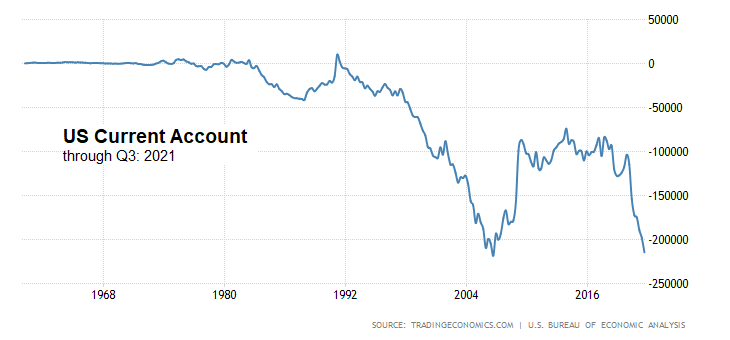

* US current account deficit at biggest gap in 15 years in third quarter:

What’s Driving Bitcoin? Factor Analysis Profiles, Part I

What makes bitcoin tick? There are many theories, ranging from a digital-age store of value to the world’s greatest Ponzi scheme. Narratives are interesting and perhaps useful, but can we quantify bitcoin’s risk betas with specificity? Let’s give it a try in a series of factor-analysis tests.

Macro Briefing: 21 December 2021

* Omicron variant is now the dominant coronavirus strain in US, says CDC

* Omicron expected to slow world economy by half in Q4 vs. Q3

* Global merger and acquisition activity rises to record $5 trillion-plus in 2021

* Companies set to install record amounts of batteries on US electric grid this year

* Why did Sen. Manchin oppose Build Back Better Act? Coal is probably a factor

* US Leading Economic Index up “sharply” in Nov, signaling upbeat outlook:

REITs and Bonds Were Havens During Last Week’s Market Losses

US real estate and fixed-securities provided diversification benefits during last week’s widespread selling that weighed on most other markets around the world, based on a set of ETFs through Friday’s close (Dec. 17).

Macro Briefing: 20 December 2021

* Build Back Better Act’s future in doubt after Sen. Manchin pulls support

* Goldman Sachs cuts US growth outlook after Manchin rejects Build Back Better

* Omicron ‘raging around the world,’ says White House’s top medical adviser

* Moderna finds its booster sharply raises antibodies to fight Omicron

* Turkey’s economic crisis threatens Europe’s stability

* Central banks see risk of sustained inflation due to Omicron

* China cuts a benchmark lending rate for first time since April 2020

* US 10-year Treasury yield starts week near a three-month low: