The resurgence in coronavirus cases, hospitalizations and fatalities in the US hasn’t taken a bite out of third-quarter growth estimates, at least not yet.

Monthly Archives: August 2021

Macro Briefing: 31 August 2021

* Last US military planes left Afghanistan, marking end of America’s longest war

* Assessing the damage in Louisiana after Hurricane Ida

* Pandemic complicates Fed’s task of defining employment goals

* Eurozone inflation rises to 3% pace in August, highest in a decade

* China’s economy comes under pressure in August via PMI survey data

* Factory growth in China slows to a crawl in August via PMI survey data

* Supply shortages continue to bedevil the economy

* Dallas Fed Mfg Index indicates softer growth in August

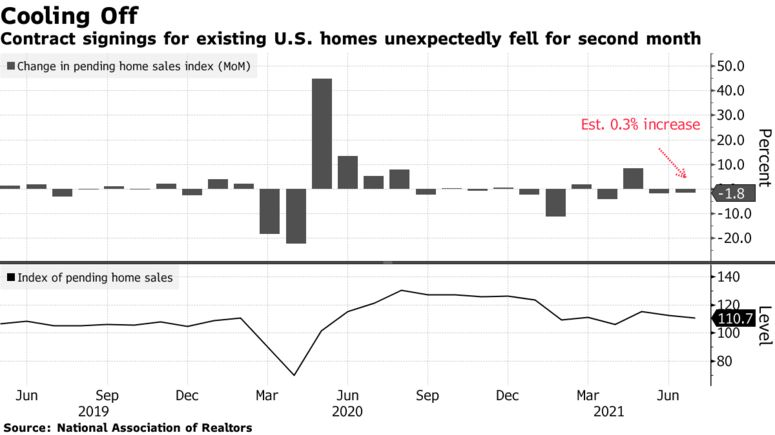

* US pending home sales fell for a second straight month in July:

Broad-Based Rallies Last Week Lifted Most Asset Classes

US bonds were last week’s outlier, posting a slight decline. Otherwise, all the major asset classes rose last week, based on a set of ETFs for the trading week through Aug. 27.

Macro Briefing: 30 August 2021

* New Orleans loses power as Hurricane Ida rages over Louisiana coast

* Kabul airport subject to multiple but apparently failed rocket attacks

* Europe considers blocking non-essential travel from US due to Covid-19

* N. Korea appears to have restarted operations for producing nuclear weapons

* US Covid-19 hospitalizations rebound to highest level since last winter

* Weighing the outlook for China tech stocks as regulatory crackdown continues

* Veteran investor Mark Mobius recommends a 10% allocation to gold

* US personal consumption expenditures rose for a second month in July:

Book Bits: 28 August 2021

David Sumpter

Summary via publisher (Flatiron Books/Macmillan)

Is there a secret formula for getting rich? For going viral? For deciding how long to stick with your current job, Netflix series, or even relationship? This book is all about the equations that make our world go round. Ten of them, in fact. They are integral to everything from investment banking to betting companies and social media giants. And they can help you to increase your chance of success, guard against financial loss, live more healthfully, and see through scaremongering. They are known by only the privileged few – until now… mathematician David Sumpter shows that it isn’t the technical details that make these formulas so successful. It is the way they allow mathematicians to view problems from a different angle – a way of seeing the world that anyone can learn.

The ETF Portfolio Strategist: 27 August

- Markets like what they heard from Fed Chairman Powell today

- Strong gains for all our portfolio strategy benchmarks this week

The anti-taper-tantrum rally: Earlier today, Fed Chairman Powell attempted to navigate the treacherous waters of 1) reminding markets that the central bank was approaching the start of winding down its asset purchases without 2) triggering a sell-off of risk assets on the view that such comments meant that rate hikes are near. In fact, the two are separate and distinct, he emphasized.

Drawdown Analysis Is Also Valuable For Economic Indicators

Calculating the history of drawdown (DD) for assets is common in the investment community, but the risk metric also provides useful information for analyzing economic data. In particular, monitoring peak-to-trough declines can offer relatively reliable estimates for turning points and estimating the probability that a decline is set to end or that a new downturn has started.

Macro Briefing: 27 August 2021

* Biden’s Afghan exit strategy rocked by two deadly bombings in Kabul

* US vows to continue Afghanistan evacuation after deadly Kabul airport attack

* More terrorist attacks in Kabul are likely, US and allies warn

* Supreme Court blocks Biden’s eviction moratorium

* Tropical Storm Ida may become major hurricane as it heads toward New Orleans

* Three Fed officials say it’s time to start trimming central bank’s asset purchases

* China eyes ban of US IPOs for firms with large amounts of consumer data

* US Q2 GDP growth revised up fractionally to 6.2%

* US jobless claims edge higher, remaining stuck in recent range:

China Is This Year’s Downside Outlier For Global Stock Markets

Shares in China continue to post sharp year-to-date losses vs. an otherwise upside bias for global stocks, based on a set of exchange-traded funds tracking the world’s major equity regions through yesterday’s close (Aug. 25).

Macro Briefing: 26 August 2021

* Terror threat complicates US evacuation plans in Afghanistan

* Global supply chain constraints expected to persist into 2022

* South Korea is first major Asian economy to raise interest rates in pandemic

* Western Digital-Kioxia merger will further reorder global chip industry

* Rethinking gold’s allure after Palantir $50 million purchase of bullion

* German consumer sentiment weakens as inflation and Covid-19 cases rise

* US core capital goods were flat in July–first no-growth month since February: