The Federal Reserve is widely expected to reaffirm its ultra-dovish monetary policy in today’s FOMC meeting and the futures market continues to price the odds of a rate hike at 0% deep into 2021. But real-world conditions in government bond trading are hinting, if only on the margins, that a post zero-forever world may not be forever after all.

Daily Archives: December 16, 2020

Macro Briefing: 16 December 2020

* GOP Senate Majority Leader McConnell publicly acknowledges Joe Biden’s victory

* Economists expect decline in today’s November report on US retail spending

* Congress still negotiating details for Covid-19 relief package

* Eurozone economy “close to stabilizing” via PMI survey data for December

* German economy reflects “ongoing resilience” in December PMI data

* Japan’s economy continues to contract in December, PMI data shows

* UK economy growing slightly via December PMI survey data

* Will the Fed change its bond-buying program in today’s policy meeting?

* NY Fed Mfg Index in Dec continues to post moderate growth

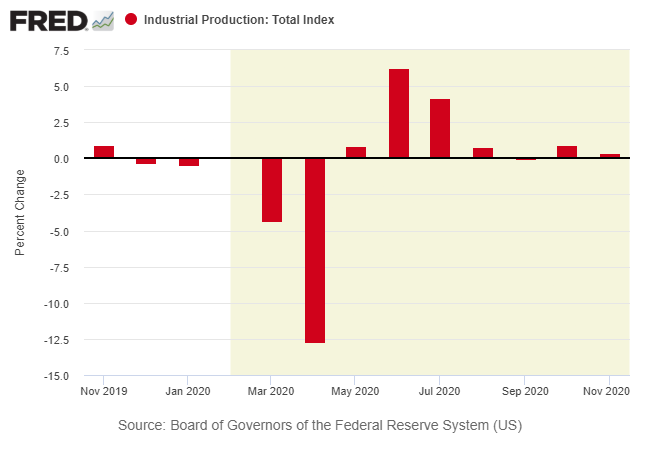

* US industrial output growth slowed in November, rising 0.4%: