Senate Republicans push back on Trump’s plans for tariffs on Mexico: NY Times

Mexican officials to meet with VP Pence today for tariffs talk: Reuters

Trump: there’s ‘always a chance’ of military action against Iran: CNBC

Fed’s Powell is open to rate cuts if warranted: WSJ

World Bank cuts forecast for global growth in 2019: WB

US auto sales rebounded in May: Yahoo Finance

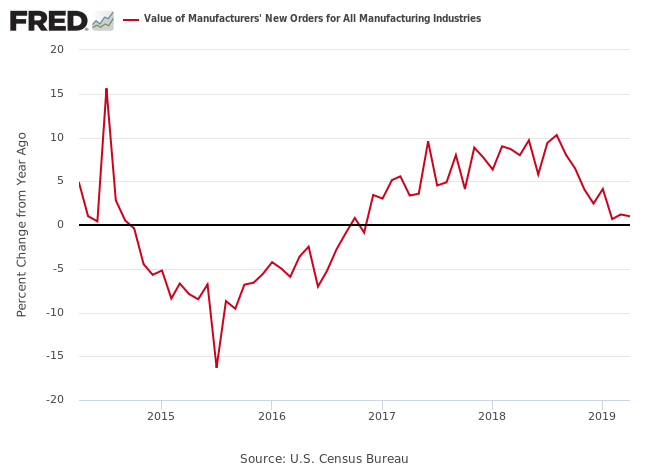

US factory orders’ 1yr trend was subdued in April at +1.0%:

Monthly Archives: June 2019

Risk Premia Forecasts: Major Asset Classes | 4 June 2019

The outlook for the Global Market Index’s (GMI) risk premium fell in May, edging down to an annualized 4.5%. The projection marks a relatively sizable decline from the 4.8% estimate in last month’s update. Today’s revision for GMI — an unmanaged market-value-weighted portfolio that holds all the major asset classes (except cash) — represents the ex ante premium over the projected “risk-free” rate for the long term.

Macro Briefing: 4 June 2019

Fed’s Bullard: rate cut may be near: CNBC

Big tech may have big problem with new US antitrust probe: Reuters

Australia’s central bank cuts interest rates: MW

Rising share of companies expect climate change to impact business: NY Times

Global manufacturing activity contracted in May: IHS Markit

Soft residential housing sector weighed on US construction spending in April: AP

Mfg PMI for US slumps to lowest print in nearly a decade: IHS Markit

US ISM Mfg Index fell in May, reflecting weakest growth since 2017: MW

Major Asset Classes | May 2019 | Performance Review

Stocks around the world took a hit in May as trade-related fears weighed on the outlook for the global economy. The deterioration in sentiment was a boon for US bonds, which attracted a surge of asset flows in the rush for a safe haven last month.

Macro Briefing: 3 June 2019

China, Mexico open to talks to defuse trade conflict with US: WSJ

Does Trump’s trade policy threaten longest US expansion in history? MW

Trump has doubts about Mideast peace plan: Politico

Trump insults London’s mayor ahead of UK visit: Bloomberg

Trump administration considered tariffs for Australia: The Hill

Eurozone mfg sector continued to contract in May: IHS Markit

UK Mfg PMI fell sharply in May, signaling contraction: IHS Markit

White House’s top economist, Kevin Hassett, will depart ‘shortly’: NY Times

Revised data shows strong US consumer sentiment ‘eroded’ in late-May: UoM

Is inverted 10yr-3mo yield curve predicting recession? Maybe not: Econobrowser

US consumer spending’s 1yr trend slipped to moderate +4.3% in April:

Book Bits | 1 June 2019

● The Levelling: What’s Next After Globalization

By Michael O’Sullivan

Summary via publisher (Public Affairs Books)

The world is at a turning point similar to the fall of communism. Then, many focused on the collapse itself, and failed to see that a bigger trend, globalization, was about to take hold. The benefits of globalization–through the freer flow of money, people, ideas, and trade–have been many. But rather than a world that is flat, what has emerged is one of jagged peaks and rough, deep valleys characterized by wealth inequality, indebtedness, political recession, and imbalances across the world’s economies. These peaks and valleys are undergoing what Michael O’Sullivan calls “the levelling”–a major transition in world economics, finance, and power. What’s next is a levelling-out of wealth between poor and rich countries, of power between nations and regions, of political accountability from elites to the people, and of institutional power away from central banks and defunct twentieth-century institutions such as the WTO and the IMF.

Continue reading