China says it will ‘never surrender to external pressure’ in trade talks: Reuters

The US-China trade battle will last decades: NY Times

White House economic adviser: ‘both sides will suffer’ in US-China trade war: CNBC

Experts outline several ways China could retaliate to US tariffs: CNBC

Saudi Arabian oil tankers attacked in Persian Gulf: Reuters

US job growth for smallest firms falls to 8-year low due to tight labor mkt: WSJ

US consumer inflation’s 1yr trend remains stable at roughly 2% in April:

Monthly Archives: May 2019

Book Bits | 11 May 2019

● Moneyland: The Inside Story of the Crooks and Kleptocrats Who Rule the World

By Oliver Bullough

Review via Inc.com

Hang onto your metaphorical hats, because this is the most eye-opening book that you’ll read all year. Moneyland documents exactly how the ultra-rich — especially dictators and criminals — structure shell companies in multiple countries (including many US states) so that they can stash, mostly in the U.S. and the U.K., a trillion dollars of ill-gotten gains every year. It describes how the real-estate business in both countries caters to these money and how the moguls in those industried (many of whom are highly placed in our government) therefore have a vested interest in keeping those dictators in power. A must read for anyone who wants to understand how the real world of wealth works.

Continue reading

Research Review | 10 May 2019 | Tail Risk

Tail Risk Management for Multi-Asset Multi-Factor Strategies

David Chambers (University of Cambridge), et al.

January 8, 2019

Multi-asset multi-factor portfolio allocation is typically centred around a risk-based allocation paradigm, often striving for maintaining equal volatility risk budgets. Given that the common factor ingredients can be highly skewed, we specifically incorporate the notion of tail risk management into the construction of multi-asset multi-factor portfolios. Indeed, we find that the minimum CVaR concentration approach of Boudt, Carl and Peterson (2013) effectively mitigates the dangers of tail risk concentrations. Yet, diversifying across multiple assets and style factors can be in and of itself a good means of tail risk management, irrespective of the risk-based allocation technique employed.

Continue reading

Macro Briefing: 10 May 2019

Trump raises tariffs on China, which vows to respond: CNBC

US-China trade talks to resume today: CNN

Estimates of economic costs to higher tariffs in US-China trade war: MW

US seizes N. Korean ship that violated international sanctions: AP

UK economic growth strengthened in first quarter: BBC

Jobless claims in US fell last week, near 50-year low: MW

US producer prices increased less than forecast in April: WSJ

US trade deficit increased slightly in March: MW

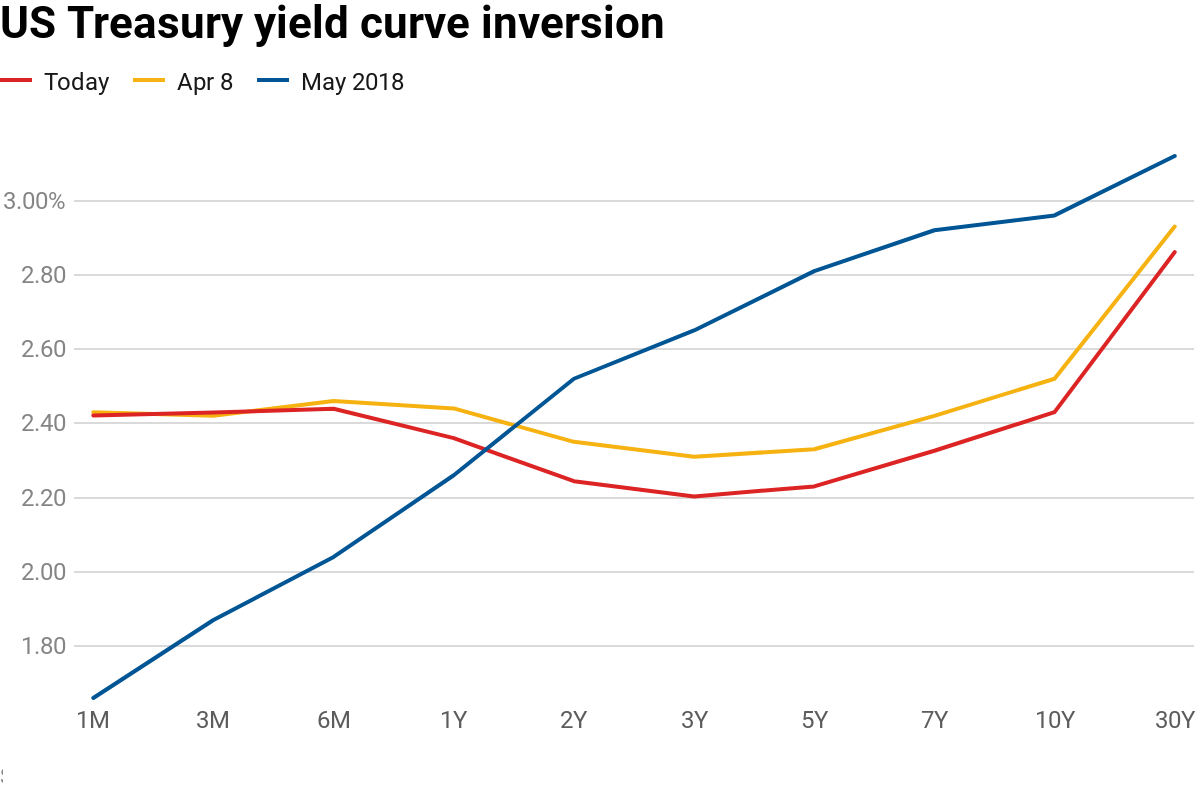

BlackRock strategist: yield curve losing predictive power: Bloomberg

10yr-3mo yield curve goes negative, suggesting higher recession risk: CNBC

Treasury Market’s Inflation Outlook Eases Ahead Of CPI Report

The widely followed 5-year Treasury market’s implied inflation forecast fell to a six-week low ahead of tomorrow’s April update on the Consumer Price Index (CPI). The softer outlook for pricing pressure could be noise that’s linked to the US-China spat over trade. Alternatively, the market is pricing in higher odds that the already subdued inflation trend is set to ease further in the months ahead.

Continue reading

Macro Briefing: 9 May 2019

A Constitutional crisis lurks in battle between Trump and Congress: CNN

House votes, along party lines, to hold Attorney General Barr in contempt: The Hill

How many Trump investigations is Congress overseeing? A lot: Politico

N. Korea fires another missile on Thursday: CNBC

Trump says China ‘broke the deal’ on trade: Bloomberg

US and China to resume negotiations ahead of possible tariff increase on Fri: AP

US-led naval drills in S. China Sea pose challenge for Beijing: Reuters

China’s consumer inflation rate rose to six-month high in April: SCMP

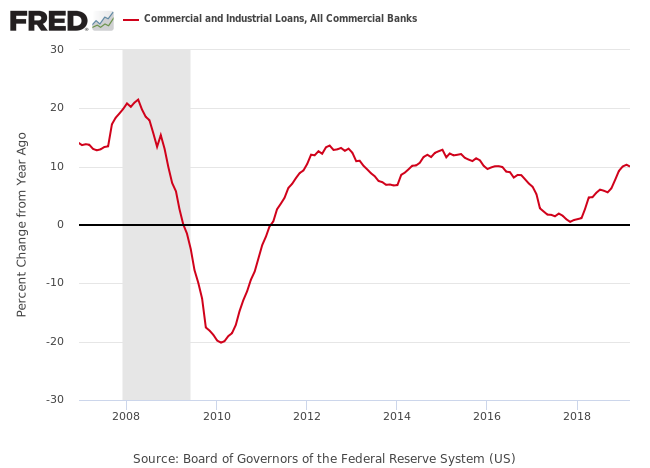

1yr growth rate for US business lending eased in March; first dip in 6 months

Trade Fears Strengthen US Bond Market’s 2019 Rally

US fixed income was already on a roll this year, but this week’s renewed concerns about the US-China trade battle have strengthened the bull market in bonds as a fresh run of risk-off sentiment weighs on equities around the world.

Continue reading

Macro Briefing: 8 May 2019

Iran’s president announces partial withdrawal from nuclear deal: CNN

How will the renewed US-China battle play out? Bloomberg

China reportedly backtracked on US draft of trade agreement: Reuters

China’s trade surplus narrowed sharply in April, surprising analysts: CNBC

Trump’s taxes show $1 billion loss for 1985-1994: NY Times

Consumer credit growth slowed in US to 9-month low in March: Bloomberg

Economic Uncertainty Policy Index for US rises to highest level since 2017: FRED

US job openings rose sharply in March, reflecting tighter labor market: Reuters

Will Friday’s Inflation Report Support The Fed’s Outlook?

Public statements by Federal Reserve officials in recent days remains unified in forecasting that the recent deceleration in a key measure of core inflation is “transitory.” The first reality check on that outlook via hard data is scheduled for this Friday’s April report for the Consumer Price Index (CPI).

Continue reading

Macro Briefing: 7 May 2019

White House plans to raise tariffs on Chinese goods: WSJ

China vice premier will attend trade talks in US: Reuters

Treasury Sec refuses House demands for Trump’s taxes: Politico

Mynamar releases two Reuters journalists: Reuters

German factory orders post slight improvement for March: Bloomberg

Japan Mfg PMI: growth returned in April, just barely: IHS Markit

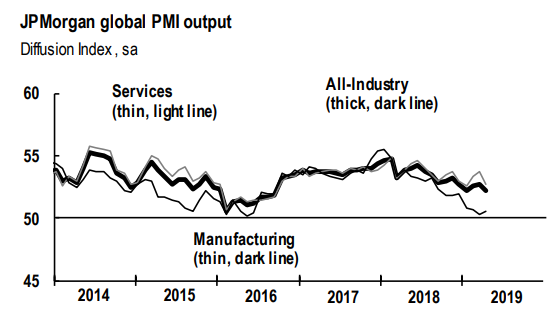

Sluggish global economic growth eased to 3-month low in April: IHS Markit