The projected risk premium for the Global Market Index (GMI) edged up again in April, reaching an expected annualized 4.8% return. The estimate reflects a slightly higher forecast compared with the 4.7% projection in last month’s update. Today’s revision for GMI — an unmanaged market-value-weighted portfolio that holds all the major asset classes (except cash) — represents the ex ante premium over the projected “risk-free” rate for the long term.

Continue reading

Daily Archives: May 2, 2019

Macro Briefing: 2 May 2019

Barr defies Congress with decision to skip 2nd day of testimony: Reuters

Iranian oil sanctions may put US and Saudi Arabia on collision course: WSJ

Fed leaves rates unchanged, expects no hikes this year: CBS

Eurozone Mfg PMI: sector contracts for third month in April: IHS Markit

US ISM Mfg Index fell to 2-year low in April, signaling slow growth: IBD

US Mfg PMI ticked higher in April: IHS Markit

Consutruction spending in US unexpectedly fell in March: Reuters

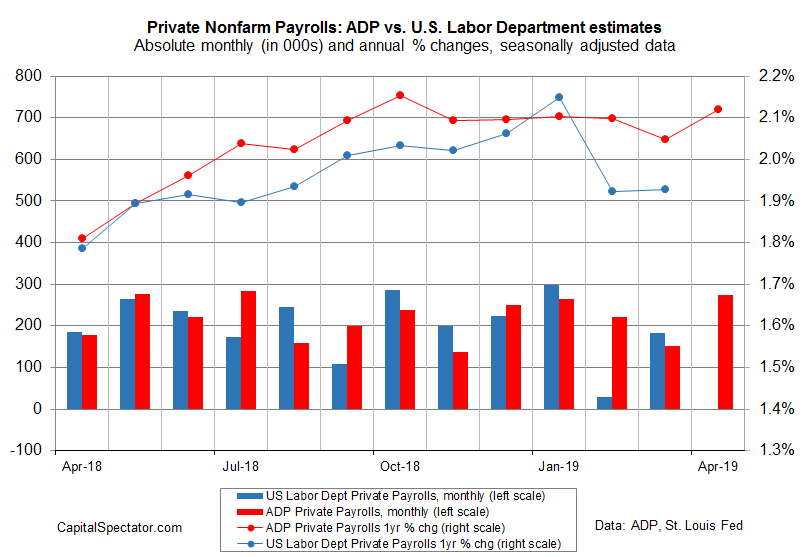

US private-sector payrolls rebounded sharply in April: ADP