Republican Senator Graham: Trump shoud support re-opening gov’t: Reuters

China’s exports in December fell the most in 2 years: Reuters

China’s trade surplus with US expands to record high: CNBC

Eurozone industrial output fell sharply in Nov–biggest slide since 2016: Reuters

UK Prime Minister May set for last-ditch effort in support of Brexit deal: BBC

Trump threatens Turkey with economic devastation over Kurds: Politico

Investors focus on softer forecasts for corporate earnings growth: WSJ

The collapse of sedan demand is weighing on US auto industry: Bloomberg

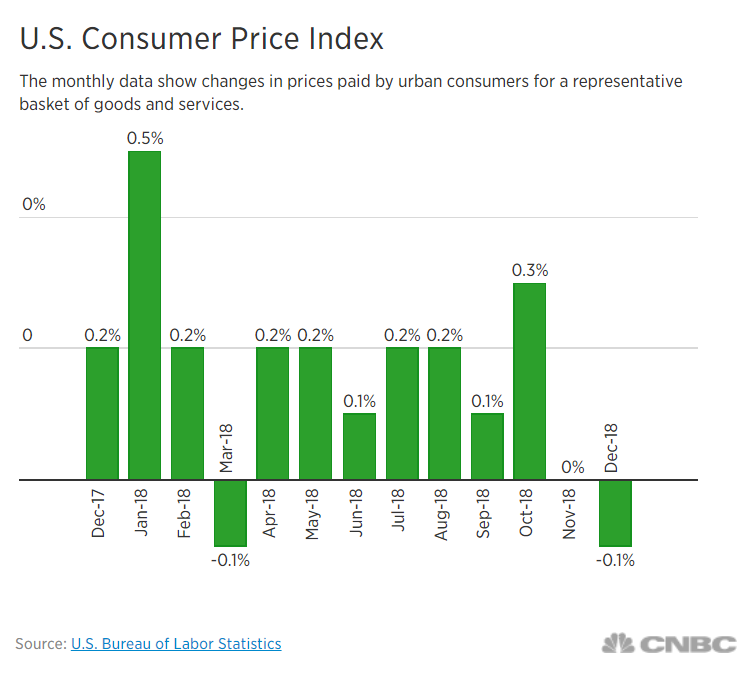

US consumer inflation in Dec fell for first time in 9 months: CNBC

Monthly Archives: January 2019

Book Bits | 12 January 2019

● Broken Bargain: Bankers, Bailouts, and the Struggle to Tame Wall Street

By Kathleen Day

Review via Kirkus Review

Following the financial meltdown of 2008, writes former business journalist Day (Business Administration/Johns Hopkins Business School; S&L Hell: The People and the Politics Behind the $1 Trillion Savings and Loan Scandal, 1993), Queen Elizabeth II asked faculty at the London School of Economics why no one had noticed. It was, they said, “principally a failure of the collective imagination of many bright people.” As the author clearly shows, national and international economic systems involve many bright people, but the experts often fail—and, “given the political landscape, they will again.” Day ably documents a succession of crises that ought to have imparted essential lessons but that instead fueled further crises—e.g., tariffs or Andrew Jackson’s undoing of Alexander Hamilton’s national bank system, Jackson being the predecessor Donald Trump seems most to admire. Much of the author’s story concerns efforts to separate banking and investment, which Franklin Roosevelt characterized as “speculation with other people’s money”; every time the two are separated, of course, politicians join them together anew only to usher in another crisis.

Continue reading

It’s Been A Good Year So Far

Seven trading days don’t tell us much about price trends, but if we plead temporary insanity and restrict our view of performance to the 2019 calendar the numbers look encouraging. What can we do with this information? Not much, but as financial entertainment goes it’s amusing. Let’s throw caution to the wind and consider how some key markets are shaping up so far this year, if only as a brief distraction from the chaos unfolding in Washington and its shutdown soap opera.

Continue reading

Macro Briefing: 11 January 2019

Senate Majority Leader McConnell blocks House bills to reopen gov’t: The Hill

Gov’t workers will miss their first paychecks today due to shutdown: TPM

Trump says he may use emergency powers to build wall: Reuters

Fed Chairman Powell: prolonged gov’t shutdown could pinch economy: CNBC

Fed debate about its portfolio of bonds and other assets heating up: WSJ

Survey of economists: US recession risk at 25% –a 6-year high: Bloomberg

Flu season expected to cost employers $17 billion: CG&C

US jobless claims continue to point to strong labor market: Reuters

Oil rallies for 9th straight session–longest winning streak on record: MW

Dec marked 59th straight month of net inflows into ETFs/ETPs globally: ETFGI

Will The Consumer Inflation Trend Ease In December?

The minutes of the Federal Reserve’s monetary meeting in December reveal a tolerance among policymakers for delaying additional interest-rate hikes. Low and stable inflation is a factor in the dovish message. Will tomorrow’s December report on the consumer inflation index (CPI) provide additional support for expecting a pause in the Fed’s recent monetary tightening?

Continue reading

Macro Briefing: 10 January 2019

Partial gov’t shutdown headed for fourth week as talks fall apart: The Hill

Trump may declare nat’l emergency to build the wall Dems won’t finance: WSJ

Democratic-led House passes bill to reopen Treasury, IRS and SBA: The Hill

N. Korea’s Kim reportedly planning for second meeting with Trump: BBC

Fed minutes: Fed ‘can afford to be patient’ about future rate hikes: CNBC

US withdrawal from Syria will be slower than Trump suggested: CNN

Analysts note progress in latest round of US-China trade talks: CNBC

Will the US economic expansion die of old age? Bloomberg

VIX Index fell on Wednesday to lowest close since Dec 4:

Fed Funds Futures Pricing In A Pause In Rate Hikes For 2019

The Federal Reserve’s recent run of raising interest rates is expected to hit a wall in 2019, according to Fed funds futures. After four rate hikes in 2018 and nine since the current cycle of tightening began in 2015, the crowd is currently anticipating that policy will remain on hold for the rest of the year, according to CME data.

Continue reading

Macro Briefing: 9 January 2019

Trump demands border wall in TV speech: Reuters

House Democrats set to test GOP with bill to re-open gov’t: Reuters

World Bank predicts global growth will slow in 2019 to 2.9%: Reuters

Signs of progress in US-China trade negotiations: WSJ

Eurozone unemployment rate dips to 7.9% in Dec, lowest since 2008: Eurostat

Partial gov’t shutdown is taking a toll on housing, say Realtors: Bloomberg

Consumer credit growth stayed strong in November: MW

US Small Business Optimism Index fell in Dec to lowest since 2016: WSJ

Eurozone economic sentiment fell to 2-year low in Dec: RTT

Weak industrial output in Germany stoke recession worries: CNBC

US job openings fell in November, but remain elevated: Reuters

Ranking The Current US Stock Market Drawdown vs. History

It’s anyone’s guess if the recent rebound in US equities will soon push the S&P 500 Index to a new high. What we do know is that the market has staged a solid bounce so far. For the eight trading days since Christmas Eve’s close, when the S&P’s current drawdown hit bottom, the index is up a solid 8.4%. There’s still a long climb ahead to recover the remaining ground lost since the S&P’s previous peak, set on September 20. To reach that summit the index would have to rally roughly 15% over yesterday’s close (January 7).

Continue reading

Macro Briefing: 8 January 2019

Trump to address nation on Tues night to address border-wall issue: Fox

Partial gov’t shutdown is starting to reverberate across US economy: NY Times

House GOP leaders suggest support fading for Trump’s shutdown fight: Politico

Analyst: US recession risk is elevated without end to US-China trade war: CNBC

Hints of progress in US-China trade talks: Bloomberg

North Korea’s Kim visits China for talks with President Xi: Reuters

Samsung is 2nd tech giant to suffer from China’s softer economy: Bloomberg

China’s economic growth has slipped below the key 6% mark, says analyst: CNBC

Small-cap stocks in focus as haven from big-cap woes: WSJ

US job openings increasingly outnumber jobless workers: Reuters

Germany’s weak industrial sector raises recession risk: Bloomberg

US ISM Non-Mfg Index: growth slows to 5-month low in December: MW